Portfolio

Hitting the gold trail

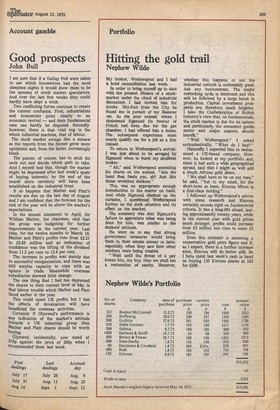

Nephew Wilde

My broker, Wotherspool and 1 had a brief reconciliation last week_ In order to bring myself up to date With the present climate of a stockmarket under the cloud of industrial discontent I had invited him for drinks. Hot-foot from the City he found me in pursuit of my Siamese cat. As the poor animal, whom I christened Sigmund (in honour of Freud) had been due for the gas chamber, I had offered him a home. The subsequent experience must nearly, qualify me for a job as a lion trainer.

To return to Wotherspool's arrival. I was just about to be savaged by Sigmund when in burst my ebullient broker.

" Ah," said Wotherspool extending his charm on the animal, "bite the hand that feeds you, eh? Just like those wrelthed dockers."

This was an appropriate enough introduction to the matter on hand. And While Sigmund climbed up the curtains, I questioned Wdtherspool further on the dock situation and its effect on the market.

His summary was that Sigmund's failure to appreciate what was being done for him, was similar to the dockers' attitude, He went on to say that strong government measures would bring them to their senses sooner or later, especially when they saw bow other workers were being treated.

" Wait until the threat of a pay freeze hits, my boy, then we shall see a restoration of sanity. However, whether this happens or not the industrial outlook is undeniably good. Ask any businessman. The major restocking cycle is imminent and this will be followed by a large boost in production. Capital investment prospects are, therefore, much brighter. I take the Confederation of British Industry's view that, on fundamentals, the stock market is due for an upturn and particularly the consumer goods sector And major exports should benefit."

"Well Wotherspool," I asked enthusiastically, "What do I buy?"

Naturally I expected him to recommend a UK-based company. However, he looked at my portfolio and, since it had such a wide geographical spread, said that I might as well add a South African gold share.

"We shall have to be on our toes," he said, "but to my mind, for the short-term at least, Kinross Mines is a first-class holding."

I followed up Wotherspool's advice with some research and Kinross certainly sounds right on fundamental criteria. It has a long-life ahead, lasting approximately twenty years, while in the current year with gold prices much stronger, profits Could increase from £3 million last time to some £5 million.

Even this estimate is assuming a conservative gold price figure and if, as I expect, there is a further increase soon, Kinross will do better still. So I have spent last week's cash in hand on buying 135 Kinross shares at 182 for £246.

Previous page

Previous page