By CUSTOS

THROGMORTON STREET never lost its faith in a settlement of the wage crisis on tilt railways and the marking down of prices in the gilt-edged market was very moderate. The new GALLAHER 6 per cent. debenture (issued at 96) opened on Wednesday at 961 and was quickly 97. Bargain hunters on the whole have been disappo'nted. The strike at the PRESSED STEEL works did not affect motor shares, but it was another reminder to me that motor shares are better left alone while the export boom is based not so much on rising world trade as on the whims of the American market. More attention was given to DUNLOP on the unexpected restoration of the dividend to 14 per cent, and the sharp recovery in trading profits from £15 to nearly £20 million. The group net profit was over 40 per cent, up and earnings on the equity came to over 32 per cent. The jump in the 10s.. shares to 18s. 6d. still leaves a yield of 7.8 per cent., but DUNLOP RUBBER is usually expected to give a greater than average yield in view of the sharp changes in its past fortunes.

Investment Trust Equities Continuing my search for safe equities at this uncertain time when we cannot yet be certain that a 'bull' market has begun, I would add select investment trust equities to those in the home consumer and chemical trades. There is no doubt that those investment trusts which have a high proportion of their capital in preference shares stand to gain more than others from the new 10 per cent. flat profits tax. It is impossible for an outsider to work out the exact profits tax position because it is not known how much of the income is 'franked' (on which no profits tax is charge- able), but one must remember that dollar income

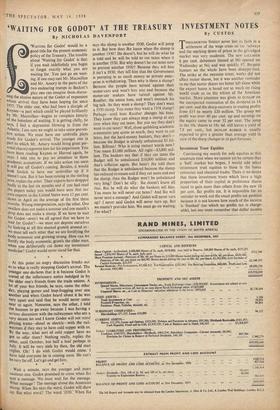

is not 'franked.' GUARDIAN and SECOND GUARDIAN, which have much less in dollar investments than most trusts, stand to gain from the profits tax as each has £1 million in preference shares to match if million in ordinary. The dividend yields obtain- able are 6 per cent. on Guardian at 60s, and Second Guardian at 30s. INVESTMENT TRUST CORPORATION has £2.2 million in preference against £3.2 million in ordinary (after the scrip issue) and the 5s. shares at 15s. 6d. yield 5.1 per cent. on the basis of 16 per cent. dividend forecast on the increased capital. I also favour LONDON AND CLYDESDALE, which •is wisely raising new capital to take advantage of the high yields now obtainable on British securities. It has just issued one in three new 5s. shares at par. These are quoted at 15s. 9d. The directors anticipate that dividends of 171 per cent, should be paid on the increased capital, giving a yield of 51 per cent.

Overseas Banks

Some high yields can be obtained from overseas banks. For example, a yield of 7.6 per cent, from the NATIONAL BANK OF NEW ZEALAND at 23s. (on the is. 9.6d. dividend) reflects investment disquiet at the recession in that country, while 7.35 per cent, from the STANDARD BANK OF SOUTH AFRICA at 33s. 6d. (on the 2s. 6d. dividend) sug- gests investment dislike of South African politics. Brighter prospects, I am told, now face the BANK OF LONDON AND SOUTH AMERICA, Which last re- ported a 30 per cent. rise in profits. The directors stated that many years had passed since profit remittances from South America had caused so little concern. This bank, together with the BANK OF MONTREAL, has set up a new bank to be called the Bank of London and Montreal to trade in the Caribbean area where there is something like a banking vacuum. The chairman is Sir George Bolton, chairman also of the parent bank, and a director of the Bank of England. At 29s. the shares yield 6.15 per cent. on the basis of the Is. 9.6d. dividend last covered 11 times.

Oil Shares In Dispute

Having expressed the view that conditions in the oil industry did not yet warrant fresh invest- ment in oil shares, SHELL and BRITISH PETROLEUM rose promptly on American buying only to falr again on the news of the Syrian disorders. I have seen the American brokers' circulars which make out a strong case for these two shares as being the cheapest of the international oil equities, but American buying is not always safe to follow. British Petroleum certainly had an excellent account to render in a difficult year-its profits in the second half being a third higher than in the first-but the political risk is greater than ever, even if the Americans believe otherwise. The market is being sustained by the promise of another scrip bonus. BinuviAn on, disappointed the optimists who had expected a higher dividend and had not bargained for a 27 per cent. fall in the profits of the trading enterprise in India, Pakistan and Burma. The shares came back from 78s. to 70s. on the report but recovered to 72s. with the rest of the market. At this price on the is. 7d. tax-free dividend the gross yield is nearly 6.1 per cent. The present value of its holdings in BP and Shell works out at 75s. 6d., so the investor is again buying the Indian and Burmah business for less than nothing. I adhere to my previous preference for CANADIAN EAGLE if an investment in oil is wanted outside the Middle East. My recommendation was certainly justified by the report, which revealed a 23 per cent, rise in net profits. The dividend was raised from 2s. to 2s. 3d. (of which 35-100ths ranks for tax relief). At 56s. 6d. for the registered the gross yield is 4.95 per cent.

Previous page

Previous page