Getting the picture

PORTFOLIO JOHN BULL

Shareholders in Associated British Picture Corporation (mac cinemas, half-share in Thames Television, film production, film pro- cessing and some property), of which I am one, must now make up their minds about the Electric and Musical Industries' offer of 67s 3d per share. It is not an easy decision to make. The AB Picture forecasts are rosy enough, but its record is drab. EMI already has one quarter of the equity in its hands and has declared that it will be content with a bare majority of the votes rather than 100 per cent control which is normally aimed at, so one might find one- self in a minority position. And distrust and suspicion divide the two sides as well as a straightforward disagreement about what AB Picture is worth.

None the less, much of the confusion can be cleared away by answering two questions: what is the EMI bid worth, taking into account income, the fact that the offer is not under- written, and the prospects for EMI itself? And at what price would AB Picture stand without the EMI offer? The EMI terms consist of what the company calls 'Alternative A'—for every five AB Picture ordinary shares, five EMI ordinary shares plus £3 nominal of 8+ per cent unsecured loan stock—and 'Alternative B,' which is six EMI ordinary shares for every five AB Picture ordinary shares. The first alterna- tive is for shareholders who want more income and less equity. I think myself that if the offer is satisfactory, then the all-equity terms are the ones to choose. Simple arithmetic shows that they are worth 67s 3d a share. Does the lack of underwriting (cash guarantee) matter? ir like the EMI'S plans and prospects at the present moment, so I take the EMI price as being a firm one.

For its part the AB Picture board has pro- duced a rattling good defence, quite wiping away a lot of the doubts about the quality of the group's management. Profits before tax, which are expected to run out at £5 million this year, are forecast to rise to at least £5.6 million next year, with a strong possibility that they will in fact touch £6 million. Putting estimates into a bracket carries more convic- tion than the plucking of a single figure out of mid-air. With earnings rising at a reason- able pace, the opportunity is being taken to raise the dividend from a promised 50 per cent for the current year to 56 per cent next year (the Treasury allows handsome dividend increases when a company is involved in a takeover fight). The result is that shareholders should get a higher income by staying where they are than they would by accepting the EMI offer. Finally, the group is at last getting- on with the development of its surplus assets under the guidance of that formidable man of property, Mr Robert Clark.

Can one accept these forecasts; and, if so, what is the appropriate share price? I am pre- pared to go along with the AB board's figuring. All the same, I believe that the share price will not alter much from its current level of 64s, a few shillings below the EMI offer. -There is, therefore, not much in it, just a few shillings. I must also consider the possibility of being left as a minority shareholder if EMI gains a further 25 per cent of the equity. So on balance, I think shareholders should accept the Eml offer forthwith; I intend to do so with my own holding of 250 shares in my first portfolio. Readers of this column who have followed me into this share have, after all, a profit of nearly 25s a share in a few months, which is not bad.

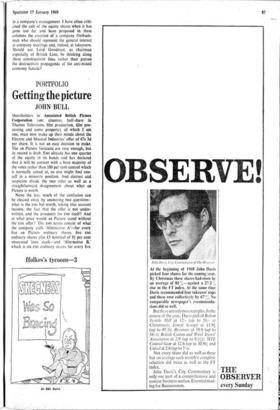

Valuations at 15 January 1969 First portfolio

100 Empire Stores at 73s .. £365 125 Phoenix Assurance at 44s 9d £260 330 Witan at 25s .. £422 .250 E. Scragg at 48s 3d £622 100 National and Grindlays Bank at 75s £375 500 Clarkson (Engineers) at 22s .. £550 60 Rio Tinto Zinc at 153s 6d £461 1,000 Associated British Foods at 12s lid £606 1,000 Jamaica Public Service at 6s .. £300 250 Associated British Picture at 66s 434 £830 100 Lyons 'A' at 95s 6d £477 200 British and Commonwealth Ship- ping at 44s £440 Cash with local authority at 7 per cent £1,708 £7,416 Deduct: expenses £199 Total £7,217

Second portfolio 15,786 (details next week).

Previous page

Previous page