FINANCE-PUBLIC & PRIVATE.

[By OUR CITY EDITOR.]

THE BUDGET CONSIDERATIONS AND MARKETS.

[To the Editor of the SPECTATOR.] Sni,,—Cheerfulness continues to be the predominant note on the Stock Exchange, and neither Ruhr crises nor Labour successes at the Polls seem to have power to damp the prevailing optimism. Those who should be most in touch with the National finances decry the chances of any immediate material reduction in taxation, and Mr. Stanley Baldwin has more than once given a strong hint that the better course is to concentrate on debt redemption with the permanent saving which it involves to the taxpayers in the matter of annual interest. Nevertheless, hope springs eternal in the taxpayer's breast, and in many quarters in the City it is still thought that the Government should be able to reduce the Income- tax at all events to 4s. 64.1. in. the Z. and it is pointed out that the very small loss suffered so far by the Exchequer through the reduction of Is. last year shows that the smaller the tax the less the evasion. On the other hand, it must te pointed out that the full effect of the reduction made last year has really to be felt in the coming year. In this connexion, may I make my own attitude towards this question of lower taxation perfectly clear? Needless to say a really sound Budget comes before every other consideration. Therefore, when the whole of the Departmental Estimates of Expenditure for the new year have been published, it is quite probable that I may be supporting in your columns the contention that it is the duty of the Government not to remit taxation in the coming year, but to make such further cuts in expenditure as shall render possible a reduction in taxa- tion a year hence. Until, however, the Estimates have been published, I believe it to be the duty of the financial critic to urge the necessity for lower taxation simply as the only means of foiling the attention of the Govern- ment upon the need for economy. All that the ordinary man in the street knows about revenue and expenditure is the extent to which he is hit by taxation. The Govern- ment and the Treasury Authorities know that the relief from the burden of taxation can only be attained through increased economy, and therefore, and because it is the force of public opinion alone which can bring about economy, it is sometimes necessary to insist upon the need for a reduction in taxation, even though when the Estimates have once been passed and the Budget arrives the critic may then fall into line with the Government in insisting that such reduction must not be made at the cost of unsoundness in the National Accounts.

During the week the Civil Service Estimates have been published, showing a reduction of £88,000,000. It is necessary, however, to point out, first, that the greater part of the reductions come from the automatic cessation of special War outlays (such, for example, as the £80,000,000 provided for in the last Budget as compensa- tion to the Railways), and that the comparison is one of estimates with estimates. In other words, the proposed saving of £88,000,000 is not a saving on the actual results for the current year, but upon the estimates of a year ago, which it is quite clear have not fully materialized, the prospect of a big realized surplus at the end of the present month resting mainly upon savings effected during the year upon the original estimates.

But whatever the Budget may have in store as regards taxation, nothing can alter the fact that as the result of economies during recent months a large amount of debt has been redeemed, and that there is hope of further economies in the near future. Consequently, the firmness

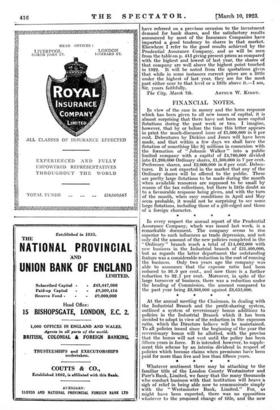

Alliance (£2 4s. paid) .. Atlas .. . ..

British Equitable ..

Commercial Union ..

Consolidated (£1 paid) .. Eagle Star (£3 paid) .. Employers' Liability .. Equity and Law.. .. 1922.

Highest. Lowest.

121 101 ..

181 134k ..

31 2f ..

32 251 ..

72/- 47/6 ..

151 131 ..

82/6 73/6 .. 27 23 .. Present Price. 121 171 31 36 63/9 13} 86/- 26i General Accident .. 7* 41 .. 6* Gresham Life (15s. paid) 2f 21 .. 21 Guardian- . 8 }I 51 .. 61 I Legal and Genera.. 3/ 3* .. 31 London and Lancashire 14* 11 .. 15 London and Scottish .. 3* 2* ..

q

London .. .. .. 8* 7 ..

81

North British and Mere. 13f 9* .. 131 Northern • • 15* 13 .. 16* Phoenix .. .. 101 9 .. 101 Prudential (£1) .. 121 8* .. 131

15/6 9/- .. 15/6 Royal Exchange.. 411 345 .. 385 Royal .. .. 221 181 .. 211 Scot. Union and Nat. 8* 5fi .. 8i Sun .. .. 171 14 .. 18 Sun Life .. .. 27f 171 .. 27}.

Yorkshire (10s. paid) • • 11* 8 .. 101 Do. £1 shares .. 231 161 .. 21

11.wesw,

of British Funds is well maintained, although the tendency for active business to shift into the Industrial and more Speculative groups is becoming more pronounced. I (Continued on page 416.) have referred on a previous occasion to the investment demand for bank shares, and the satisfactory results announced by most of the Insurance Companies have imparted a good tendency to shares in that market. Elsewhere I refer to the good results achieved by the Prudential Assurance Company, and as will be seen from the table on p. 415 giving present prices as compared with the highest and lowest of last year, the shares of that company are well above the highest point touched in 1922. It will be noted from the quotations given that while in some instances current prices are a little under the highest of last year, they are for the most part either near to that level or a little above it.—I am, Sir, yours faithfully,

Previous page

Previous page