Investment Notes

By CUSTOS THE equity market has come back further and not even the excellent results of MARKS AND SPENCER can stop it falling if that is the fashion- able trend. As I have said, the reaction should not be too severe and the opportunity should be taken of buying shares of the M and S type if yields become attractive. M and S profits before tax have risen by 111 per cent and the dividend is up from 35 per cent to 381 per cent with a one-for-two scrip issue. The fact that the divi- dend yield (after a 2s. 6d. fall in the price) is 3 per cent and the earnings yield 4.2 per cent makes it vulnerable to a differential profits tax under Labour, but Labour is not yet in power and has not yet decided to have a differential profits tax. It might well have a corporation tax on the American lines, so that highly efficient companies like M and S are not unfairly treated. If high yields are considered politically safer, which I do not admit, BRISTOL AEROPLANE and HAWKER SIDDELEY have just produced reports good enough to make them attractive. Bristol at 23s. 6d. yield 6.4 per cent on the forecast 131 per cent after the scrip issue (yield on earnings 12.2 per cent), while Hawker at 33s. 6d. yield 7.3 per cent on the dividend increased from II per cent to 12 per cent. Hawker's diversifi- cation (40 per cent being industrial) could add to its profits this year, but next July its con- vertible debentures, if exchanged into ordinary (they are presently quoted at a discount on the ordinary), could reduce equity earnings from 25 per cent to 20} per cent. I prefer Bristol as being less speculative in view of its profitable engine business.

A Switch

The directors of EDWARDS HIGH. %/Actium have decided to maintain the dividend of 9 per cent, in spite of its being short-earned, because they feel 'justified in siew of the long-term prospects.' After the collapse in profits in 1962. there has been a welcome recovery, with export orders well up, but it is not yet clear whether profit margins are adequate. With a dividend yield of only 3.3 per cent and an earnings yield of under 2 per cent, I suggest an exchange from these shares at 10s. 6d. into BOULTON AND PAUL at 10s. 9d. to yield 5.7 per cent on dividends. Recent results show a turn-round in profitability. The works making mechanised plant for steel mills have a full order book and the company's many products for the building industry are in good demand. As the company has just brought into production its highly automated timber mill at Lowestoft (which unloads, stores and cuts Limber), its current profits should be in excess of those for the year to September, 1963. Inci- dentally, the dividend was only short-earned if investment allowances are excluded.

Investment Trusts

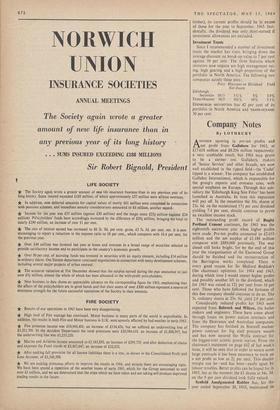

Since I recommended a number of investment trusts the market has risen, bringing down the average discount on break-up value to 7 per cent against 10 per cent. The three features which investors now require are high management rat- ing, high gearing and a high proportion of the portfolio in North America. The following two companies satisfy these tests:

Price Discount on Dividend Net Assets Yield Edinburgh Securities 10/3 111% • 8% 3.9% Trans-Oceanic 16/3 101% 10% 3.1%

EDINBURGH SECURITIES

has 42 per cent of its

portfolio in North America and TRANS-OCEANIC 30 per cent.

Previous page

Previous page