Investment Notes

By CUSTOS

THE Treasury, on the advice of the Bank of England, is still playing a damping game in the gilt-edged market. Short-dated bonds were moving up well on the firmness of the £ until the issue of a new £450 million tranche of the 5 per cent Exchequer 1967 at 964. I am still bullish of the 'shorts' and 'mediums,' for Bank rate has got to come down very soon and no obstacle to its reduction is likely to come from America. It is good to note that President John- son has decided against any further rise in the discount rate in the measures he is taking to resolve his balance of payments problem. As compared with the firmness in government bonds, equity shares seem to have an easier trend. If this continues, I would begin to pick up the de- pressed leading oil shares. The story is current that some concession will be made to the oil companies in the corporation tax formula. As SHELL and BP are paying tax overseas at the rate of about 564 per cent, their gross dividends would have to be cut sharply if they had tax relief only to the extent of, say, a 374 per cent corporation tax. If they could offset most of the excess tax against the income tax they would now have to deduct from shareholders' dividends, they would not have to make such steep cuts. At present prices of 54s. 6d. and 35s. 6d. respectively, BP

and Shell both yield 6.9 per cent gross. RovsL Durcx, by comparison, yields only 3.2 per cent.

Gold Shares and 'Charter' It is not surprising that gold shares should be looking up on General de Gaulle's call for retreat to the old gold standard. The significant feature of the French,proposals for IMF reform is that they all involve writing up the price of gold, which every French hoarder has been ex- pecting for years. But the Americans remain firmly opposed to the idea and without their consent the price cannot be altered. Of course, if you can visualise both the dollar and the £ being ultimately devalued in relation to, say, the gold bloc, there will be a profit for dollar and sterling shareholders of the Soutb African gold mines. My advice is, therefore, to hang on, but not to acquire a fresh holding of gold shares on any speculative rise in the market which outside politics may cause. The safest way to invest in gold is through a purchase of the new CHARTER coNsommo-the merger between 'Chartered' Central Mining and Consolidated Mines Selec- tion. About 39 per cent of its assets are in South Africa, 16 per cent in copper and the rest of Africa, 23 per cent in North America and 22 per cent in the UK and elsewhere. The bulk of the 39 per cent is in gold and gold finance shares. The assets were valued in the market at December 31, 1964, at 29s. Id. per Charter share and the current market price is 19s. 6d. Until the tax position is cleared up, dividends are not firmly forecast, but Is. 4d. per share is antici- pated, giving a yield of 6.85 per cent.

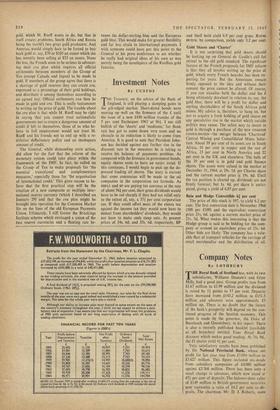

Bain and Hodge Convertible 61 per cent

The price of this stock is 107, to yield 6.2 per cent. The first conversion date is November 1966 (100 per £100) and the equivalent conversion price 21s. 6d. against a current market price of 21s. 3d. What makes this interesting is that the Hodge group is said to be bidding for the com- pany at around an equivalent price of 23s. 6d. Other bids are likely. The company has a valu- able fleet of transport vehicles for the carriage of retail merchandise and the distribution of oil.

Previous page

Previous page