BANKING ON BLOOD-LINES

Martin Vander Weyer reveals how Barclays is still under the influence of a 150-year-old squirearchy

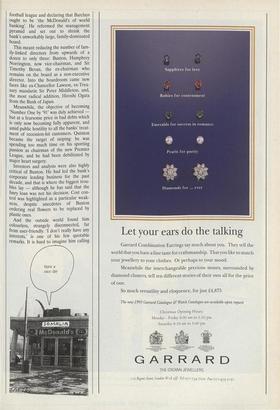

AT LORD'S, the fans of David Gower accuse England's cricket selectors of pick- ing all Players and no Gentlemen. Over at Barclays, the outcry is in the opposite sense: the board of Britain's largest bank has awarded its captaincy to the last of the Gentlemen, Andrew Robert Fowell Bux- ton, and from the institutional sharehold- ers in the members' stand comes a thunder of disapproval.

The problem with the 53-year-old Bux- ton is that, however promising he looked at an earlier stage, he is associated with the bank's recent decline almost as closely as the outgoing chairman, Sir John Quin- ton. But critics suspect that Buxton's accession as chairman and chief executive next month has been protected because he is a scion of the families whose private banks merged to form Barclays in the late- 19th century.

Despite a shareholding of less than 1 per cent between them, this obscure squirearchical alliance still — if appear- ances are to be believed — has influence in the bank's affairs. Both as social history and as corporate politics, it makes a fasci- nating case-study. For shareholders at a moment of crisis in the bank's perfor- mance, it is a matter of deep concern.

That crisis has its origin in 8 April 1988, the date of a controversial Barclays issue of new shares to raise £920 million. Share- holders resented the call, and the ebullient Quinton had to walk round to City invest- ment institutions to explain. It would, he said, make Barclays 'Number One by '91'. Buxton, who became managing director shortly afterwards, added that he and Quinton would 'work closely . . . on agreed policy' to make Barclays 'one of the strongest banks in the world'. Christo- pher Fildes wrote 'Barclays has made its shareholders pay £920 million for a shirt, and put it on Andrew Buxton.'

What followed was a dash for balance- sheet growth which turned into a morass of bad debts, particularly in the property sector. Among a string of well publicised disasters, one loan to Imry — described by analysts as the worst loan of this recession — may lose the bank £200 million. The proceeds of the 1988 raid on its own shareholders has, in effect, been poured down the drain. A loss is predicted for the year, and the final dividend may have to be cut or passed.

But Mr Buxton is still destined for the chair. To understand why, we have to trace a line, and a selection process, for almost 150 years, from the marriage of Sir Thomas Fowell Buxton Bt — brewer, philanthropist and anti-slavery campaigner — to a Miss Gurney of Norwich.

The Gurneys had established a bank in that city in 1775. Throughout the 19th cen- tury, they intermarried with other East Anglian banking families, including the Barclays and the Trittons, whose London partnership, Barclay, Bevan, Tritton & Co., had its origins in the 1690s. This extended dynasty merged its businesses with those of other families — the Quaker Tukes, the Bolithos of Cornwall and numerous others — to form the modern Barclays Bank.

While still substantial owners of the com- pany, the families evolved a form of enlightened nepotism in which their most able sons, after brief training, ran districts of the bank which had been their forebears' private fiefdoms. The best of each genera- tion advanced to the board and the chair. Meanwhile, the best of their non-family employees (of whom my father was one) rose on a separate, slower ladder from clerk to branch manager to head office functionary. Until only a few years ago, the class distinction between the two streams was absolute.

This unique system survived the ever- widening ownership of the bank's shares and the pressures of a more egalitarian age. After the second world war, the gener- al manager, Cuthbert Fitzherbert, recruited a new generation of cousins and family friends from Winchester, Harrow and Oxbridge. Many were ex-Guards officers, and several, reflecting a particular preju- dice of Fitzherbert's, were former masters of the New College Beagles. The blood royal of the founders' kin, diffused across many surnames, was discreetly recorded only on 'a special list', kept in the vice- chairman's drawer.

One of the innermost sanctums of the family network was the 'parlour' in Lom- bard Street once occupied by the partners of Barclay, Bevan, Tritton & Co., and still the seat of the director responsible for City business — the present incumbent is a Barclay; his predecessor was a Tritton. For 40 years, until the late 1960s, it was the lair of Theodore Barclay and Emlyn Bevan, without whose assent few major decisions could pass. It is part of Barclays legend, for instance, that Emlyn Bevan sponsored the advancement of his pipe-smoking Eto- nian kinsman, Tim, whose appointment as a vice-chairman at the age of 41 in 1968 secured his place in line for the top. As Sir Timothy Bevan, he was chairman from 1981 to 1987, and a stalwart of Barclays tradition.

The tradition was not, after all, indefen- sible. It provided what is now called 'suc- cession planning' at a time when few public companies had any such thing, and it engendered a degree of local indepen- dence which often made for good lending decisions. To its advocates, the proof of the family selection process was that Bar- clays had become one of the world's most respected banks. But the system also represented a bul- wark against progress, a layer of unjustifi- able cost and an intense frustration to the careers of men like my father, who was deputy chairman under Bevan until 1983. He and others fought, with limited success, to rationalise the district struc- ture and abolish 'special list' prefer- ment.

