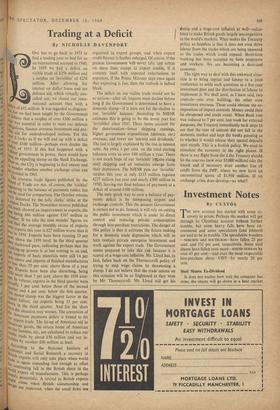

Investment Notes

By CUSTOS

THE new account has started with some re- covery in prices. Perhaps the market will get through its Christmas account without further trouble, but some heavy falls have been en- countered and some speculators (and jobbers) are said to be in trouble. The speculative wonders —NORCROS and sounicRos—have fallen 25 per cent. and 331 per cent. respectively. Some steel shares have fallen even more—SOUTH DURHAM by over 43 per cent.—and even the most respectable hire-purchase sharc—UDT---by nearly 20 per cent.

Steel Shares Ex-Dividend It does not matter how well the company has done, the shares will go down in a bear market when the annual report is published. This explains the bad behaviour of steel shares last week, but I did warn investors that if UNITED STEEL did not pay 20 per cent. the whole market would fall. After showing excellent results, with net profits up 27f per cent., United only paid 18 per cent. and, to make matters worse, announced a rights issue of one-for-three at par. Tilts -is to be ibilosVed by-ft Mit-far-ftrar-serip bonus. At 76s. the ex-all price would be about 48s. and the potential yield on the forecast divi- dend would be just over 5 per cent. STEEL OF WALES also produced an excellent report and raised the dividend from 10 per cent. to 12f per cent., but the shares fell and at 42s. 6d. the yield is now nearly 6 per cent. THOMAS FIRTH AND JOHN BROWN were disappointing, with a rise of only about 5 per cent. in gross profits, but the dividend was raised from the equivalent of 9 1/5 per cent. to 12f per cent, and at 47s. 6d. the yield is 5.3 per cent. JOHN' SUMMERS was also dis- appointing in both profits and dividend and declined to 57s. 9d. (27 per cent. below its top) to yield 5.3 per cent. As things are, there is nothing to make steel shares move against the bear market trend over the short term and a further, if moderate, fall is to be expected. Some switching seems desirable.

Artizans and General Properties Some switching in the property market is also desirable—from the glamorous shares which yield around 2f per cent. to the more solid which yield over 4 per cent. For example, ARTIZANS AND GENERAL. This company was originally formed to invest in workers' houses, but since 1955 there has been a change towards commercial and resi- dential properties in and around London and more recently in flats and houses in a new hous- ing estate in Birmingham. Some of the older properties have been sold for over £1 million and another £1 million (net) has been raised by a debenture issue. Further, an investment has been made in Canadian and American property ven- tures. The company has a steady record of advancing profits—with a big jump since de- control. Equity earnings have in fact doubled in the past two years. In 1959 14.2 per cent. was earned and 12 per cent. paid, and for 1960 a further increase in dividend may be expected. At 53s. 6d. the £1 shares yield 4.4 per cent. on the old dividend.

Consolidated Zinc

There has been a fall this year of 22 per cent. in the shares of CONSOLIDATED ZINC, which now stand at 62s. 6d. to yield 6.3 per cent. on the 20 per cent. dividend last covered twice over by earn- ings. Some uncertainties having been cleared up the shares are a firmer market, but I cannot yet recommend a purchase in view of the 'watering' of the equity which lies ahead. The company has a new partner in the Kaiser Aluminium Com- pany, which has taken the place of British Aluminium in the Commonwealth Aluminium Corporation formed jointly to develop the great bauxite deposits of Queensland. It is receiving LI+ million from Kaiser for the right to partici- pate in CAC at this stage. Of the £20 million which Consolidated Zinc will have to find as its share of this vast project, £10 million will come from a convertible loan stock issued to 'CHART- ERED' and the rest from its own earnings and possibly a 'rights' issue later on. Meanwhile the directors hope to maintain a liberal dividend bolicy provided lead-zinc prices are maintained or improved. Unfortunately both lead and zinc are slumping to new low levels. However, the shares should be watched for a buying oppor- tunity.

Previous page

Previous page