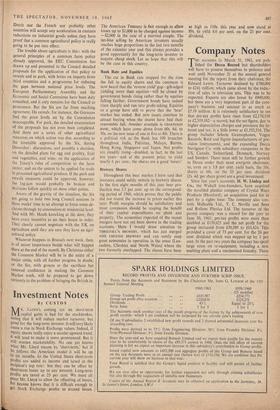

Company Notes

ite accounts to March 31, 1961, are pub- ." M lished for Decca Record but shareholders will have to possess themselves in patience and wait until November 21 at the annual general meeting for the report from their chairman, $ir Edward Lewis. Turnover declined by £700,000 to £241 million, which came about by the reduc- tion of sales in television sets. This was to be expected. Exports are also lower by £900,000, but these are a very important part of the com- pany's business and amount to as much as £7.19 million. It is extremely satisfactory to see that pre-tax profits have risen from £2,176,199 to £2,319,182—a record; but the net figure, due to higher depreciation charges and provision for in- terest and tax, is a little lower at £1,192,316. The group includes Selecta Gramophones, Vogue Records, Reid and Sigrist (manufacturers of pre- cision instruments), and the expanding Decca Navigator Co. with subsidiary companies in the US, Canada, Switzerland, Denmark, Norway and Sweden. There must still be further growth in Decca under their most energetic chairman; so, even on a 3.8 per cent. yield basis, the 10s. shares at 60s. on the 23 per cent. dividend (2s. 4d. per share gross) are a good investment.

Since last year's accounts, H. W. Lindop and Co., the Walsall iron-founders, have acquired the moulded plastics company of Crystal Ware Products (Hereford), an acquisition paid for in part by a rights issue. The company also con- . trols Malleable Ltd., T. C. Neville and Sons and Rollene Plastics Ltd. The turnover of the parent company was a record for the year to June 30, 1961; pre-tax profits were more than doubled at £139,625 and the net profit for the group increased from £30,589 to £63,424. This provided a cover of 73 per cent. for the 26 per cent. dividend which was stepped up by 1 per cent. In the past two years the company has spent large sums on re-equipment, including a new smelting plant and a mechanised foundry. These

improvements will make the company more com- petitive, but it is not expected that the same demand for the company's products will prevail this year. Colonel C. A. B. Lindop, the chair- man, therefore finds- it difficult to forecast the future, so that the yield of 9.4 per cent. on the ls. shares at 2s. 9d. is to be expected.

Regis Property completed their ,year on June 30, 1961, and the accounts show an increase in revenue and profits over those for 1960. The net profit after tax was up from £151,523 to £187,132, but there is still plenty of room for a higher gross revenue. The company is still suf- fering from rent control on 528 flats out of their total of 2,298 and also from depressed rentals which were arranged on some of their office properties immediately after the war. This con- dition will be considerably improved over the next four or five years. The company is alive to the possibility of extending its interests when money rates ease and is therefore seeking powers now to increase the authorised capital by £3 million to £7 million; 2,200,000 £1 ordinary shares are at present issued. Sir Aynsley Bridg- land is chairman of this company which has had a progressive record and should continue to offer shareholders a sound investment with prospects for a gradual dividend increase. The £1 shares at 57s. 6d. give a good return of 4.4 per cent. on the 134- per cent. dividend.

The chairman, Mr. G. H. L. Kent, and direc- tors of Lenggeng Rubber are to be congratulated on their company's results for the year ended March 31, 1961, for (in spite of a fall of 2.5d. per lb. in the average price realised for the crop) thanks to some farsighted forward con- tracts, plus a small reduction in costs, the net profit. (before tax) has risen from £84,229 to £86,182. This is indeed a well-managed estate, for, since 1956, output has risen by 50 per cent. and the average return is the very high one of over 900 lb. of rubber per acre, It is not ex- pected that the current year's results will be quite as good as last year's, but any reduction of the dividend from 55 per cent. is surely discounted by the present price of 5s. for the 2s. ordinary shares. The balance sheet is very liquid with cash at £95,192 against the issued capital of £107,291.

Previous page

Previous page