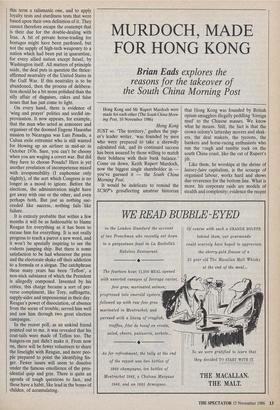

MURDOCH, MADE FOR HONG KONG

Brian Eads explores the

reasons for the takeover of the South China Morning Post

Hong Kong and Mr Rupert Murdoch were made for each other (The South China Morn- ing Post, 10 November 1986)

Hong Kong JUST so. 'The territory,' gushes the pap- er's leader writer, 'was founded by men who were prepared to take a shrewdly calculated risk, and its continued success has been assured by those willing to match their boldness with their bank balance.' Come on down, Keith Rupert Murdoch, now the biggest single shareholder in — you've guessed it — the South China Morning Post.

It would be indelicate to remind the SCMP's genuflecting amateur historian that Hong Kong was founded by British opium smugglers illegally peddling 'foreign mud' to the Chinese masses. We know what he means. Still, the fact is that the crown colony's latterday movers and shak- ers, the deal makers, the tycoons, the bankers and horse-racing enthusiasts who run the Tough and tumble rock on the south China coast, like the cut of Rupert's jib.

Like them, he worships at the shrine of laissez-faire capitalism, is the scourge of organised labour, works hard and shows due reverence for the bottom line. What is more, his corporate raids are models of stealth and complexity; evidence the recent $2,000-million acquisition of 20th-Century Fox Film Corporation and Metromedia's seven television stations. Why, even the man's nationality is negotiable.

But why the SCMP, and why now? 'The SCMP deal isn't very sexy at all,' scoffs one international broker. On the face of things he is right. Murdoch has bought 34.9 per cent of a group of newspapers, magazines, printing facilities and retail bookshops. After a closer look at the books he can exercise an option to raise his stake to 50 per cent or more. Almost certainly, he'll like what he sees. With a daily readership nudging 300,000 the SCMP's net profits last year were $21 million. Judged against investment and expenditure it is, as it claims, 'the world's most profitable news- paper'.

Assets include major stakes in the Far Eastern Economic Review, a widely re- spected, if rather dull, economic and poli- tical weekly turning more than respectable profits, and Asia Magazine, a regionwide giveaway that reaps huge advertising re- venues. Finally there are the SCMP's new German-built presses which, when they start rolling early next year, will offer unrivalled capacity for fast, high-quality colour printing.

To be sure, a nice little earner, but compared with the vastness of Murdoch holdings in Britain, the United States and Australia, not much to become excited about. That is especially so given that News Corp, his international holding com- pany, is still mired in US debts.

The answer, of course, is that the SCMP, sweet though it is, isn't the whole story. Like the sellers ('We have been presented with an offer we can't refuse') Mr Murdoch has left much unsaid.

The sellers first. The Hong Kong and Shanghai Banking Corporation — known here as the Bank, in light of its almost total dominance of the colony's retail banking sector — issued its formal statement of confidence in the post-1997 future of Hong Kong under Peking's rule in April of this year. Lion dances, martial music and champagne inaugurated its new headquar- ters building; 52 levels of battleship-grey steel and glass resembling nothing so much as a beached oil rig. It remains the world's most expensive building. It is hard to question the commitment of one billion dollars immovably embedded at the heart of the financial district. That chore com- pleted, the Bank is now merrily moving offshore. And top of the shopping list is a European bank, with Lloyds regarded as a prime target. In short, the Bank needs the cash.

Mr Li Ka-shing's Hutchinson Whampoa Ltd also wants the money. In recent months a flurry of selling has made Mr Li known locally as `Li the Cash' liquidly rich to the tune of $750 million. How he'll spend it is now the subject of intense speculation. Not least because companies under his control account for 18 per cent of the Hong Kong stock market. But we'll come to that later.

Both `Li the Cash' and the Bank have had problems with the SCMP. The Sunday after its chairman, Sir Michael Sandberg, began the Bank's bail-out, the Sunday Morning Post gave front-page coverage to his daughter's wedding — misspelling the name of the groom.

Of greater consequence, perhaps, critic- al comment on Peking, London and the local administration's cynically high- handed approach to the territory's future is viewed as' a possible threat to the cosy relationship which the Bank has built with the mainland communists. As the major shareholder, Peking might well conclude that the Bank must be calling the SCMP tune. 'Li the Cash' has suffered more personal affronts. One can see his point of view. What's the use of owning 25 per cent of a newspaper if it still prints allegations of stock market manipulation by a company you control?

