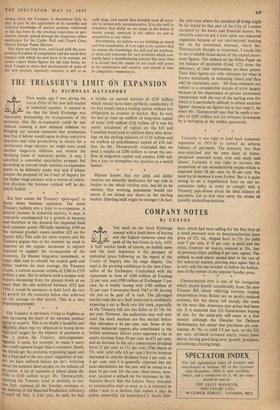

THE TREASURY'S LIMIT 6N EXPANSION

By NICHOLAS DAVENPORT Two weeks ago I was giving the

raison d'etre of the new bull market

41,1:, in industrial equities. It seemed to me that the Stock Exchange was reasonably discounting the re-expansion of the economy, that the re-expansion could be met without creating a new demand inflation by bringing our unused resources into production and that if labour would agree to drop restrictive practices and raise productivity in return for a satisfactory wage advance we might even avoid another wage-cost inflation and reverse the declining trend of industrial profits. It was, I admitted, a somewhat speculative prospect but according to current trade statistics re-expansion seems to be definitely under way and if labour accepts the .proposal of the Court of Inquiry for the higher wage advance with a waiver of restric- tive practices the business outlook will be dis- tinctly bullish.

But here comes the Treasury 'spoil-sport' to damp down business optimism. The latest Treasury bulletin sets a limit to re-expansion. A general increase in industrial activity, it says, is ordinarily accompanied by a growth in incomes and therefore in the demand for imported food and consumer goods. (Broadly speaking, £100 on the national product means another £25 on the import bill.) This calls for more exports and the Treasury argues that at the moment we need to improve on the regular increment in exports required to support the re-expansion of the economy. To finance long-term investment, to repay debt and to rebuild the central gold and dollar reserves we must average, the Treasury claims, a current account surplus of £300 to £350 million a year. But to achieve such a surplus with exports increasing from the present levels at no more than the rate achieved between 1952 and 1956 it, would be necessary to hold back the rate of growth for the economy below that achieved on the average in that period. This is a very depressing prospect.

The Treasury is obviously trying to frighten us into increasing the shard of the national product going to exports. This is no doubt a laudable and 0sirable object but my objection to laying down statistical targets for the balance of payments is that it makes the Treasury 'anti-expansion' 41incied; it tends, for example, to make it carry on a credit squeeze longer than is necessary, Surely We should get the economy expanding again and Pitt a final end to the two years' stagnation of out- Put we have suffered before we start worrying about the national ideal surplus on the balance of Payments. A lot of nonsense is talked about the £300 to £350 million target.' Mr. Thorneycroft, speaking the Treasury brief as dutifully as any new boy, repeated all the familiar mystique at the meeting of the ;National Production Advisory Council on May 3. Last year, he said, we had

a surplus on current account of £230 million which would have been perfectly satisfactory if we had simply been a trading nation without any obligations as investor or banker. But, he said, we had to meet an outflow of long-term capital of some £190 million (£26 million of it was the yearly instalment of capital on the US and Canadian loans) and in addition there were draw- ings on the sterling balances of £150 million and an outflow of miscellaneous capital of £50 mil- lion. So Mr. Thorneycroft concluded that we need a surplus of £200 million to cover the out- flow of long-term capital and another £100 mil- lion a year to strengthen our position as a world banker.

* Heaven knows that our gold and dollar reserves are absurdly inadequate for our role as banker to the whole sterling area, but let us be realistic. Our working population would not starve if we closed our doors as the sterling banker. (Sterling itself might be stronger.) In fact,

Previous page

Previous page