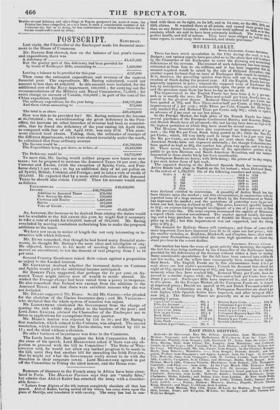

POSTSCRIPT. SATURDAY.

Last night, the Chancellor of the Exchequer made his financial state- ment to the House of Commons. Last night, the Chancellor of the Exchequer made his financial state- ment to the House of Commons.

Mr. BARING first showed, that on the balance of last year's income and expenditure, there was

A deficiency of £1,457,222 But the greater part of this deficiency had been provided for by issues of Exchequer Bills, amounting to 1,260,000 Leaving a balance to be provided for this year £197,000 Then came the estimated expenditure and revenue of the current financial year. The expenditure, Mr. Baring calculated, would not amount to less than 49,432,0001, In this amount were included, for the additional cost of the Navy department, 100,0001.; for carrying out the recommendations of the Military and Naval Commission, 75,000/. ; for extra charge on account of Canada, 350,000/. ; in part of the cost of the China expedition, 150,000/. The ordinary expenditure for the year being £48,757,000 And these extras amounting to 675,000 The total is as above £19,432,000 How was this to be provided for? Mr. Baring estimated the income at 46,700,0001.; for, notwithstanding the great deficiency in the Post- office, the increase on other branches of revenue had been so consider- able, that he found the deficiency of the year ending 5th April 1840, as compared with that of 5th April 1839, was only 2731. This state- ment elicited loud cheers. Taking, then, the estimates of receipts of the different departments, which were almost invariably under the mark, he calculated that from ordinary sources The Income would be £46,700,000

The Expenditure being put down, as before, at 49,432,000

The Deficiency would he £2,732,000 To meet this, Mr. Baring would neither propose new loans nor new taxes ; but lie proposed to increase the Assessed Taxes 10 per cent ; the Customs and Excise, (with the exception of Spirits, Corn, and Post- horse-duty) 5 per cent. ; to lay an additional duty of 4d. per gallon on all Spirits, British, Colonial, and Foreign ; and to take a vote of credit of 395,000/. He expected that by a more strict collection of the Assessed Taxes he should also obtain 150,0001. Then his account would stand as follows.

EXPENDITURE £49,432,000

INcome. £46,700,000 Addition to Assessed Taxes 276,000 New Survey for ditto 150,000 Customs and Excise 1,426,000 Spirits 485,000 Vote of Credit 395,000 99,432,000 As, however, the increase to be derived from raising the duties would not be available to the full extent this year, he might find it necessary to take a vote of credit for 850,000/. instead of 395,000!. Mr. Baring concluded by moving resolutions authorizing him to snake the proposed additions to the taxes.

We have not room to notice at length the not very interesting or in- structive talk which followed.

Mr. IluSIE remarked, that though he had heard many financial state- ments, he thought Mr. Baring's the most clear and intelligible of any. He objected, however, to his mode of meeting the deficiency ; and moved an amendment, to tax the descent of real property from 1 to 10 per cent.

Several Country Gentlemen raised their voices against a proposition so unjust to the Lauded interest. Mr. Govintinsi doubted whether the increased duties on Customs and Spirits would yield the additional income anticipated.

Sir ROBERT PEEL suggested, that perhaps the 10 per cent, on As-

sessed Taxes might induce men of wealth to reside abroad. He wished the Postage-charge had been raised from a penny to twopence. He also remarked that Ireland was exempt from the addition to the Assessed Tuxes; and that there were excellent reasons why she was not included.

Mr. Ewnter supported Mr. Hume. So did Mr. G nom—who pleaded for the abolition of the Marine Insurance-duty ; and Mr. VILLIERS- "who declared that the whole system of taxation was unjust. Mr. LABOUCHERE vindicated the Government from the charge of sparing the rich whilst they added to the burdens of the poor ; and Lord JOHN IlussELL advised the Chancellor of the Exchequer not to listen to applications for exemptions from any quarter.

Mr. Hunie's motion was rejected by 156 to 39; and Mr. Baring's first resolution, which related to the Customs, was adopted. The second resolution, which increased the Excise-duties, was carried by 111 to 15 ; and the third without a division.

No other business of importance was done in the Commons.

The Lords heard Mr. Butt against the Irish Corporation Bill. At

the close of his speech, Lord MELEOURNE asked if there was any ob- jection to proceed with the bill in Committee ? The Duke of WEL- LINGTON said, he would not allow any further progress to be made in the bill, until they had another bill for amending the Irish Poor-law, that he might see what the Government really meant to do with the franchise in their corporate towns. Lord MELBOURNE agreed to put off the Committee to Friday the 22nd instant, and the House rose.

Previous page

Previous page