Company Notes

By LOTHBURY

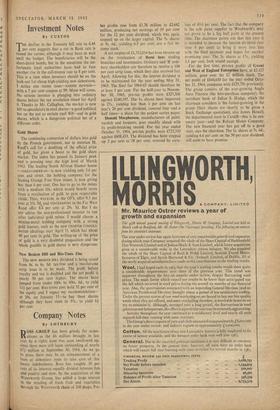

ROSS GROUP has been greedy for acqui- sitions as the £6 million brought in last Year by a rights issue was soon swallowed up, since there were still loans outstanding of nearly 47i million at September 30, 1964. As we go to press there may be an announcement of a loan or debenture issue to take care of this heavy indebtedness. Ross has roughly 50 per Cent of its interests equally divided between fish and poultry and now, by the acquisition of the Waterworth Group, has added a large interest In the retailing of fresh fruit and vegetables through the Waterworth chain of 260 shops. Pre-

tax profits rose from £1.76 million to £2.662 million, producing net earnings of 19 per cent for the 12 per cent dividend, which was again stepped up on the larger capital. The 5s. shares at 9s. 6d., yielding 6.3 per cent, are a fair in- come stock.

A net surplus of £1,752,054 has been thrown up on the revaluation of Berni Inns trading branches and investments. Ordinary and 'B' ordi- nary shareholders are therefore to receive a 100 per cent scrip issue, which they also received last April. Allowing for this, the interim dividend is to be maintained for the year ending May 31, 1965. The final for 1964-65 should therefore be at least 5 per cent. For the half-year to Novem- ber 30, 1965, pre-tax profits were £327,568 against £240,197. The Is, shares have improved to 27s., yielding less than 1 per cent on last year's 20 per cent dividend, covered four and a half times-a share for the patient surtax payer.

Donald Macpherson, manufacturers of paint, varnish and lacquers, goes steadily ahead with its profit-breaking record. For the year ended October 31, 1964, pre-tax profits were £723,349 against £608,433. The dividend has been stepped up 2 per cent to '18 per cent, covered by earn- ings of 43.6 per cent. The fact that the company is the sole paint supplier to Woolworth's may not prove to be a big bull point at the present time. The chairman points out that this year it is intended to increase the interim dividend (last time 4 per cent) to bring it more into line with the final payment and hopes for another promising year. The 5s. shares at 17s., yielding 5.3 per cent, look sound enough.

For the first time, pre-tax profits of Gwent and West of England Enterprises have, at £2.427 million, gone over the £2 million mark. The net profit of £844,650 for the year ended Octo- ber 31, 1964, compares with £639,796 previously. The group consists of the ever-growing Anglo Auto Finance (the hire-purchase company), the merchant bank of Julian S. Hodge, which the chairman considers is the fastest-growing in the group (their shares are shortly to be given a Stock Exchange quotation), also James Howell, the departmental store in Cardiff-this is its cen- tenary year-and the Reliant Motor Company. The new financial year has got off to a good start, says the chairman. The Is. shares at 7s. 6d., yielding 6.6 per cent on the 50 per cent dividend, still seem to have promise.

Previous page

Previous page