Portfolio

I remember Nanny dying

Nephew Wilde

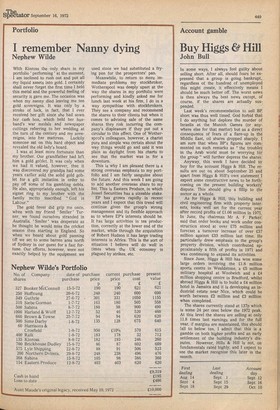

With Kinross the only share in my portfolio ' performing ' at the moment, I am inclined to rush out and put all my liquid assets into gold. I certainly shall never forget the first time I held this metal and the powerful feeling of security it gave me. The occasion was when my nanny died leaving me ten gold sovereigns. It was only by a stroke of luck, in fact, that I ever received her gift since she had sown her cash box, which held her husband's war medals and newspaper cuttings referring to her wedding at the turn of the century and my sove reigns, into her mattress. Luckily someone sat on this hard object and revealed the old lady's hoard.

I was at least more fortunate than my brother. Our grandfather had left him a gold goblet. It was cnly when we had it valued, however, that it was discovered my grandpa had some years earlier sold the solid gold goblet for a gilt imitation in order to pay off some of his gambling debts. He also, appropriately enough, left his signet ring to my brother with the family mato inscribed " God is Labour."

The gold fever did grip me once, when with my friend ' Smiler ' Turner, we found ourselves stranded in Australia. ' Smiler ' was desperate as he thought he would miss the cricket season then starting in England. So when we heard about gold panning off we set to some barren area north of Sydney in our quest for a fast fortune. Our efforts, however, were not exactly helped by the equipment we used since we had substituted a frying pan for the prospectors' pan.

Meanwhile, to return to more immediate problems my stockbroker, Wotherspool was deeply upset at the way the shares in my portfolio were performing and kindly asked me for lunch last week at his firm. I do in a way sympathise with stockbrokers. They see a company and recommend the shares to their clients but when it comes to advising sale of the same shares they risk incurring the company's displeasure if they put out a circular to this effect. One of Wotherspool's colleagues, however, a charist pure and simple was certain about the way things would go and said it was plain as daylight from his charts to see that the market was in for a downturn.

This is why I am pleased there is a strong overseas emphasis to my portfolio and I am fairly sanguine about the future. And this week I am going to add another overseas share to my list. This is Eastern Produce, in which Jessel Securities has a sizeable stake.

EP has grown rapidly in recent years and I expect that this trend will ccntinue given the group's strong management and its flexible approach as to where EP's interests should be. It has large activities in tea production, correctly at the lower end of the market, while through the acquisition of Robert Hudson it has large trading interests in Africa. This is the sort of situation I believe will do well in times when the UK economy is plagued by strikes, etc.

Previous page

Previous page