The Bevan chairmanship is remembered as a period of hesitant change at a time when other banks seemed to be striding ahead. By its later stages, morale was low and some of the best men — like Malcolm Williamson, now chief executive of Standard Chartered — opted to go else- where.

The candidates to succeed Bevan included Buxton, the Cambridge-educat- ed, 56-year-old Quinton, and others. When the board chose Quinton, the first man ever to come right through the ranks ('We must all feel jolly proud of him,' a family grande dame said to me. 'You realise he started as a driver.'), the announcement was welcomed as a breath of fresh air. At a managers' conference during the interregnum, Bevan's continu- ing presence cast such a pall that Quinton had to take charge of proceedings. The accelerated handover which followed (by no means as public as the current fracas) was thought to have piqued the departing chairman. If Quinton's selection was a triumph for meritocracy, no one has ever suggested that Buxton's rise to the upper echelons was without merit. But his own recent claim that he had always been surprised by his progress seems disingenuous. Lineal descendant of Sir Thomas Buxton, step-son of a Barclays director, product of Winch- ester, Oxford and the Grenadiers, tall and commanding, he was the beau ideal of a family recruit. When, after the property crash of 1974, he proved also to be a steely negotiator of loan recoveries, a task nor- mally allotted to the toughest Players rather than the Gentlemen, he was marked out as the man to watch. Thereafter, no reaction to him by his peers could sensibly ignore that he was likely one day to be chairman, and his own arrogance seemed to reflect that view.

In the absence of older family claimants, it was natural, therefore, that Buxton at 47 had been seen as a candidate to follow Bevan. It was common gossip amongst managers that Buxton was passed over sim- ply on grounds of youth, and that Quinton was only there `to keep the seat warm for Andrew' next time round.

But Quinton turned out to be very much his own man. He presented a cheerful, populist face to the world, sponsoring the football league and declaring that Barclays ought to be 'the McDonald's of world banking'. He reformed the management pyramid and set out to shrink the bank's unworkably large, family-dominated board.

This meant reducing the number of fam- ily-linked directors from upwards of a dozen to only three: Buxton, Humphrey Norrington, now vice-chairman, and Sir Timothy Bevan, the ex-chairman who remains on the board as a non-executive director. Into the boardroom came new faces like ex-Chancellor Lawson, ex-Trea- sury mandarin Sir Peter Middleton, and, the most radical addition, Hiroshi Ogata from the Bank of Japan. Meanwhile, the objective of becoming `Number One by '91' was duly achieved but at a fearsome price in bad debts which is only now becoming fully apparent, and amid public hostility to all the banks' treat- ment of recession-hit customers. Quinton became the target of sniping: he was spending too much time on his sporting passion as chairman of the new Premier League, and he had been debilitated by major heart surgery. Investors and analysts were also highly critical of Buxton. He had led the bank's corporate lending business for the past decade, and that is where the biggest trou- bles lay — although he has said that the Imry loan was not his decision. Cost con- trol was highlighted as a particular weak- ness, despite anecdotes of Buxton ordering real flowers to be replaced by plastic ones.

And the outside world found him colourless, strangely disconnected, far from user-friendly. 'I don't really have any interests,' is one of his few quotable remarks. It is hard to imagine him calling the Nick Ross radio phone-in from his car, as Quinton once did, to defend the bank against its critics.

Despite Buxton's acknowledged skills, the feeling is that he is neither a great communicator nor a world-class banking statesman. Even some of those who admire him think that he has not done enough to justify promotion. But promo- tion is his, nevertheless. Quinton's impend- ing retirement and the immediate transfer of executive power were announced in April with an abruptness which obliged him to say that 'there has been no coup'. Anonymous Barclays sources claimed that Buxton had provoked the decision by threatening to resign. There had been `modest encouragement . . . for Quinton to go early.' The decision was reached by a sub-com- mittee of non-executive directors, whose senior member (unofficial sources hint) was none other than Sir Timothy Bevan. History would not suggest that his sympa- thies were with Quinton. But many other combinations of chairman and chief execu- tive were possible, rather than handing the combined job to Buxton.

Outsiders can only guess whether 'fami- ly' interests had any influence. Bevan could not steam-roll the vote, but he could perhaps have made the point that not to make Buxton chairman, an appointment expected for almost 20 years and predes- tined for 150, would be to signal panic to the world.

Institutions were outraged. The Gover- nor of the Bank of England chose the same day to pronounce in favour of 'sepa- ration as a general rule of chief executive and chairman'. Others quoted the new Cadbury guidelines on corporate gover- nance, which said much the same thing. But the real concern is not to do with abstract principles. It is to do with the man for the job and whether that is Andrew Buxton. Amid rumours of boardroom tur- moil, the bank so far has merely indicated that the situation will be kept under review; a chief executive under Buxton might be possible, but to appoint a new chairman over him would be 'most unlike- ly', Shareholders are unsentimental. They have already seen wholesale management changes at Midland and NatWest. Barclays traditions are not sacred to them; share prices and dividends are. The shares slumped after the announcement of Bux- ton's accession but, ironically, the pound may have come to Mr Buxton's rescue. Since sterling fell out of the ERM, Bar- clays has blipped upwards as a 'recovery' stock. Lower interest rates have eased the pressure on the loan book; revalued over- seas earnings will have helped profits. It may still be possible to maintain the final dividend.

If so, Mr Buxton will live to bat another day. If not, he may find the crowd booing him out by the Gentlemen's exit.

Previous page

Previous page