Investment Notes

By CUSTOS

9-10 a distressed Throgmorton Street, im- I poverished by the lack of business, the £54+ million bid for LEWIS'S INVESTMENT TRUST comes at an opportune time. Mr. Charles Clore has apparently had his eye on LIT for some time and had acquired a holding of about 10 per cent. His BRITISH SHOE CORPORATION has over £20 million of liquid assets and is able to make a use- ful bid of a little over 16s. for LIT (which was selling last week at 13s. 9d.) by offering one BSC share, plus £2 of BSC 7 per cent convertible loan stock, plus £1 of cash for every five LIT. (The paper element in the bid has been underwritten at £3 cash, which puts a floor of 16s. under the offer.) Sir Rex Cohen, the chairman of LIT, controls, it is understood, about 30 per cent of the equity and I cannot see his group being willing to sell. LIT owns, besides Selfridges, stores in Birmingham,• Liverpool, Manchester, Blackpool, Bristol, Glasgow; Hanley and Leeds. Its properties have a book value of around £361 million. Assuming that LIT profits this year are 61 per cent up, as at half-time, it means that LIT is being acquired for about eighteen times earnings, which seems a fair enough price. The Cohen group may want to fight, but shareholders of LIT, after seeing profits pretty stagnant for the last five years, will surely want to accept the offer.

Furnishing Retailers For the first time since credit restrictions were re-imposed in 1960, the furnishing trades in 1964 had a really successful year. Total sales were 8 per cent above the previous year against 5 per cent for all retail sales. The growth in furnishing sales has continued during the current year, the average rise being 7 per cent for the first half- year. This is a much better performance than has been shown in the durable-goods shops. Having regard to the big increase in the housing pro- gramme-500,000 houses in 1970-there is no reason why this improvement should not con- tinue, for about one-third of all furnishing sales is accounted for by new homes. A further point is that the recent restrictions on hire-purchase agreements in cars and other durables may switch some trade to furnishings, which were excluded from the order. I have just read an excellent memorandum on the furnishing trades by a lead- ing firm of brokers, who favour a switch from

NEW DAY, MAPLE and PHILLIPS FURNISHING into COURT BROTHERS, HARDY and TIMES FURNISHING.

In view of the comparative record of these com- panies, I am inclined to agree with this recom- mendation. The highest yield is obtainable from Times Furnishing, whose tailoring subsidiary (Willerbys) is now recovering from a set-back.

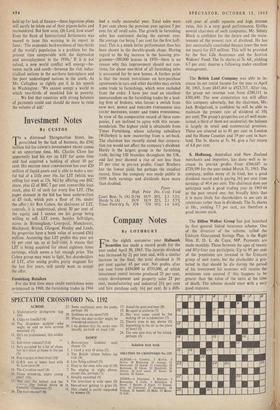

The chairman has recently stated that corpora- tion tax would not affect the company's dividend. Hardy is the largest group in the furnishing trade, having 120 branches throughout the UK, and last year showed a rise of not less than 37 per cent in pre-tax profits. Court Brothers has the lowest yield, but perhaps the steadiest record. Since the company was made public in 1959 both earnings and dividends have more than doubled. Times High Price Div. Cvrd. Yield Court Bros. 5s. (A) 21 /4f 18/9 20% 2.3 5.2% Hardy 5s. (A) .. 19/9 18/9 22% 2.1 5.7%

Times Furn'sh'g 5s. 8/6 7/6 10% 1.6 6.4%

Previous page

Previous page