CITY AND SUBURBAN

Why Rupert wants to sell the stately house of Hambro

CHRISTOPHER FILD ES

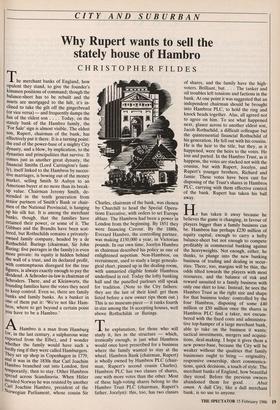

The merchant banks of England, how Opulent they stand, to give the founder's kinsmen positions of command; though the balance-sheet has to be rebuilt and the assets are mortgaged to the hilt, it's in- clined to take the gilt off the gingerbread (or vice versa) — and frequently damps the fun of the eldest son . . . . Today, on the stately bank of the Hambro family, the 'For Sale' sign is almost visible. The eldest son, Rupert, chairman of the bank, has effectively put it there. It is a turning point: the end of the power-base of a mighty City dynasty, and a blow, by implication, to the dynasties and principalities that survive. It comes just as another great dynasty, the financial Smiths (Lord Carrington's fami- ly), itself linked to the Hambros by succes- sive marriages, is bowing out of the money market, selling Smith St Aubyn to an American buyer at no more than its break- up value. Chairman Jeremy Smith, de- scended in the tenth generation from senior partners of Smith's Bank or chair- men of the National Provincial, is hanging UP his silk hat. It is among the merchant banks, though, that the families have retained their power, or some of it. The Gibbses and the Brandts have been scat- tered, but Rothschilds remains a privately- owned family company, headed by a de Rothschild. Barings (chairman, Sir John Raring: five peerages in the family) is even more private: its equity is hidden behind the wall of a trust, and its declared profit, With contemptuous disregard for the true figures, is always exactly enough to pay the dividend. A Schroder-in-law is chairman of Schroders. There, and at Kleinworts, the founding families have the votes they need to keep control. Even so, there are family banks and family banks. As a banker in One of them put it: 'We're not like Ham- bros, where to get beyond a certain point You have to be a Hambro.'

A. Hambro is a man from Hamburg (or, in the last century, a sulphurous wine exported from the Elbe), and I wonder Whether the family would have such a lordly ring if they were called Hamburgers. They set up shop in Copenhagen in 1779, and it was in the 1830s that Carl Joachim liambro branched out into London, first temporarily, then to stay. Other Hambros Spread across Scandinavia. When Hitler invaded Norway he was resisted by another ,,,Carl Joachim Hambro, president of the 'Norwegian Parliament, whose cousin Sir Charles, chairman of the bank, was chosen by Churchill to head the Special Opera- tions Executive, with orders to set Europe ablaze. The Hambros had been a power in London from the beginning. By 1851 they were financing Cavour. By the 1880s, Everard Hambro, the controlling partner, was making £150,000 a year, in Victorian pounds. In our own time, Jocelyn Hambro as chairman described his policy as one of enlightened nepotism. Non-Hambros, on recruitment, used to study a large genealo- gical chart, pinned up in the dealing-room, with unmarried eligible female Hambros underlined in red. Today the lofty banking hall and the panelled parlours still speak for tradition. (Note to the City fathers: they are the last of their kind: get them listed before a new owner rips them out.) This is no museum-piece — it ranks fourth in size among the 16 accepting houses, well above Rothschilds or Barings.

The explanation, for those who will study it, lies in the structure — which, ironically enough, is just what Hambros would once have prescribed for a business where the family wanted to stay at the wheel. Hambros Bank (chairman, Rupert) is wholly owned by Hambros PLC (chair- man, Rupert's second cousin Charles). Hambros PLC has two classes of shares, one with more votes than the other. Most of these high-voting shares belong to the Hambro Trust PLC (chairman, Rupert's father, Jocelyn): this, too, has two classes of shares, and the family have the high- voters. Brilliant, but. . . . The tanker and oil troubles left tensions and factions in the bank. At one point it was suggested that an independent chairman should be brought into Hambros PLC, to hold the ring and knock heads together. Alas, all agreed not to agree on him. To see what happened next, glance across to another eldest son, Jacob Rothschild, a difficult colleague but the quintessential financial Rothschild of his generation. He fell out with his cousins. He is the heir to the title, but they, as it happened, were the heirs to the votes. He lost and parted. In the Hambro Trust, as it happens, the votes are stacked not with the cousins, but with Rupert, Jocelyn, and Rupert's younger brothers, Richard and Jamie. These votes have been cast for disposing of the Trust's shares in Hambros PLC, carrying with them effective control of the bank. Rupert has taken his ball away.

He has taken it away because he believes the game is changing, in favour of players bigger than a family business can be. Hambros has perhaps £230 million of equity capital, enough to carry a hefty balance-sheet but not enough to compete profitably in commercial banking against the heavyweights. Not enough, either, he thinks, to plunge into the new banking business of trading and dealing in secur- ities. There, too, margins will be thin, the odds tilted towards the players with most resources, and the balance of risk and reward unsuited to a family business with only one shirt to lose. Instead, he sees the Hambro Trust as the right size and shape for that business today: controlled by the four Hambros, disposing of some £40 million or £50 million once the shares in Hambros PLC find a taker, not encum- bered with the fixed costs and administra- tive top-hamper of a large merchant bank, able to take on the business it wants: tactical investments, mergers and acquisi- tions, deal-making. I hope it gives them a new power-base, because the City will be weaker without the qualities that family businesses ought to bring — originality, responsive ownership, short communica- tions, quick decisions, a touch of style. The merchant banks of England, how beautiful they stood. Before the previous owners abandoned them for good. . . . Absit omen. A dull City, like a dull merchant bank, is no use to anyone.

Previous page

Previous page