Financial Notes

UNDERLYING OPTIMISM.

BUSINESS in the Stock Markets during the last few weeks has been considerably restricted, a circumstance by no means surprising in view of the Easter holidays, to say nothing of anxieties with regard to the international political situation and the usual uncertainties with regard to the Budget. The really remarkable thing about markets, however; is the steadiness which they have shown in spite of the lack of business. Gilt-edged stocks have been kept up by cheap money, but, indeed, practically every department of the Stock Exchange has shown an undertone of firmness. Much, of course, must- now depend upon political developments, but, unless international politics.yAtOtild take --some very unpleasant turn, it looks as though thire-wotikklie2iiiiincrease

in general business after the Budget. _ ;.. * '

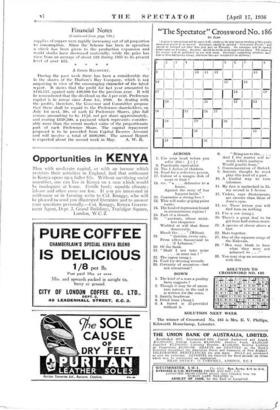

EAGLE ST.ut , The latest annual report of the Eagle Star. aad Dominions Insurance Company makes a very excellent showing, and in the following table will be found the under- writing profits of the departments,- exclusive of interest income, the total interest earnings and the disposition of the profits :

.1933.

1934. 1035.

Fiie Account .. • -• -£36,8443 . £45,825 £70,139 Accident • • .. • 9,913 - '. 5,964 8,809 Employers' Liability .. 4,615 4,493 4,216 Motor .. ..

33,322 18,055 17,662 General • • .. 83,772 86,448 110,678 Marino • • • • 25,000 25,000 25,000 Life .. • • . • 130,897 18,158 72,275 Total ..

- 3%4165 - 203,933 308,71-7 Interiisi; &c. . . ' ' . .

-15037

186,787 230,431 Investment Profits ..

60,382 56,111 From Reeervir...

- *nom

- - Share Premium

32,946

528,932 484,048 595,319 Expenses .. . • 53,109 51,272 35,524 Taxes .. .

59,420 68,064 71,373 Written off ..

101,872 13,722 123,685 To Investments

90,000

To Reserve ..

100,000

To Pensions .. • • -

100,000 Dividends .. .. 147,502 184,664 228,427 Forward ..

147,810 214,138 257,265

* Front-Exchange Reserve.

The• directors are npw pioposing to inirease the Ordinary share capital of the company , by 1:44,044 Ordiitary, s • res of £3 each, to rank pan passu with the existing Ordinary shares, thus making the total authorised share capital up to £5,500,000. The directors state that they are satisfied that the two issues of Preference shares proved to be in the interests of the company and to the advantage of the Ordinary shareholders, and they consider that the oppor- _ (.6:entinued an 72°9.728.)

Financial Notes

(Continued from page 126.) - tunities still 'presenting themselves for using additional capital in the business and for making investments of an attractive character justify the creation of further Ordinary share capital. They further intimate that .a proportion of the new shares will be issued when, in the opinion of the directors, it is to the advantage of the Ordinary shareholders to do so, and at a price which, in the opinion of the directors; will be attractive to shareholders.

* * * * ROYAL EXCHANGE ASSURANCE.

The report of the Royal Exchange.Assurance covering the year up to December 31st last is an exceedingly good one, the gross new business of £4,564,449 comparing with £3,990,418 for the previous year. In the Fire Department the premiums amounted to £1,483,828 as against £1,432,296, and there was transferred to Profit and Loss £229,964 against £187,221 in the previous year. In the Accident Department the premiums amounted to £1,171,975 against £1,299,044, and the transfer to Profit and Loss was £74,798 as compared with £37,577. In the Marine Department there was also a slight increase in the premiums from £574,880 to 1596,823, while the amount transferred to Profit and Loss of 125,000 was the same as in the previous year. The total ascertained surplus on the Life Account at the end of the year, including interim bonuses allotted during the quinqurnium, amounted to £1,618,568. The Life Assurance Fund new amounts to £11,791,709, the Fire Fund to £1,193,532 and the General Accident Fund to £1,421,048. The profits from the Fire, Marine, Accident and Trustee and Executor Departments, together with the share for 1935 of the Proprietors' Allocation Account, amounting in all to £392,133, have been carried to Profit and Loss, the balance of which now'stands at £1,269,729. The total assets now amount to £21,983,604, and the dividend payable for the keir is 30 per cent., being the same as for the previous year.

* * * * FINANCING THE FARMER.

