BANE OF ENGLAND.

THE usual half-yearly meeting of the proprietors was held on Thurs- day; and considerable surprise was created by a proposition from the Directors to reduce the dividend from 4 to 3/1 per cent. for the current half-year. To those who have watched the state of the Bank ac- counts, it has for some time been evident, that a reduction of thiN nature would sooner or later be forced upon the Directors ; but it was not anticipated that its adoption would take place so' soon. From what passed at the meeting, there can be little }wipe of any speedy resumption of the higher rate of dividend which has unfit now been paid ; as, in addition to the competition of the Joint Stock Banks,whichw ill doubtless lessen the future amount of business and cons7- quent profits, a considerable sum ought to be reserved annually out of those profits, for the purpose of replacing the capital that has been sunk in the purchase of the annuity technically termed the Dead-weight, and the 3,638,250/. received from the Government in 1833, also invested in Long Annuities. The future dividends must therefore be entirely pro. vided for out of the profits, as it is quite evident that the rest or kisses cannot he further trenched upon : for although that amount is ap. parcntly large, it is not so in reality, and does not exceed 10 per cent

upon the liabilities of the Bank. That the proprietors should be anxious to .clutch as much immediate profit as possible, leaving posterity to shift for itself, is very natural ; but it is the duty of the Directors to provide in time for the great loss of income which the establishment will suffer by the expiration of the two annuities above specified. By reducing the dividends, they have taken the only course left open to them for that purpose. After all, the proprietors should bear in mind, that the mar- ket value of their stock is more likely to be permanently supported by the payment of a smaller dividend, solely out of real profits, than by a delusive division of capital in the shape of dividend ; and that although the rest may not be actually divided among them, any increase in its total will, as an indication of prosperity, be felt in the improved value it will impart to their stock ; while, if it were absorbed yearly in small portions, there must come a period at which a much greater decrease of the dividend than the one now contemplated, would be rendered neces- sary. The present is therefore only to he considered as one of those fluctuations to which all trading companies are liable, and of which the Bank has had frequent previous experience ; as will appear front the following statement of the amount of dividend paid at various periods upon its stock.

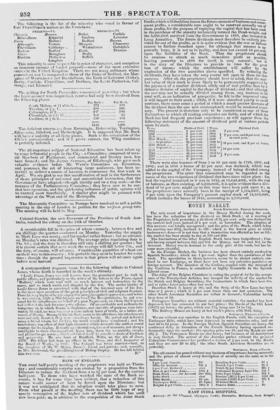

Year$. Diridrnd Publ. Pears. Diridend Paid.

1694 8 per emit. 1788 7 per cent.

1697 9 per cent. 7 p

17C8 9 per cent. 1805 per cent. and 5 per cent. Loess

in each yenr.

1730 March 6 per cent. 1806 September 51 per cent. 1810. to} 10 per cent. and 5 per et. bonus. 1732 March 6 per cent. 18.1,

Septenther

5t per cent. 1816 to

—

17-12 5i percent. 1813 10 per cent. 1753 41 per cent. 18',:3 to}

8 per cent.

1767 . 51 per cent. 180 1781 6 per cent.

There were also bonuses of from 5 to 10 per cent, in 1799, 1801, and 1802 ; and in 1816 a bonus of 25 per cent. was declared, which was added to the capital of the Company, instead of being divided among the proprietors. The error thus committed may be regarded as the cause of the two reductions of dividend that have since taken place : tbr, had the capital remained as it was in 1816, at 11,642,40111., with the rest or balance, as then existing, of 5,200,0001., it is quite evident that a divi- dend of 10 per cent. might up to this time have been paid upon it; as the proprietors have annually been in the receipt of 1,164,240/., being 8 per cent. upon the Company's present capital stock of 14,553,0004 which includes the bonus of 1816, amounting to 2,910,0001.

Previous page

Previous page