Investment Notes

By CUSTOS

Fr tin disappointing results of the joint stock banks confirm me in the belief I have held for the past six months that bank shares are today unattractive investments. The MIDLAND'S profits are a little over 1 per cent. down, those of LLOYDS 2.4 per cent. down and BARCLAYS 1 per cent. down. Barclays are making a two-for- five scrip issue and declaring a dividend of 10 per cent. on the enlarged capital, the rate for 1962 being 13 per cent. against the equivalent of 12.8 per cent. in 1961. Barclays remains per- haps the most attractive in the list, but with the dividend yields ranging mostly between 3.3 per cent. and 3.5 per cent. (Lloyds at 3.7 per cent.), bank shares are hardly likely to attract much investment support. The banking results gave a heavy tone to most equity markets, but what is called 'the undertone' remained firm except in property shares, which are still being oversold.

Discount Company Shares Since I recommended discount shares in May, 1961, there has been a considerable rise—around 30 per cent. on the average—and some excellent dividend distributions. Last year the discount

companies enjoyed very favourable trading con- ditions and the results declared by ALEXANDERS and UNION DISCOUNT last week were as good as the market expected. Last year has been de- scribed as 'the' year for discount companies, for they had built up their bond portfolios at the end of 1961 when bond yields were high and in 1962 saw bond values rise steadily as three cuts were made in Bank rate—two in March from 6 per cent. to 5 per cent. and one in April to 4+ per cent. Last week's cut to 4 per cent. finished off the rise and it is hardly to be expected that another year like 1962 will be seen by discount companies for a very long time. There is, there- fore, good reason to suggest that profits might well be taken in a number of discount shares. When the Bank of England announced last week's cut in Bank rate it made also an im- portant technical change designed to keep money rates up for foreign money while allowing in- terest rates to fall for domestic borrowers. This was the decision to charge the discount market up to 1 per cent. above Bank rate for loans instead of merely charging Bank rate as it has done before. When sterling comes under pres- sure again and the Bank wishes to avoid an efflux of foreign money, this will enable it to maintain or raise the rate offered on Treasury Bills and local authority loans (which have lately received a lot of foreign money) although the rates for commercial borrowing may be held down to encourage industrial investment. (My colleague will be delighted to see this beginning of the two-tier system of interest rates which he has been advocating.) The discount com- panies do not anticipate much trouble in acclimatising themselves to this new technique —their present profit margins are very-comfort- able—but it does seem to be an additional argu- ment for reducing an investment in discount shares.

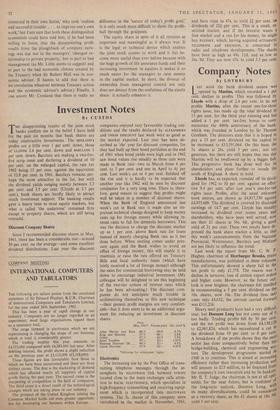

Price May, 1961' Present price Div. yield % Mien Harvey and Ross 46/3 69/6 4.3% King and Shaxson 57/3 88/- 2.8% Gillett 47/3 65/3 3.8% Jesse Toynbee .. 39/- 52/- 3.85% National Discount (B) 49/3 51/- 4.9% Union Discount .. 53/9 56/- 4.45% 'Allowing for subsequent 'rights.'

Electronics

The increasing use by the Post Office of trans- mitting telephone messages through the at- mosphere by microwave link between towers located close to the main exchanges calls atten- tion to RACAL ELECTRONICS, which specialises in high-frequency transmitting and receiving equip- ment which is incorporated into microwave systems. The 5s. shares of this company were introduced to the market in November, 1961, and have risen to 47s. to yield 21 per cent. on dividends of 22+ per cent. This is a small, re- stricted market, and if the investor wants a free market and a run for his money, he might buy PLESSEY, which, having acquired AUTOMATIC TELEPHONE and ERICSSON, is concerned in radio and telephone developments. The shares have been as high as 49s. 1+d. and as low as 34s. 9d. They are now 45s. to yield 3.3 per cent.

Previous page

Previous page