Investment Notes

By CUSTOS

?lastrally in equity shares brought about by 1 last week's cut in Bank rate to 61 per cent. quickly fizzled out. After all, the immediate busi- ness prospect remains exactly the same. Until the clash between Government and trade unions has been resolved the market has nothing bullish to discount. It will remain depressed if the profit squeeze produces some exceptionally bad com- pany reports. There is one ray of light. The stream of new issues seems to be slowing down. Some of the recent issues have depressed the shares unduly. Take LAPORTE, whose shares have fallen by over 35 per cent. this year. Last year the high point was 34s. and the yield 31 per cent. Today, after a one-in-five issue at 18s., the, price is 19s. and the yield is 53 per cent. The issue was made to pay for expansion—the taking over of Howards and a German chemical company. The chairman has said that the profits for the year to March, 1962, will be somewhat lower, but that the final dividend will be maintained. As one of the big chemical 'groups in the coun- try, specialising in the production of hydrogen Peroxide and titanium oxide, the company should in due course recover its former prosperity. CIEBENRAms, which have issued one-in-fifteen at 42s. 6d., have come back to 53s. 6d. (against a h!gh of 77s. 6d.) to yield over 31 per cent. The directors estimate that profits for the year to July 31, 1962, will be close to, but not in excess of, the record figures of the previous year. If this is realised they expect to recommend the same rate of dividend on the increased capital. This 'eenis a good opportunity to buy the new shares Tree of stamp.

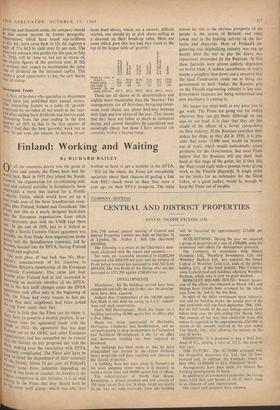

Investment Trusts A firm of brokers who specialise in investment !,.lusts have just published their annual survey. ' he interesting feature is a table of 'growth' expressed by an index of net assets at the year- end after adding back dividends and interest paid. Measuring from the year ending in the first quarter of 1951 to that in the first quarter of 1)61 I find that the best 'growths' work out at °ver 30 per cent. per annum. In buying invest- ment trust shares, which are a narrow, difficult market, one should try to pick shares selling at a discount on their break-up value. Here are some which pass this test and also stand at the top of the league table of 'growth':

Break-up value at

31.8.61 ... Present price Div. yield ...

'Growth' in net assets, 1951/61 ti

41,t3

25(.- 22/9 3.5 297%

1

17.

29/31 27/6 3.6 337%

1.2 &n

38/81 36/- 3.3 295%

ro

32(6 31/3 3.2 328% 30/3 27/3 3.1 289% 17/93 15/9 3.3 316%

These are all shares of 5s. denomination and slightly more marketable than the 'heavies.' The managements are all first-class. As a group invest- ment trust shares are about half-way between their high and low prices of the year. That means that they have not fallen as much as industrial shares, and cannot therefore be considered out- standingly cheap, but those I have selected are certainly within a buying range.

Previous page

Previous page