Investment Notes

By CUSTOS TREASURY mismanagement of the gilt-edged market was shown up this week when a long-dated stock—Treasury 53 per cent. 2008-12—fell to yield a full 6 per cent. flat. This was a 'tap' stock on tap at the unrealistic price of 954. It has fallen to its 'real' level of 923. This had a very disturbing effect on other long- dated and irredeemable stocks, War Loan falling to a new historical `low'— to under 585. To make matters worse, the Treasury is allowing ISHRA to go ahead With the marketing of the iron and steel prior charges which have a nominal value of around £120 million. Such a huge operation, which seems quite unnecessary and uncalled for, is sufficient to drive long-dated gilt-edged stocks down another 4 points, for the new issue market is unlikely to take an iron and steel debenture to yield less than 65 per cent. or a preference to yield less than 63 per cent. to 7 per cent. It has been suggested that some of the recent selling of gilt-edged has been coming from foreign holders who are getting apprehensive about sterling. Whether this is true or not this is not the time to allow the gilt-edged market to get demoralised. Before long the Treasury must issue a conver- sion loan to replace £796 million 25 per cent Funding 1956-61 due in April. Before long, also, trustees will receive powers to exchange half their gilt-edged for equities. Do the Treasury managers want to see a stampede of trustees out of the gilt-edged market, involving perhaps more than £1,000 million of stock? The Treasury would be well advised to release the banks' special deposits and bring back some confidence to the gilt-edged market.

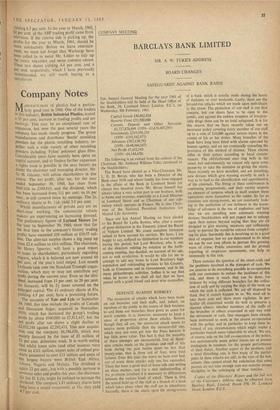

Bank Shares The bank dividends were all up to expecta- tions, but the market did not respond as it might —due no doubt to a stale bull account. It would not be surprising to see the bank share market settle down on a higher yield basis of around 4 per cent. I adhere to my recommendation last week that UNITED DOMINIONS TRUST, having fal- len 20 per cent. this year, has a greater potential rise than the joint stock banks. Investors might also be bold and switch into one or two of the New York bank shares. Allowing for double tax- ation relief, yields of just over 5 per cent, gross can be obtained from FIRST NATIONAL CITY BANK Of NY, from CHASE MANHATTAN and from MOR- GAN GUARANTY TRUST. Wall Street seems to be bullish of Mr. Kennedy's new administration and although the market may be temporarily over- bought it might easily try to penetrate its 1960 high, which means a rise of over 10 per cent.

Cinema Shares On the RANK ORGANISATION purchase of the 20th Century Fox holding in the syndicate which controls Gaumont-British some investment buy- ing was seen in the cinema share market which was no doubt prompted by the feeling that the decline in cinema attendances is flattening out. Rank is engaged on a long-term tidying-up of its complicated structure and ultimately Gaumont-British will, no doubt, be absorbed completely. I never understand why such a big disparity in yield exists between Ranks, yielding 3 per cent., and its junior partner, Gaumont- British, yielding 6.2 per cent. The shareholders of Gaumont-British would have to be compensated if they were asked to give up income on the final merger. ASSOCIATED BRITISH PICTURES has also recovered well from its 1960 low and it is now Yielding 6.3 per cent. In the year to March, 1960, 62 Per cent. of the ABP trading profit came from television. If the cinema side is picking up, the Profits for the year to March, 1961, should be more satisfactory. Before we leave entertain- ment, we must not forget that Warburgs have been called in to assist Mr. Littler to tidy up the STOLL TIIEATRES and MOSS EMPIRES GROUP. These two shares yielding 4.4 per cent. and 4 Per cent, respectively, which I have previously recommended, are still worth buying as a

Previous page

Previous page