Breathing space

PORTFOLIO JOHN BULL

No new stock this week, but a second look at two already in the portfolio. In the insurance world, things have been moving to my advan- tage: but in the aircraft world the signs are contradictory and more difficult to read.

I am, I must admit, pleased that Phoenix Assurance has failed to gain control of York- shire Insurance. The terms finally proposed by the two contestants—General Accident was also in the bidding—were extraordinarily generous. just over £40 million compared with a first offer of £27 million. The fact that both manage- ments were looking three to five years ahead ex- cuses the price. In the short run, however, victory is frankly expensive: the impact on the two dividend covers proves that. General Acci- dent's will fall from 1.57 times to about 1.3 times as a result of the expense of servicing the capital which Yorkshire shareholders pick up. In the case of Phoenix, dividend cover would have fallen to the 1.15 to 1.2 times range— uncomfortably thin.

So Phoenix shareholders, while sorry that their board failed to capture an important piece on the table, can be glad that their equity has not been watered down. The new American arrangements, upon which I based my recom- mendation, still stand. Indeed, the outcome is that Phoenix is now the most attractively priced insurance share available. Yielding 4.5410

per cent against an industry average of 3.8 per cent and with a chance of a higher dividend at the end of the year, it looks handsome. The share price has bobbed around a bit in the past fortnight in the unnatural conditions of a takeover fight, but it has not fallen below the price at which I drew attention to the situation.

Rolls-Royce is another share in the port- folio over which a certain amount of con- troversy has developed. Since I wrote about the company there have been three announce- ments of interest. The most serious concerned the Spey engines which are going into the Phantom fighters ordered by the RAF. Produc- tion problems have held up progress by several months. Some loss of full power at high alti- tudes seems to have been experienced, though modifications are already curing the trouble. All the same, this rectification will cost the company money—no guesses yet as to how much.

Then a few days later came a much more cheering announcement: Rolls-Royce is to pro- vide engines for the whole of the Anglo-French helicopter project. As usual in defence fields, little precise information is available. The helicopter order, however, must involve hun- dreds of engines and millions of pounds of business. Finally, last week, Rolls-Royce pro- duced its interim results for the year. I must record that they are difficult to intepret accurately. The market's first reactiorr was to take the shares Is 101d higher to 50s 3d. The next day second thoughts lopped 3s off the price. Major difficulty in interpretation was the lack of comparative figures available for the „group in the previous year. However, the key iassage—'the achievement of the forecast £8 million net profit [this year] is dependent on two factors: one is the volume of turnover finally achieved and the other the profitability on a wide range of government contracts being completed or for which prices still have to be agreed'—is set in a minor key. Indeed, this led one firm of brokers to take a distinctly bearish view of the situation, pushing its clients out of the shares. I do not for a moment think that readers should follow suit. The shares are not extravagantly priced; the order book takes the group well beyond 1970; margins should recover in 1968.

As far as equity markets in general are con- cerned, it is a relief to see economic events catching up with Throgmorton Street. The monthly survey of business opinion published in the Financial Times earlier this week con- tained a number of encouraging signs. Most companies are now working on rising produc- tion trends. Export order books have perked up. The great manpower shake-out last winter has had a salutary impact upon costs. Thus the extra business now in sight could produce some hefty increases in profits. None the less, I shall continue to favour shares with defensive characteristics. And I wait with eagerness for a turnround in the gilt-edged market. Mean- while my money remains with my local borough treasurer.

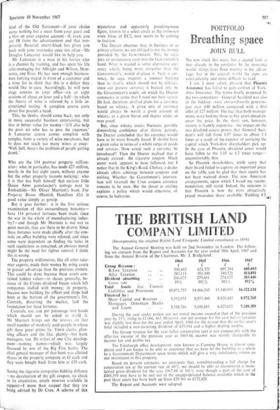

Valuation at 8 November 1967 100 BAT at 87s .. ..

£435 100 Empire Stores at- 58s .. 1290 125 Rolls-Royce at 45s 104d .. .. £287 50 Phoenix Assurance at 140s xd £350 150 Lyle Shipping at 29s 744 .. £222 600 John I. Jacobs at 8s .. .. £240 Cash with local authority at 5i per cent 13,184 Total .. £5,008

Previous page

Previous page