Closing the Gap

By JOHN BULL

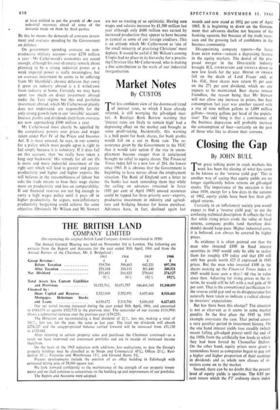

THE great talking point in stock markets this week has been the closing of what has come to be known as the 'reverse yield gap.' This is another way of saying that equity yields are no longer significantly below returns on gilt-edged stocks. The importance of the occasion is that since 1959, except for a few days in the autumn of 1962, equity yields have been less than gilt- edged returns.

Certainly in an inflationary society you would expect to find a 'reverse yield gap,' to use the confusing technical description. It reflects the fact that while rising prices erode the value of fixed returns, company profits (and therefore divi- dends) should keep pace. Higher industrial costs, it is believed, can always be covered by higher prices.

As evidence it is often pointed out that the man who invested £100 in fixed interest securities in 1945 would only be able to realise them for roughly £50 today and that £50 will only buy goods worth £25 if expressed in 1945 prices. But the man who invested £100 in the shares making up the Financial Times index in 1945 would have seen a thre rise in value since then. Adjusting for rising prices in the in- terim, he would still be left with a real gain of 50 per cent. That is the conventional justification for the reverse yield gap and so its disappearance has naturally been taken to indicate a radical change in investors' expectations.

But has there been this change? The situation is not as clear-cut as it seems to some market pundits. In the first place the 1945 to 1966 example overstates the case. That period covers a very peculiar period in investment history. On the one hand interest yields rose steadily (which meant falling gilt-edged prices) until the end of the 1950s from the artificially low levels to which they had been forced by Chancellor Dalton. On the other hand, equity prices were given a tremendous boost as companies began to pay out a higher and higher proportion of their earnings in dividends and as whole new classes of in- vestors came on to the market Second, there can be no doubt that the present level of equity yields is spurious. The 6.83 per cent return which the FT ordinary share index

shows takes account of the fact that substantial dividend cuts are expected. The record since the beginning of July is not encouraging. Smith's Crisps, Anglo Auto, Fairey, Amalgamated Roadstone, Tap and Die, Gallagher, United Glass, Smiths Industries—these are some of the companies which have reduced their dividend payments. They represent a wide cross-section of industry.

Thirdly, the way the reverse yield gap is actually measured is to compare the average return on the old FT thirty share index with that on 21 per cent Consols. As I write the former shows 6.83 per cent, the latter 6.80 per cent. But neither measure is a particularly representative guide.

Dividend yield on the FT-Actuaries 500-share index, for instance, is 6.43 per cent. And if you add the ninety-four financial shares which form an index of their own, the yield comes down to 6.19 per cent. The outstanding feature of 2f per cent Consols is that they carry no redemption date. That is not the sort of government stock the average investor goes for these days.

Having made all these reservations about the concept of the reverse yield gap, one is left with the genuinely interesting fact that fixed interest yields and equity yields have lately drawn rather more close together than has usually been the case for the past seven years or so.

It may be that with the prescience for which it is famed, the stock market has come to the con- clusion that the Big Freeze and its aftermath really do mean the end of vicious inflation. If so it is a touching tribute to a Labour govern- ment from a most unexpected quarter. It is much more likely that investors believe that small vic- tories against rising prices will be achieved by taking large chunks out of company profit mar- gins and that dividends will be restricted for political reasons. In any case the new tax system makes their payment much more expensive.

Finally it is worth noting that among the broad band of companies whose shares yield much the same as say, gilt-edged securities with five years to run, there are some units which will provide investors with a much better run for their money than the equivalent fixed interest stock. Guest Keen, for instance, with 140 million or so in cash to come from the nationalisation of its steel interests and with a strong international position (particularly since the acquisition of Birfield) to buttress it against home market wobbles, is an example. The shares yield 6.7 per cent.

Previous page

Previous page