Account gamble

Bond Worth Holdings

John Bull

It is often puzzling to find one sector in the market that consistently appears to be neglected. Carpets shares have come a long way from their low level of last year but even so are still selling on fairly humble ratings. The reasons behind this cautious appraisal stem from the inherent fears that with small capitalised companies (as most carpet groups are) one might be locked in a stock when the sector falls and carpet shares are prone to sharp setbacks When there are signs that consumer spending is drying up.

Although I see the point behind these arguments I feel that the market unnecessarily takes a depressed view at the present moment and in one case in particular I feel there could be a sharpish rerating. This is Bond Worth Holding whose results Will be announced in the next account. This carpet-cum-furniture company has Made a rapid recovery and from losses of £1.3 million in 1970 it now looks in line to Make profits of around £1 million in the Year to end-June.

These results will follow the sharp increase in profits at the interim stage When they rose from £202,003 to £494,000. And earnings on my estimate will be 19.6 Per cent on a fully taxed basis, though With tax losses in hand and no charge this Year the figure will be more in the region of 291 per cent. At 45p, therefore, the Shares are on a PE ratio of only 9.2 or 6.3 (on the higher earnings figure).

The main, reason for sticking my neck out and advising purchase of Bond Worth is that even after achieving £1 million the group should continue to do well in the current year. Carpet sales are still buoyant and some manufacturers are saying that conditions now are more in line with those in the peak selling season later in the year.

One reason why things are going so well IS that house completions are increasing and there is no reason to take a pessimistic view on this score—at least until the end, of the year. Bond Worth is also helped by having other strings to it bow outside carpets through its furniture interests. Also, even when the home market turns flat, there is a degree of protection from the group's overseas interests. It has °Aerations in Ireland and Australia but more important, with the EEC drawing Close, is that it has expanded fast in Europe. Bond Worth already has a sub sidiary in Holland and only last month it aurchased a German company Hamberger rePPich-Lager, which trades throughout Germany and has an annual turnover of over £2 million.

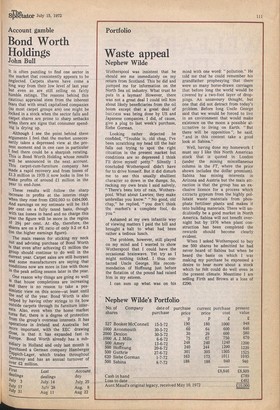

First dealings July 3 JUly 17 July 31

Last Account dealings day July 14 July 25 July 28 Aug. 8 Aug 11 Aug 22

Previous page

Previous page