Investment Notes

By CUSTOS

Canadian Bank rates hit the gill-edged market more severely than equity qiaro. Hopes had already been fading of an early reduction in the British Bank rate, but this had till been regarded as a possibility early in the New Year, Now this seems to be much too optimistic. At the same time, the gilt-edged market has been suffering from competition from the ..pate of debenture and loan stock issues.

Dollar Shares Whenever the dollar investment pain:nun rises over 16 per cent there are always brokers who will say that it is going up to 24 pet cent. In point of fact, the rise in this premium has been due to business operations, not to investment portfolio operations. As the Bank of England will not release official exchange for industrial and commercial investment overstay, the com- panies which have been expanding in foreign markets have had recourse to the dollar invest- ment pool. An investor who pays 16 per cent premium to buy a dollar share in Wall Street at the peak of the Johnson boom must be out of his senses. It has been clear for some time that Wall Street has been 'loopy.' Every bull market has a political as well as an economic base and while growth in America is not going to be stopped by a 44 per cent Bank rate, it is obvious that the bloom is running off the Wall Street boom.

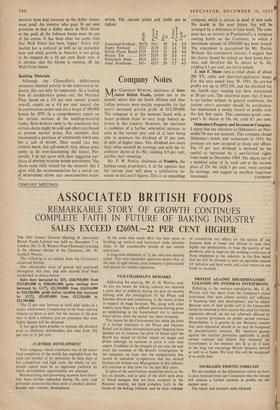

Building Materials Although the Chancellor's deflationary measures checked activity in the construction in- dustry, this can only be temporary. As a leading firm of stockbrokers points out, the National Plan, based on a 3.8 per cent annual growth overall, counts on a 4.6 per cent annual rise in construction output and sets a target of 500,000 houses by 1970. In a comprehensive report on the various sections of the building-material trades, these brokers come to the conclusion that certain shares might be sold and others purchased at present market prices. For example, they recommend a purchase of ASSOCIATED PORTLAND, but a sale of RUGBY. They would also buy LONDON BRICK, but sell MARLEY TILE, whose price seems to be over-discounting the future. Per- sonally, I do not agree with their suggested pur- chase of BRITISH PLASTER BOARD INDUSTRIES. The shares seem fully valued for the moment. But .I agree with the recommendation for a switch out of DERBYSHIRE STONE into AMALGAMATED ROAD- STONE. The current prices and yields are as follow:

•• tgl

Associated Portland . 59/71 Rugby Portland 27/3 British Plaster Board 27/9 Marley Tile 28/9 Derbyshire Stone 20/6 Amal. Roadstone ., 54/-

CU U .1 •••••

0.. 51/- 21/9 23/9 23/9 18/- 43/3

...k' .4) ..fel

10 15

11 20 15 20

.13 A 05

C.) 2.4 3.1 2.0 2.0 1.6 1.7

3

0.1 -61:,.

3.9 3.4 4.6 4.1 4.1 4.5

Previous page

Previous page