Investment Notes

By CUSTOS

AFTER their recent rise the share markets are undergoing what is known as a technical correction. It will be observed from the charts that the bull market in Throgmorton Street is moving hand in hand with the bull market in Wall Street. The investment dollar premium has now moved up to 9 per cent and the only thing which will knock Throgmorton Street out of line will be domestic politics. The TUC de- mand for nationalisation of electrical manufac- turing unsettled the market in these and in steel shares. The investor should pay little attention to this fright, for Mr. Harold Wilson is not lightly moved from his course, which is to nationalise steel only and expand public owner- ship in other ways if necessary. Both these share groups should be watched for buying oppor- tunities. In the meantime the market may drift until the half-yearly figures for lei are an- nounced on September 24. If they are good, the upward trend in equities should be resumed.

The Rank Organisation

The results of the RANK ORGANISATION for the year ending June were much better than the market (or I) expected. Trading profits were up 35 per cent and net profits after tax up 54 per cent. The earnings on the equity have jumped from 45 per cent to 60 per cent, or from 51 per cent to 74 per cent after investment allowances. The dividend has been raised 21 points to 271 per cent. The sharp improvement in profits was due to the non-cinema interests. There was a good recovery in Rank. Radio and Television, in RT & G Trust, which 'holds the relay and rental interests, and in Rank Precision Indus- tries. In the rental industry it would appear that Rank-Xerox has contributed about £240,000—a profit for the first time. The estimates which I referred to recently emanating from the Ameri- can Xerox indicated that pre-tax profits from Rank-Xerox could amount to Ell million by 1965 to 1966, which would add about 25 per cent to earnings on the Rank equity capital. This gives the optimists something to go for. As the chairman has said that subject to a bad setback in the economy as a whole 'profits for 1963,-64 will show a satisfactory increase and this favour-

able trend will continue,' Rank shares seem bound for higher levels. Instead of the expected bonus, a convertible bond issue is to be made on a rights basis for £10 million. This issue may give those who have not yet participated an op- portunity to acquire this interesting equity. The 'A' shares have risen to 47s., to. yield 2.9 per cent on present dividends and about 6 per cent on earnings.

Willenhall Motor

I referred to WILLENHALL MOTOR RADIATOR on April 5 at 20s., to yield at that time 5 per cent, and I repeat the recommendation today in view of the increase in the interim dividend from 5 per cent to 61 per cent. A similar rate of in- crease 'in the final would bring the distribution up to 261 per cent against 20 per cent for the previous year. If one works on a conservative estimate of 26 per cent, the yield at the present price of 26s. 3d. would be just under S per cent. The company's business is the manufacture of fully-fitted steel cabs for commercial vehicles, car bodies, van bodies and pressed panels and other components for the automobile indus- try. The chairman in March referred to the large increase in the production of pressed work for the Ford Motor Company, with whom further important contracts have been made during the year. The indications are that the current year will show a further increase in turnover and profits. A takeover bid in the future is, as I have said before, a possibility. It is a narrow market and an investor should wait for a dull market day if he wants to buy. Construction and Cement The construction industry, fully recovered from its winter setback, is now ahead of its output peak of 1962 and the cement companies are de- livering at a record rate. This gives an invest- ment point to the recent 20 per cent rights issue of ASSOCIATED PORTLAND CEMENT, whose new shares, now 55s. 6d., can be bought free of stamp up to September 20. The equivalent dividend is 8.34 per cent, but taking 8.1 per cent the shares Would yield a good 3 per cent on dividends and over 8 per cent on earnings if they were to come back by Is. Obviously a 'blue chip' to watch for a buying opportunity.

International Nickel 1 have to correct a statement which I made on August 30 that the President of International Nickel had forecast lower earnings in two years' time. This is denied and I must apologise. The company's spokesmen remain optimistic about the outlook.

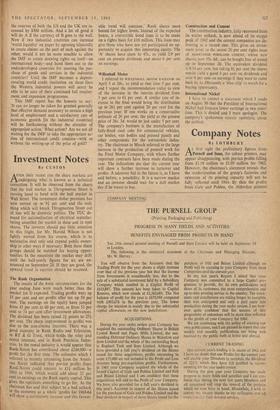

Previous page

Previous page