De Gaulle, the £ and the $

By NICHOLAS DAVENPORT

IT is probably true to say that the £ has been saved by General de Gaulle. What is not clear is whether be has exposed the dollar once again to danger. I admit that this statement is provocative and needs explana- tion : so here goes.

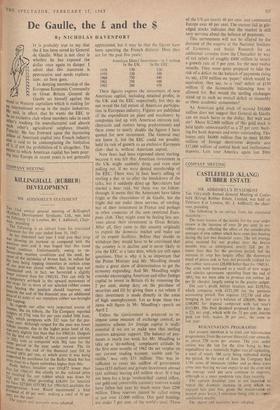

2,1 In denying membership of the 2,f) European Economic Community to Great Britain General de Gaulle set himself against the trend in Western capitalism which is making for an international set-up in the major industries. Re said, in effect, that he wants the EEC to be an exclusive club whose members take in each Other's washing (in manufactures) and absorb each other's agricultural surpluses (mainly french). He has frowned upon the increasing Inflow of American capital into French industry and is said to be contemplating the limitation " it, if not the prohibition of it altogether. The ent to which American capital has been pour- ing into Europe in recent years is not generally appreciated, but it may be that the figures have been upsetting the French dictator. Here they are for the past five years:

American Direct Investment—in S million In the UK. In the EEC.

1958 170 230

1959 330 300 1960 750 440 1961 290 400 1962 300 450 These figures express the investment of new

American capital, including retained profits, in the UK and the EEC respectively, but they do not reveal the full extent of American participa- tion in European industry. Figures are published of the expenditure on plant and machinery by companies tied up with American interests (oil,

chemicals and motors being predominant) and these come to nearly double the figures I have

quoted for new investment. The General may not know it, but the EEC could not possibly hold its rate of growth as an exclusive European club—that is, without American capital.

Now fears had been expressed about sterling,

because it was felt that American investment in the UK might suddenly drop, and even start

pulling out, if we were denied membership of the EEC. There was, in fact, heavy selling of

sterling a day or so after the breakdown of the talks, but it suddenly dried up. Speculators had started a bear raid, but there was no follow- through. It seems that the Americans have taken fright at the chauvinism of de Gaulle, but the fright did not make them nervous of sterling, but of their investment in France and perhaps in other countries of the now restricted Euro- pean club. They might even be feeling less ner- vous about their investment in Great Britain.

After all, they came to this country originally to exploit the domestic market and make use

of its export facilities. Before they decide to

withdraw they would have to be convinced that the country is in decline and is never likely to

join the EEC at a later date, which are still open questions. That is why it is so important that the Prime Minister and Mr. Maudling should make a great show of determination to get the economy expanding. And Mr. Maudling might consider encouraging American and other foreign capital to invest in Britain (i) by removing the 2 per cent. stamp duty on the purchase of securities and (ii) by giving them a tax rebate if their investment is made directly in the areas of high unemployment. Let us hope these two items will figure in Mr. Maudling's speech on April 2.

Unless the Government is prepared to re- impose some measure of exchange control, an incentive scheme for foreign capital is really essential if we are to make sure that sterling receives adequate support. The balance of pay- ments is much too weak for Mr. Maudling to take up a 'do-nothing,' complacent attitude. In the first nine months of 1962 the net surplus on our current trading account, visible and 'in- visible,' was only £51 million. This was in- sufficient to cover the outflow of government loans (£53 million) and private investment abroad

(£41 million), leaving £43 million short. If it had not been for a large 'unidentified' capital inflov,, our gold and convertible currency reserves would have fallen last year by much more than £200 million. These reserves cannot be called strong at just over £1,000 million. Our gold holdings are under 7 per cent. of the world's total. Those

of the US are nearly 40 per cent. and continental Europe over 40 per cent. The current fall in gilt- edged stocks indicates that the market is still very nervous about the balance of payments.

This nervousness will not be allayed by the demand of the experts at the National Institute of Economic and Social Research for an additional stimulus from the Chancellor by way of tax reliefs of roughly £400 million to secure a growth rate of 5 per cent. for the next twelve months. They seem quite prepared to take the risk of a deficit on the balance of payments rising to, say, £350 million on 'paper,' which would be equivalent, they say, to a 'real' deficit of £150 million if the favourable balancing item is allowed for. But would the sterling exchangeS stand up to such an overall deficit as staunchly as these academic economists?

An American gold stock of around $16,000 million does not suggest that General de Gaulle can do much harm to the dollar. But wait and see! About $12,000 million of this gold stock is held (quite unnecessarily) as a 25 per cent. back- ing for bank deposits and notes outstanding. This leaves only $4,000 million free to meet $8,000 million of foreign short-term deposits and $17,000 million of central bank and institutional deposits. Last year America again Lost $900

million of gold, bringing her gold losses up to $8,000 million for the last six years. Her deficit on international payments in 1962 was still $2,000 million (against $2,500 million in 1961). Europe gained practically all that America lost in gold last year and it is significant that private hoarders absorbed $1,100 million, which was nearly 90 per cent. of the new gold mined. France took most of the European inflow, in spite of the fact that she paid back to the US in advance $470 million of loans. France has now the largest balance of payments surplus in Europe. The Americans must be anxious lest France and Germany begin to call their short-term dollar deposits as a result of the worsening political relations between Europe and the US. An unpleasant run on the gold reserves at Fort Knox is not impossible, and who would be surprised if the Americans, acting as peevishly as the General, then put an embargo on further sales? It is an unpleasant thought that the subsequent rise in the dollar price of gold would enable France to repay her dollar debts at much less cost in gold francs.

Previous page

Previous page