Second Thoughts on the Budget

By NICHOLAS DAVENPORT IF my second thoughts on-the Budget are slightly more critical, it is not because 1 have shifted one inch in my t..-J opinion of Mr. Maudling.

As compared with his prede- cessor, he still appears to me as light displacing darkness, as sanity expelling madness.

e) There is nothing more dan- gerous for Great Britain than an ignorant politician in charge of an all-power- ful Treasury. If he is economically uneducated he falls immediately under the influence of the hard-money hierarchs of the Civil Service or of smile deflation-minded economist outside who will talk a language which he does not under- stand and give him an inferiority and guilt com- plex. Was not Mr. Thorneycroft spellbound by Professor Robbins and Mr. Selwyn Lloyd by Professor Paish? am sure neither understood What his particular Professor meant, but felt that somehow the nation had sinned against the golden calf and must pay the penalty of a 7 per cent Bank rate and a year or two of dismal stagnation. But Mr. Maudling, who knows his economics, cannot be fooled by money fanatics or intimidated by foreign bankers. He bluntly told the House of Commons that the key to the strength of sterling is 'healthy expansion based Oil increasing efficiency and control of costs' and that if expansion leads to a stocking-up move- ment he will finance it out of the reserves or by borrowing from the IMF or elsewhere. He told them that with the spare industrial capacity now available a more buoyant home market will pro- vide a basis for lower unit costs, more competi- tive export prices and so higher exports. Finally, he told them not to worry about the Budget line' and the deficits—that the main point a Chancellor must consider in framing his Budget iS the size of the probable national monetary demand in relation to the amount of the national resources available. If there is a deflationary gaP-Ta margin of unused resources—tax con- c.essions are necessary to bring these resources into use. All these points have been the constant theme of my articles here for many years and the Pronouncement of them by an educated and enlightened Chancellor fills me with the joy of sPring. That is why I welcomed the first deficit above the line with such enthusiasm. Do you know that in the last nine financial years the Predecessors of Mr. Maudling have been exact- ing forced savings from this overtaxed nation at an average rate of £364 million a year? I

thank heaven that we now have a Chancellor who can stop this Treasury madness.

nut criticism must not be restrained by spring ie‘er, The Prime Minister has subsequently re- Nealecl In a speech last Friday that the Budget atyas intended as a bid to secure TUC co-opera- -1" M an incomes policy. Expansion without inflation, he said, must depend on an incomes

the and an incomes policy must depend on

'fie workers feeling

odeal. that they have had a fair This explains, of course, why Mr. Maudling decided to give his income tax reliefs by way the allowances and not by cutting the stan- dard rate. Sixpence off the standard rate would v meant that the biggest gainers would be

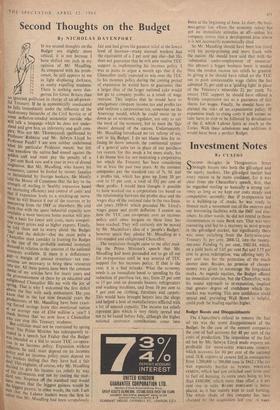

the biggest Payers; in other words, the rich. am 5U re that the Labour leaders -were the first to "Iona that Mr. Maudling had been scrupulously fair and had given the greatest relief at the lowest level of incomes—many manual workers had the equivalent of a 2 per cent pay rise—but this does not guarantee that he will now receive TUC support in implementing his incomes policy. I was at pains to argue a month ago that if the Chancellor really expected to win over the TUC to his incomes policy during the coming period of expansion he would have to guarantee that a larger slice of the larger national cake would not go to company profits as a result of wage restraint. This implies that he would have to amalgamate company income. tax and profits tax and institute a corporation tax, somewhat on the American model, which he could move up or down as an economic regulator, not only to suit the need of the economy, but to meet the 'fair shares' demand of the unions. Unfortunately. Mr. Maudling introduced no tax reform of an sort in his Budget. I do not blame him for re- fusing to move towards the continental system of a general sales tax in place of our purchase tax system. for this needs a lot more study, but I do blame him for not instituting a corporation tax which the Treasury has been considering for at least the past two years. At the moment companies pay the standard rate of 7s. 9d. and a profits tax, which has gone up from 10 per cent to 15 per cent, a total of 531 per cent of their profits. I would have thought it possible to have worked out a corporation tax based on the relationship between the profits slice and the wages slice of the national cake in the two finan- cial years 1959-61 which preceded Mr. Lloyd's wages pause and profit deflation. I cannot see how the TUC can co-operate over an incomes policy until some bargain on these lines has been reached. They will certainly not be moved by Mr. Macmillan's idea of a 'people's Budget,' however much they admire Mr. ,Maudling as a fair-minded and enlightened Chancellor.

The suspicious thought came to me after read- ing the Prime Minister's speech that Mr. Maudling had been persuaded not to go all out for re-expansion until he was assured of TUC support for his incomes policy. If that is the case, it is a bad mistake. What the economy needs is an immediate boost to spending by the reduction of purchase tax, say, from 25 per cent to 15 per cent on domestic heaters, refrigerators and washing machines, and from 10 per cent to 5 per cent on clothing, furniture and carpets. This would have brought buyers into the shops and helped a host of manufacturers afflicted with a lot of unused capacity. The income tax reliefs represent jam which is very thinly spread and not to be tasted before July, although the higher national insurance contributions come into force at the beginning of June. In short, the busi- ness-getter (on whom the economy relies) has got no immediate stimulus at all—unless his company moves into a development area where it is not necessarily economically sited.

So Mr. Maudling should have been less timid with his pump-priming and more frank with the nation. He should have said that with the 'substa nt ia I under-employment of resources' (his phrase) a bigger business -boost is needed than the modest income tax reliefs he granted. In giving it he should have relied on the TUC not to push unreasonable wage claims (he has admitted 31 per cent as a 'guiding light' in place of the Treasury's miserable 21 per cent). To ensure TUC support he should have offered a flexible corporation tax as a guarantee of fair shares for wages. Finally, he should have ex- plained the risks of an expansionist policy. If expansion leads to rising costs it will sooner or later have to stop or be followed by devaluation of the f, which 1 abour hates as much as the Tories. With these admissions and additions it would have been a perfect Budget.

Previous page

Previous page