Company Notes

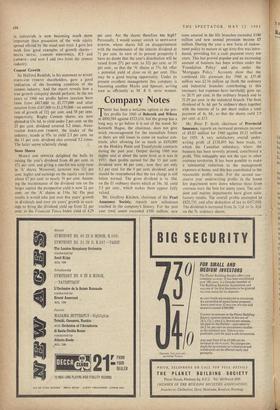

MHERE has been a welcome upturn in the pre- I tax profits for 1960 of Babcock and Wilcox at £890,584 against £523,154, but'the group has a long way to go before it is out of the wood. Sir Kenneth Hague, the chairman, does not give much encouragement for the immediate future as there are still losses to come on nuclear con- tracts, after allowing for as much as £650,000 on the Hinkley Point and Transfynydd contracts during the past year. Output during 1960 was higher and at about the same level as it was in 1957: then profits earned for the 15 per cent. dividend were 46 per cent.; now they are only 8.2 per cent. for the 9 per cent. dividend, and it should be remembered that the tax charge is still below normal. The gross dividend is Is. 10d. on the £1 ordinary shares which at 34s. 3d. yield 5.3 per cent., which makes them appear fully valued.

Mr. Geoffrey Kitchen, chairman of the Pearl Assurance Society, reports new milestones reached in the company's history. For the past year total assets exceeded £300 million, new sums assured in the life branches exceeded £100 million and new annual premium income £5

million. During the year a new form of endow- ment policy to mature at age sixty-five was intro- duced, providing for a cash payment every ten years. This has proved popular and an increasing amount of business has been written under the `Foundation Policy' and also under the `Mortgages Policy.' Accounts show that the combined life premium for 1960 at £37.48 million was £2.34 million up (both the ordinary and industrial branches contributing to this increase); but expenses have inevitably gone up, to 20.71 per cent. in the ordinary branch and to 31.29 per cent. in the industrial branch. The final dividend of 3s. 6d. per 5s. ordinary share together with the interim of ls. per share makes a total payment of 4s. 6d., so that the shares yield 2.9 per cent. at £13.

Mr. ,Peter F. Scott, chairman of Provincial Insurance, reports an increased premium income of £9.83 million for 1960 against £9.21 million for 1959. A very satisfactory overall under- writing profit of £138,893 has been made, to which the Canadian subsidiary, where the business has been severely pruned, contributed a profit. This unhappily was not the case in other overseas territories. It has been possible to make a substantial reduction in the management expenses at home, and this has contributed to the reasonable profits made. For the second suc- cessive year underwriting profits in the home fire department were down whereas those from overseas were the best for many years. The acci- dent and marine departments have given satis- factory results. The overall profits amounted to £820,735, and after deduction of tax to £457,010. The dividend is increased from 2s. 14d. to 2s. 44d. on the 5s ordinary shares.

Previous page

Previous page