Company Notes

By LOTHBURY

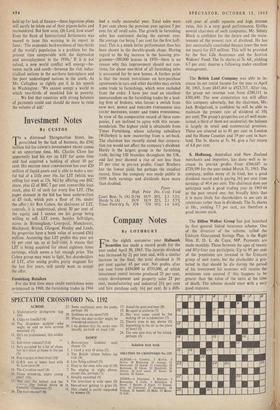

FOR the eighth successive year Hallmark Securities has made a record profit for the year ended April 30, 1965. The interim dividend was increased by 21 percent and, with a similar increase in the final, the total dividend is 50 per cent against 45 per cent. Net profits after tax rose from £434,000 to £535,000, of which investment rental income produced 25 per cent, estate development and property sales 23 per cent, manufacturing and industrial 351 per cent and hire purchase only 161 per cent. In a diffi- cult year of credit squeeze and high interest rates, this is a very good performance. Unlike several chairmen of such companies, Mr. Sidney Block is confident for the future and the main- tenance of the present rate of dividend. He has just successfully concluded finance (over the next ten years) for £15 million. This will be provided by the Sun Life Assurance and the Scottish Widows' Fund. The Is. shares at 7s. 6d., yielding 6.7 per cent, deserve a following under, excellent management.

The British Land Company was able to in- crease its net rental income for the year to April 30, 1965, from £847,464 to £923,715. After tax, the group net revenue rose from £280,111 to £301,440. The new corporation tax will affect this company adversely, but the chairman, Mr. Jack Bridgeland, is confident he will be able to maintain the present rate of dividend of 101 per cent. The group's properties are all well main- tained, a third of them are residential; the balance is largely in retail and commercial piemises. These are situated as to 81 per cent in London and the Home Counties and 19 per cent in Scot- land. The 5s. shares at 7s. 9d. give a fair return of 6.8 per cent.

S. Hoffnung, Australian and New Zealand merchants and importers, has done well to in- crease its pre-tax profits from £566,687 to £729,599 for the year ended March 31, 1965. The company, unlike many of its kind, has a good dividend record and is paying 16/ per cent from earnings of 40.4 per cent. The chairman does not anticipate such a good trading year in 1965-66 as the past record one, but broadly hints that it is more likely for shareholders to see cuts in retentions rather than in dividends. The 5s. shares at 18s., yielding 7.7 per cent, are therefore a good income stock.

The Dillon Walker Group has just launched its first general linked insurance scheme. One of the directors of the scheme, called the Unicorn Guaranteed Savings Plan, is the Right Hon. E. D. L. du Cann, MP. Payments are made monthly. Those between the ages of twenty and fifty-four can participate. Up to 95 per cent of the premiums are invested in the Unicorn group of unit trusts, but the planholder is pro- tected in that should he die during the period of his investment his nominee will receive the minimum sum assured if this happens to be greater than the value of the units at the time of death. The scheme should meet with a very good response.

Previous page

Previous page