HOUSING

Why not buy?

HEATHER STUBBS

There are 7 million households renting ac- commodation in England and Wales at the moment. According to a recent survey com- missioned by the Housing Research Found- ation, at least 1.1 million of these are in fact in a position to buy their own house.

What stops these renters buying if, as the HRF found, they are earning £1,250+ (£1,500+ in London), and could therefore get a mortgage in the region of £3,000, with repayments around £25-£30 per month. The main reason the renters gave for not buying was that they didn't think they could afford a mortgage (36 per cent), they could not save the deposit (26 per cent).

Some 31 per cent of the renters are in fact paying £6 per week or more, and would therefore be paying no more if they had a £3,000 mortgage. In fact with tax rebate they would be slightly better off. The 38 per cent who were paying under £4 would have to part with a couple of pounds

a week more, some of which would be off- set by tax adjustment. Those paying between £4 and £6 would not notice any difference. As for the deposit, the latest changes recom- mended by the building societies to aid pros- pective customers should help solve that problem for many would-be owners.

Where, then, are the new houses to be bought? Few, if any, council houses will appear on the market now that Labour has regained control of the boroughs. Houses on the private market are still too expensive in the main for the renters in question. At the end of 1969, the average price of a new house, excluding London and the South East, was £3,850. It is now around £4,300 and only 10.12 per cent sell below £3,500.

Thus, those earning around £1,250 are renting rather than buying partly because there is a lack of suitable housing under £3,500. But what of those earning a few hundred more than this figure, and who could, if they chose, pay up to £4,500 for their own house? The better-off in the study appear to be the ones who actually prefer to rent, even though the rent was costing more than a mortgage. They may well be waiting till they come across a new house which offers more than average in the way of flexible space and interesting design.

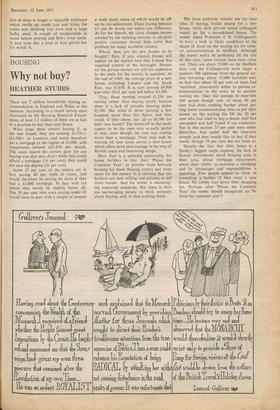

Here then is a splendid opportunity for house builders in this. their 'Please the Customer Year', to provide more low-cost housing for those floating renters and more space for the money. It is obvious that the builders are now willing and anxious to sell more houses. And the NHBRC is encourag- ing improved standards. But there is little use encouraging people to think seriously about buying, only to find nothing there. The local authority tenants are the ones who, if buying, would plump for a new house, while their private rental colleagues would go for a second-hand house. The NHBRC asked Professor I. B. Cullingworth to have a look at likely candidates in the shape of those on the waiting list for coun- cil accommodation in Sheffield. Although the report won't be published till the end of this year, some curious facts have come out. There are about 22.000 on the Sheffield lists, and the Cullingworth team chqse a random 500 addresses from the general sec- tion (covering about 11,000 families) only to find that about 38 per cent of them had 'vanished', presumably either to private ac- commodation in the town or to another waiting list. They did manage to interview 260 people though and, of these, 80 per cent had done nothing further about get- ting better accommodation than to put their names on the waiting list. Of the 20 per cent who had tried to buy a house, half had succeeded and half found it too expensive. Yet in this section 75 per cent were under thirty-five. Just under half the interview sample said they would like to buy if they could, though 39 per cent did not want to.

Despite the fact that their home is a family's biggest single expense, the lack of factual information about housing costs in their area, about mortgage repayments, about their ability to_maintain a mortgage and its advantages and responsibilities is appalling. Few people appear to think of consulting a builder if they want a new house. He comes way down their shopping list. Perhaps after 'Please the Customer Year' the NHBRC should inaugurate an 'in- form the customer year'?

Previous page

Previous page