The Agricultural Mortgage Corporation, formed in 1928 to provide long-term loans to finance agricultural activities,

has now thoroughly proved its • usefulness, and the latest report shows that the year ending March 31st last was an active one. The total of mortgage loans completed to that date was £11,590,913, compared with £11,124,083 a year previously. The security for these loans consists of mort- gages of over 798,000 acres of agricultural land and buildings Valued at over £18,000,000. Further loans to a total of /148,665 were approved by the directors and improvement Fans were completed to a total of £67,000. Repayments during the year were lower at £537,290, as against £657,761 in the previous year, but they included 1462,406 accepted in special reductions and repayments approved by the directors. Naturally the company has been adversely affected by the severe decline in interest rates over the past 'few years and the profit balance is rather lower at /28,347, including £4,634 brought into the accounts, as against £38,225 a year previously, when the amount brought in was 16,829. A sum of £2,664 is placed to Special Reserve ' and £10,000 to General ReserVe. It is proposed, however, to carry forward the balance of £7,350, omitting the usual 2} per cent. dividend.

* * DE BEERS IMPROVEMENT.

The latest report of De Beers Consolidated Mines, Linifted, covering the year 1935, shows a substantial advance in revenue, the Diamond Account amounting to 11,526,111, • against £900,323 in the previous year. Moreover, interest ; and dividends total £1,369,099, against £528,056, inclnding . £750,000 received in shares from African Explosives. Profit on investments realised and other income brings the available total up to just over £4,000,000, compared with 12,350,000 a year ago. . Expenditure, however, amounted to £853,570, and of the balance 160,365 is required for premium on the Debentures redeemed at the end of the year, £195,000 for acquisition from the Koffyfontein Mines, £251,252 for machi- nery and plant, and £1,602,180 for the General ReserVe. The half-year's Preference dividend to June 30th, 1931, costs £400,000, and £54,842 is unappropriated. The report refers to the improvement in the Diamond market, but there is no reference to further Preference dividend payments.

Faun Morons:

The latest report of the Ford Motor Company shows that the net profits of £597,153 compare with £483,663 for the previous year. It has to be noted, however, that the figuin was influenced favourably by the absence of any need to make provision against the loss by the Cologne Company, which required £152,755 in the previous year. The trading profits, however, amounted to £1,513,450, as against £1;440,908, while there is a profit of £63,106 on exchange against a loss bf £84,830. A larger provision, however, is made for obsolescence and depreciation, while £92,000 is written off the expenses of adapting plant for new production. The 5 per cent.- dividend requires £348,750 and the balance carried forward is increased from £523,000 to £771,000. It is evident; therefore, that in the distribution of profits a conservative policy is being fol- lowed. Moreover, the balance-sheet is a good one, current assets showing a surplus over liabilities of over £2,000,000.

* * *

Noussircn UNriroat LIFE.

Judging from the good results which have characterised the final year of the quinquennium of the Norwich Union Life Insurance Society, it is evident that the quinquennial valuation will' give a satisfactory result. During the last year mortality claims were blow- expectation and the rate of interest was no less than 1410s. 2d. per cent., less tax. At a -previous valuation the rate assumed in ttr valuation of assurances was already the low one of 2f per cent so there is no call for any revision in that respect. Moreover,' the Society wrote down its securities at the end of 1931 to thle very low level then prevailing, so there must be very large retierv'es ' against any possible future depreciation. • The new :business last year totalled £10,787,590 net, after deducting re-asatir- ances, as compared with £10,172,142 in the previous year. The funds at the end of last December stood at £42,242,207. *

THE COPPER Acmes:us:NT.

While the shares of the Rio Tinto Company have ,been affected by the disturbances in Spain, the Copper market as a whole has been firm during the week on the reports, subsequently confirmed, that the present Restriction Scheme would be extended until the middle of 1938. The Restriction Scheme has undoubtedly been beneficial to the copper industry as a whole, for at the time of the signing of the Agreement

(Continued on page vi.)

Financial Notes

(Continued from page 728.)

supplies of copper were rapidly increasing out of all proportion to consumption. Since the Scheme has been in operation cheek has been given to the production expansion and world stocks have decreased materially, while the.price has risen from an average of about £32 during 1935 to its present level of over £35.

A Coon RECOVERY.

During the past week there has been a considerable rise in the shares of the Hudson's Bay Company, which is not surprising in view of the encouraging character- of the latest report. It shows that the profit for last year amounted to £144,717, against only £40,980 for the previous year. It will be remembered that the dividend on the 5 per cent. Preference capital is in arrear since June 1st, 1930. In dealing with the profits, therefore, the Governor and Committee propose that there shall be repaid to the Preference shareholders, on July 1st next, 30s. of each £5 Preference Shares, plus full arrears amounting to 6s. 11id. net per share approximately, and costing £139,500, a payment which represents consider- ably more than the recent market value of the proportionate part of each Preference Share. The capital repayment proposed is to be provided from Capital Reserve Account and will involve a total of £600,000. The annual Report is expected about the second week in May. A. W. K.

Previous page

Previous page