Company Notes

By LOTHBURY

THE Royal Bank of Scotland has, with its two subsidiaries, Williams Deacon's and Glyn Mills, had a good year. Group profits rose from £1.67 million to £1.99 million and the dividend is raised by 14 points to 17 per cent. Deposits have increased from £143.2 million to £151.5 million and advances were approximately £3 million up. There is no doubt that the future of the bank's prosperity will depend on the con- tinued progress of the Scottish economy. This point is made by the governor, the Duke of Buccleuch and Queensbury, in his report. There is also a recently published booklet (available at all branches) entitled Your Royal Bank ACCOUlli which makes good reading. At 74s 9d., the £1 shares yield 41 per cent. THE Royal Bank of Scotland has, with its two subsidiaries, Williams Deacon's and Glyn Mills, had a good year. Group profits rose from £1.67 million to £1.99 million and the dividend is raised by 14 points to 17 per cent. Deposits have increased from £143.2 million to £151.5 million and advances were approximately £3 million up. There is no doubt that the future of the bank's prosperity will depend on the con- tinued progress of the Scottish economy. This point is made by the governor, the Duke of Buccleuch and Queensbury, in his report. There is also a recently published booklet (available at all branches) entitled Your Royal Bank ACCOUlli which makes good reading. At 74s 9d., the £1 shares yield 41 per cent.

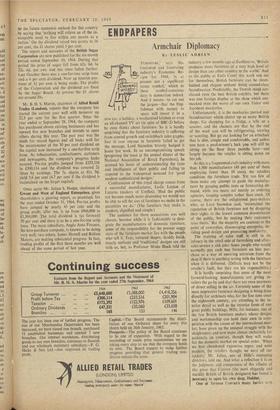

Very satisfactory results have been published by the National Provincial Bank, whose net profit for last year rose from £5.094 million to £5.627 million. This figure included dividends from subsidiary companies of £4.080 million against £3.768 million. There has been only a small change in advances, which now stand al 474 per cent of deposits. The balance-sheet value of £149 million in British government securities now represents a ratio of 14.2 per cent to de- posits. The chairman, Mr. D. J. Robarts, sums

up the future economic outlook for this country by saying that 'nothing will relieve us of the in- escapable need to live within our means as a nation.' On the dividend raised two points to 16 per cent, the £1 shares yield 5 per cent.

The report and accounts of the British Sugar Corporation are now published for the six-month period ended September 30, 1964. During that period the price of sugar fell from 62s. 6d. to 32s. 6d. per cwt. and has since fallen further. Last October there was a one-for-two scrip issue and a 6 per cent dividend. Now an interim pay- ment of 31 per cent is being made. The profits of the Corporation and the dividend arc fixed by the Sugar Board. At present the £1 shares are around 20s.

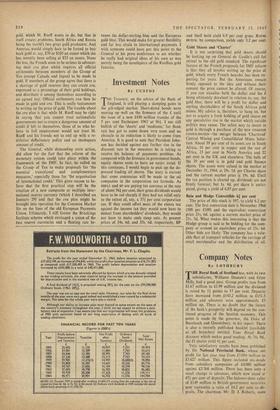

Mr. B. H. S. Martin, chairman of Allied Retail Trades (London), reports that the company has started the current year well with turnover up 22.3 per cent for the first quarter. Since the year ended at September 28, 1964, the company has purchased eleven existing businesses and has opened five new branches and intends to open others during this year. The past year was the ninth for record figures and all looks well for the maintenance of the 30 per cent dividend on the capital now increased by a one-for-five scrip issue. As tobacconists, confectioners, stationers and newsagents, the company's progress looks assured. Pre-tax profits jumped from £233,516 to £300,114 and the dividend was covered 2f times by earnings. The Ss. shares at 41s. 9d. yield 3.6 per cent (4.7 per cent if the dividend is maintained on the larger capital).

Once again Mr. Julian S. Hodge, chairman of Gwent and West of England Enterprises, gives shareholders a glowing report, as promised, for the year ended October 31, 1964. Pre-tax profits have jumped by nearly 45 per cent and the group profit, after tax, is up from £966,000 to £1,304,000. The total dividend is (as forecast) 50 per cent and there is to be a one-for-ten scrip issue. The main subsidiary, Anglo Auto Finance, the hire-purchase company, is known to be doing very well; two others, James Howell and Reliant Motors, are making substantial progress. In fact, trading profits of the first three months are well ahead of the same period of last year.

Previous page

Previous page