Investment Notes

By CUSTOS

THE reduction in Bank rate to 6 per cent last week actually caught the gilt-edged market unawares. It had begun to lose hope of any fall while interest rates were tending to rise still further on the Continent and money was being made tighter in America. The result was a marking-up of prices in the .'short' to middle- dated stocks. The 'longs' were more moderate gainers. The improvement in sterling should help to allow the recovery to grow. Bank shares

[Continued on page 767 rose in sympathy with gilt-edged and the firmer tendency in leading equity shares was extended.

Investment Shocks Abroad The British investor is not the only one to run into hard times. In Japan there has been a brokers' failure and the government has had to come to the rescue of the bourse. In Germany investors, fearful that the Social Democrats may win the September election, have been switching from equities to the higher. yielding bonds. The market has been suffering from the withdrawal of American funds and the imposition of a 25 per cent withholding tax which has stopped up the sources of foreign money, particularly Swiss. So short is capital that the bond market has fallen sharply and the next government loan is expected to have a 7 per cent coupon at 98. In France the continuing fall in equity shares has prompted the govern- ment to take measures to encourage the investor. Domestic shareholders are allowed to claim back the 50 per cent corporation tax paid by the company (Mr. Callaghan please note). But they are not in a buying mood, for profit mar- gins are being squeezed in France as elsewhere. In Holland the markets have had to absorb continual selling from America and from other foreign sources because the withholding tax is being raised to 25 per cent (which might be- come the European norm) and pension funds Will not be able to reclaim it after a period of two years' grace. In Italy the market has re- covered since the balance of payments was re- stored but is still nervous over the political crisis. On the whole the world markets are in a deflationary phase and even the great bull mar- ket of America has begun to crack. This was set off by the change in the Federal Reserve policy from easy money to tight. To make matters worse Mr. McChesney Martin has been talking of the similarity in conditions today to those which preceded the great Wall Street crash in 1929.

Overspill and Oil

The Chancellor's concession to the companies taxed overseas is important. The period of grace for relief is to last for seven years in- stead of five and the full relief will last for three years instead of two before it begins to taper off. (The 1969-70 relief will fall to 80 per cent, 1970-71 to 60 per cent, 1971-72 to 40 per cent and 1972-73 to 20 per cent.) The relief will be the full amount of the credit for over- seas tax in the base year and not a proportion of that credit according to the dividend in the base year (which would have penalised the company paying out a small proportion of its profits). However, it is virtually impossible to calculate what the relief will be for most com- panies because the overseas taxation is not always exactly given. In the case of the oil companies the new arrangement still makes SHELL suffer much more than DP. The amount of over-spill for Shell, that is, the amount by which overseas taxation exceeds British corpora- tion tax, is estimated at about £8 million while £29 million is required to 'gross up' the divi- dend. BP, however, looks like being eligible for £43 million against a requirement of only £26 million. (It paid overseas tax in 1964 of £127 million—or 60 per cent—while corporation tax of 40 per cent would have cost £84 million.) The companies concerned should let their share- holders know how they are likely to be affected at the earliest possible moment, but a switch into BP seems desirable. The shares have risen from a low point of 44s. to 52s. 3d. to return 7.6 per cent on the basis of the old dividend of 2s. 4d. tax free (which will no doubt be cut).

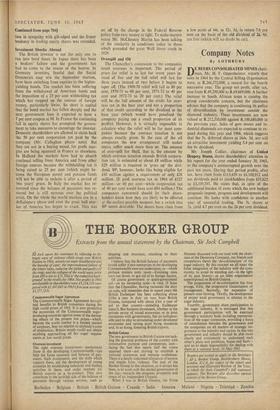

Previous page

Previous page