Enter Mr Murdoch, or rather, enter Pearson PLC, the British parent company of the Financial Times, the Economist and Lazard Merchant Banking Group. Mr Li's interest in Pearson gained substance in September, when he bought 4.99 per cent of the company. He wanted more. Pear- son, meanwhile, has been looking for a way to build FT circulation in the Far East. Dow Jones' Asian Wall Street Journal has demonstrated the market potential. What better than a share swop; more of Pearson for Mr Li, access to the SCMP presses for the FT. Something went wrong. Perhaps a suspicion that what really interested Mr Li was not an interest in Pearson, but a controlling interest. Enter the combative opportunist Murdoch to pick up the pieces.

But will he be content with a relatively straightforward $150 million buy out? SCMP insiders think not. A small, albeit profitable, Asian newspaper is not really the Murdoch style. Top of the hit list is thought to be the Sing Tao Yih Pao, Hong Kong's best selling Chinese-language daily. The group's owner, Australian-based Mrs Salty Aw Sian (who tried to buy the Observer some years back), is far too chummy with Taiwan's nationalist regime to feel relaxed about a Hong Kong future under Peking. And under the terms of her inheritance, restraints on her selling out expire next year. Sing Tao is an attractive prize. The group not only dominates the Chinese classified advertisement market in a way the SCMP dominates the English, it also owns the Hong Kong Standard, the Post's only English-language competition.

The plot, as becomes evident, thickens. And there's more. A change in ownership at the SCMP allows Dow Jones to take a majority holding in the Far Eastern Econo- mic Review — a move the company is known to relish. What if Murdoch simply trades Dow Jones' interest in SCMP for SCMP's interest in the FEER?

The way now opens for SCMP presses to print its own titles, Sing Tao Yih Pao, a `This could be the end of barbarism as we know it.' new evening paper to replace a closed- down Hong Kong Standard, some of Mur- doch's union-plagued Australian maga- zines and an Asian edition of the FT. By all accounts 'Li the Cash's' interest in Pearson centres on its merchant banking arm. In the event of a successful, albeit hostile, takeover, who better to buy the FT than buccaneering Mr Murdoch? Surely a sym- pathetic monopolies commission could be persuaded that its unique character made it irrelevant to News International's existing British titles?

So far, so byzantine. And no mention yet of Hong Kong's vivid prospects in satellite and cable television — two money-spinners close to Murdoch's heart. The territory is ideally placed to hook into a global satellite network, and cable is set to launch next year. And for all the modish cynicism about doing business in bureacracy-ridden, foreign-currency-poor China, even the hardest business heads are excited by the prospect of one billion consumers. Peking reformers are still bat- tling to win acceptance for artists wanting to paint female nudes. So the prospects for a People's Daily Sun are as remote as ever. But Murdoch has already talked to Peking about involvement in a custom-built `media-centre' in the Chinese capital, and confidence-building investments in Hong Kong can only improve his standing.

What, meanwhile, is in prospect for Hong Kong's leading English-language daily? Not much by all accounts. `The Post is streamlined, computerised, non- unionised and makes bags of money,' says one editor. `Why should the Dirty Digger change it?' And the colonial administra- tion's hands-off philosophy stops short of sex and violence. Any lurid downmarket shift would be thwarted by the colony's ever vigilant censors.

In truth, what disgruntled Brits call `the dingo mafia' has already landed. In the past 12 months 'refugees' (some would now say 'Trojan horses') from Murdoch's Sydney Daily Telegraph and Sunday Tele- graph arrived to edit both the Daily and Sunday Morning Post. They're known collectively as Biffo — 'bloody ignorant flickers from Oz'. But neither has done major violence to their newspapers. Indeed what's generally been regarded as the `Establishment' voice has become more critical of its masters in Peking, London and Hong Kong.

Since most of the Chinese-language press — written by people who'll have to live here after 1997 — has taken Peking's advice not to rock the boat with divisive notions like local democracy, the SCMP's role has become doubly important. If there's a fear aroused by Murdoch's takeover it is that he, like the homegrown over-achievers, will view politics as nothing more than an extension of business. 'Prav- da' is the nickname accorded the SCMP by one columnist on a rival paper. Maybe he spoke too soon.

Previous page

Previous page