Investment Notes

By CUSTOS

THE decline in the Treasury bill rate to 6.44 per cent suggests that a cut in Bank rate is round the corner, although it may have to wait until the budget. The beneficiaries will be the short-dated bonds, but in the meantime the un- fortunate local authorities have had to face another rise in the call-money rate to 8 per cent. This is a time when investors should be on the look-out for cheap high-yielding new debentures. I notice one recent issue-JOSEPH DAWSON- with a 7 per cent coupon at 99. More will come. No serious investor is plunging into ordinary shares before the tax revolution timed for April 6. Thanks to Mr. Callaghan, the market is now left to speculators in steel shares-a good political bet on the not so certain steel Bill-and in gold shares, which is a dangerous political bet of a different order.

Gold Shares '

The continuing conversion of dollars into gold by the French government, not to mention M. Rueff's call for a doubling of the official price of gold, has given a boost to the gold share market. The index has passed its January peak and is pressing near the high level of March 1963. The leading South African finance house --ANGLO-AMERICAN-is now yielding only 3.6 per cent and OFSIT, the holding company for the leading Orange Free State mines, is now giving less than 6 per cent. One has to go to the mines With a medium life, which would benefit more from a revaluation of gold, to gain respectable yields. Thus, WELKOM, in the OFS, offer 8.3 per cent at 35s. 9d4 and VENTERSPOST in the Far West Rand offer 81 per cent at 29s. 3d. But I do not advise the non-professional investor to run after individual gold mines. I would choose a mining-metal holding company with a strong gold interest, such as the new CHARTER CONSOLI- DATED (dealings start April 1), which has about 40 per cent in gold. The writing-up of the price of gold is a very doubtful proposition and the Whole gamble in gold shares is very dangerous.

New Broken Hill and Rio-Tinto Zinc The NEW BROKEN HILL dividend is being raised from 4s. to 6s. 6d. tax-free and a two-for-one scrip issue is to be made. The profit before royalty and tax is doubled and the net profit is nearly 50 per cent higher. The shares have jumped from under 100s. to 106s. 6d., to yield 11+ per cent. RIO-TINTO ZINC hold 32 per cent of the equity and I repeat my recommendation- at 29s. on January 15-to buy these shares, although they have risen to 35s., to yield 6.1 per cent.

Previous page

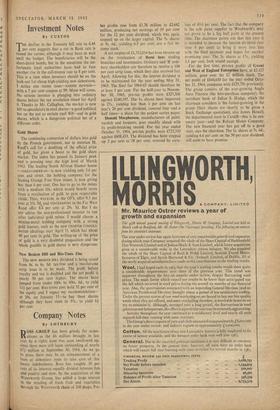

Previous page