Finance—Public & Private The Austrgian Ctisis Fnoiu time to time

I have felt it necessary in these columns to draw attention to the serious character of the financial and exchange crisis in Australia, and have been obliged to emphasise the extent to which that crisis was, in part, occasioned by, and to an enormous extent aggravated by, Labour politics or Socialism in Australia. It may he doubted whether a political party has ever imparted a more serious blow to the credit of its own country, and incidentally to the credit of the Empire, than that which has been imparted during the past week by the Labour Government in Australia. I know it may be said that it is only Mr. Lang, the Premier of New South Wales, who is alleged to have suggested a tampering with Aus- tralia's full liability on its external debt, and that Mr. Scullin, the Commonwealth Premier and the Premiers of the other States promptly repudiated Mr. Lang, but the fact remains that by repudiating the agree- ment at one time made after Sir Otto Niemeyer's visit, and by adopting a programme of a semi-inflationary character, a continuance of the power of Australia to bear her external debt 'seems likely to be gravely jeopardised.

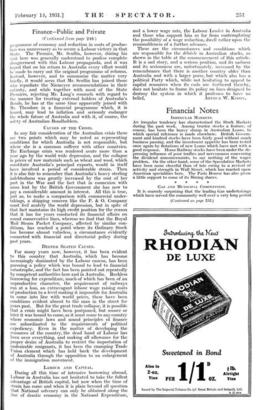

Here, at all events, is a brief record of recent move- ments in Australian securities, the first' column giving the highest point of the last three years and the second column giving the quotations at the time that the Niemeyer programme was accepted by the Commonwealth Cabinet and the other States, while the third column gives the approximate price at the time of writing :—

Commonwealth of Australia 6% Stk. .. 104 991 83 Do. 5% 1935-45 1001 93 73 Do. • 5% 1945-75 1011 91f 70 New South Wales 4% Ins. 821 72f 50 o. 3% .. .. 87 87 64 Queensland 4% Ins. 1940 .. 831 761 56 Do. 5% Ins. 1940 .. 100 -901

-57

S. Australia 5% 1932-42. .. 100 911 69 Victoria 4f% 1940 .. .. 96 83 59 Do. 5% Cons. 1945 .. .. 1001 901 67 W. Australia 41% Ins. .. .. 92 82 60 Do. 5% Ins. .. .. 1001 89 69

In view of the fact that something like 8500,000,000 of British capital is invested in Australian securities—which, be it noted, still stand in the trustee rank—it is not surprising that this colossal fall in prices should have occasioned something like dismay in the minds of British investors and British trustees. We live, however, in times when something like two columns of popular news- papers are given to the birth of twins to a criminal in prison, while events which mark-not merely colossal losses to British investors but -real decadence in Empire pro- sperity receive scant notice.

DISAPPOINTED HOPES.

It will be noted that the second column of the fore. going table, the date for which was towards the end of August of last year,- shows that prices- up to that point had not fallen very greatly, and the point is important to bear in mind because there is no reason to suppose that the position as then examined and reported upon by Sir -Otto Niemeyer contained any more-favourable- ele- ments in it than those of more recent months. Prices, hoWever, rallied in August, because it was thought that the Australian Government was genuinely convinced of the urgent necessity for immediate drastic economies in national outlays, and for the necessary wage reductions to adequately lower costs of production. In this, hoWever, it turns out that British investors were mistaken.. Mr. Scullin, immediately after the agreement had been readied accepting the proposed reforms, sailed for this country to take part in the Empire Conference, and he had no sooner departed than, under. the lead .of: &f Lang, a vigorous Labour propaganda turning down the Niemeyer programme was set in motion. Even at that stage there was vague talk by Labour extremists of repudiating Australia's obligations, and Mr. -Lang so far persuaded the electors of New South Wales that the Niemeyer (Continued' on page 251.)

- Finance—Public and Private

(Continued from page 248.) programme of economy and reduction in costs of produc- tion was unnecessary as to secure a Labour victory in that State. The Premier, Mr. Scullin, however, during his visit here was generally understood to profess complete disagreement with this Labour propaganda, and it was hoped that on his return to Australia every effort would he made to carry out the original prograinme of reforms. Instead, however, and to summarise the matter very briefly, it would seem that Mr. Scullin has joined those who repudiate the Niemeyer recommendations in their entirety, and while together with most of the State Premiers, rejecting Mr. Lang's counsels with regard to the manner for treating external holders of Australia's Bonds, he has at the same time apparently joined with Mr. Theodore in a financial programme which, it is feared, may lead to inflation and seriously endanger the whole future of Australia and with it, of course, the safety of Australian Bondholders.

CAUSES OF THE CRISIS.

In any fair consideration of the Australian crisis there are two points which may be noted as representing conditions for which Australia is not responsible, but where she is a common sufferer with other countries. The Exchange crisis was rendered acute more than a year ago by the world wide depression, and the collapse in prices of raw materials such as wheat and wool, which constitute Australia's principal . exports, would in itself have involved a period of considerable strain. Then it is also fair to remember that Australia's heavy sterling indebtedness was greatly increased by the cost of her part in the War and the fact that in connexion with sums lent by the British Government she has now to pay a considerable amount in interest. All this is true, just as, to make a comparison with commercial under- takings, a shipping concern like the P. & 0. Company must feel acutely the world depression, but in spite of that fact maintains its high credit position for the reason that it has for years conducted its financial affairs on sound conservative lines, whereas we find that the Royal Mail Steam Packet Company, affected by similar con- ditions, has reached a point where its Ordinary Stock has become almost valueless, a circumstance evidently connected with financial and directorial policy during past years.

DEEPER SEATED CAUSES.

For many years now, however, it has been evident to this country that Australia, which has become increasingly dominated by the Labour caucus, has been pursuing a policy which was bound to lead to financial catastrophe, and the fact has been pointed out repeatedly by competent authorities here and in Australia. Reckless borrowing for expenditure, much of which has been of an unproductive character, the acquirement of railways run at a loss, an extravagant labour wage raising costs of production to a level making it impossible for Australia to come into line with world prices, these have been conditions evident almost to the man in the street for years past. - But for the great trade collapse, it is possible that a crisis might have been postponed, but sooner or later it was bound to come, as it must come to any country where economic laws and sound principles of finance are subordinated to the requirements of political expediency. Even in the matter of developing the resources of the country, the dead hand of Labour has been over everything, and making all allowance for the proper desire of Australia to restrict the importation of undesirable emigrants, it has been the cramping Trade Union element which has held back the development of Australia through the opposition to an enlargement of the immigration movement.

LABOUR AND CAPITAL.

During all this time of intensive borrowing abroad, Labour in Australia has not hesitated to take the fullest advantage of British capital, but, now when the time of strain has come and when it is plain beyond all question that National solvency can only be obtained along .the line of drastic economy in the National Expenditure, .

and a lower wage rate, the Labour Leader in Australia and those who support him so far from contemplating the possibility of a wage reduction, dwell rather upon the reasonableness of a further advance.

These are the circumstances and conditions which are responsible for the debacle in Australian stocks, as . shown in the table at the commencement of this article. It is a sad story, 'and a serious position, and its sadness and its seriousness are, unfortunately, increased by the remembrance that there is another country older than Australia and with a larger purse, but which also has a political Party which, while not hesitating to appeal to capital resources when its ends arc furthered 'thereby, does not hesitate to frame its policy on lines designed to destroy the system in which it professes to have no

Previous page

Previous page