Backing the man

PORTFOLIO JOHN BULL

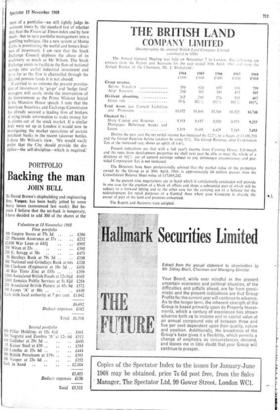

Sir David. Brown's shipbuilding and engineering firm, Vesper, has been badly jolted by some heavy losses (announced last week). But be- cause I believe that the set-back is temporary, I have decided to add 300 of the shares at the

Valuation at 13 November /968 First portfolio 100 Empire Stores at 77s 3d .. • • £386

125 Phoenix Assurance at 37s .. • • £232 • £2,000 War Loan at £451 .. £905 330 Witan at 23s

• • £380 250 E. Scragg at 38s • • £475

50 Barclays Bank at 79s 3d £198 100 National and Grindlays Bank at 64s £320 500 Clarkson (Engineers) at 18s 3d .. £456 60 Rio Tinto Zinc at 133s £399 1,000 AssOciated British Foods at 12s 0:14 £603 1,000 Jamaica Public Services at 5s 81(1 £284 250 Assodiated British Picture at 45s 9d £572 100 Lyons 'A' at 88s £440 Cash with local authority at 7 per cent £1,042

£6,692

Deduct: expenses £182

Total £6,510 Second portfolio 600 Pillar Holdings at 15s 44t1

500 Negretti and Zambra 'A' at 12s 6d

410 Gallaher at 29s 3c1 15 Kaiser Steel at f39 250 Lonrho at 35s 6d ..

100 British Petroleum at 119s ..

300 Vosper at 23s 6d

Cash in hand

£5,453

Deduct: expenses £130

Total £5,323 £461 £312 £600 £585 £444 £595 .. £352 .. £2,104 croft on a yacht, the contract having been stantially enhance the company's position.

sibareholders is being fully maintained at 13+ Brown Corporation.

I am prepared to take the forecast at face value. I assume, theretore, that it is right to add back last year's exceptional losses to the residual profit figure .in order- to get some idea of what the current year s profits could be. Tha: addition indicates a pre-tax profits figure 0! over £500,000. Taking a low tax rate and assum- ing full conversion of the loan stock, the upshot is that the shares are selling at nine times pro. spective earnings—which. if my optimi,m is justified in the event, makes the shares decidedly cheap. There is always the hope, too, that Sir David will inject Son. of his private interests into Vosper, his only publicly quoted company, When I last reviewed my first portfolio I wrote that there was .1 ..tuestion mark over my holding in Unilever. The figures for the previous quarter had indicated a slowing down, but the dip in the trend line could easily have proved to be temporary. In fact the results for the third quarter of the year now prove to have been equally uninspiring and so I have decided to sell my holding. I have held the shares for a year, having bought them last November (in devalua- tion week) at 44s 9d My exit price is 68s.

The figures showed that although third quarter sales were running 20 per cent ahead of the comparable -period of the previous year, Without the benefit of devaluation .the improve- ment would only amount to 5 per cent. It is plain, therefore, that the group's underlying growth rate is pedestrian. I am also discouraged by the fact that profit margins seem to be under pressure again. Taxation is rising as more of the group's profits come from high taxation areas. Taking all these considerations together. the shares appear to be selling at seventeen times earnings—not extravagant but not cheap.

I have taken up my rights in Rio Tinto Zinc this week. The basis was one new share at Ills for every twenty held. Now that the issue has been completed, the share price has perked up again.

Previous page

Previous page