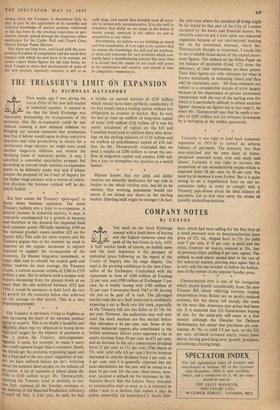

COMPANY NOTES

By CUSTOS THE week on thc Stock Exchange opened with a fresh burst of buying and the highest turnover since the peak of the last boom in July, 1955.

A 'bull' market feeds, of course, on bullish news and the most important is the prospect of industrial peace following on the report of the Courts of Inquiry into the wage dispute. The next is the growing confidence in the new Chan- cellor of the Exchequer. Confronted with the repayment in June of £100 million of Funding 21 per cent. and £300 million of Exchequer 5 per cent. he is boldly issuing only £100 million of 4+ per cent. Conversion Stock 1962 at 99, leaving the rest to be paid off in cash. The gilt-edged market took this as a 'bull' point and is confidently expecting a cut in Bank rate this week, especially as the Treasury bill rate has fallen to £3 14s. 9d. per cent. However, the authorities may well wait until the stock markets are less excited before they introduce a 4+ per cent. rate. Some of the recent industrial reports also contributed to the bullish sentiment. GUEST KEEN reported a rise in equity earnings from 59 per cent. to 67+ per cent. and an increase in the very conservative dividend from 12 per cent. to 13+ per cent. (The shares at 57s. now yield only 4.8 per cent.) SOUTH DURHAM increased its interim dividend from 3 per cent. to 4 per cent. and it is generally expected that the total distribution for the year will be raised to at least 10 per cent. for the year. Steel shares, how- ever, received a setback on the statement by Mr. Aneurin Bevan that the Labour Party intended to renationalise steel as soon as it is returned to office—'and in a fashion that makes it stay in public ownership' (in bankruptcy?). South Dur- ham, which had been selling for the first time at a small premium over its denationalisation issue price of 27s. 6d., slipped back to 27s. (to yield over 7 per cent. if 10 per cent. is paid) and the STEEL COMPANY OF WALES, reissued at 20s., lost its premium (thus yielding 8 per cent. again). The setback in steel shares spread later to the rest of the industrial market, proving once again that it is very rash for the investor to follow the bullish- ness of the tipsters in the popular Sunday press.

* * *

CONSOLIDATED ZINC is one of the companies which should benefit considerably from the new Finance Bill clause relieving overseas trading corporations from British tax on profits retained overseas, but the shares fell sharply this week on the news that American zinc prices had been cut. It is expected that US Government buying of zinc for the stock-pile will cease in a few months although the Director for Defence Mobilisation has stated that purchases are con- tinuing. At 76s. to yield 5.9 per cent, on the 221 per cent. dividend (covered nearly twice) these shares, having good long-term 'growth' prospects, are nearing a buying range.

Previous page

Previous page