COMPANY NOTES

AYEAR ago shareholders of British and Commonwealth Shipping were warned by the chairman, Sir W. N. Cayzen, Bt., that it might not be possible to maintain the 20 per cent. dividend for 1959; in fact he gave the same warn- ing when paying the interim dividend of 61 per cent.—the same as the previous year. However, a total dividend of 20 per cent. is again being paid, but, as was expected, profits are consider- ably lower. These have fallen (pre-tax) from £4.8 million to £2.16 million; investment allow- ances have of course, in part, provided for the dividend which is covered nearly three times. It seems unlikely that the 10s. ordinary shares will improve very much from the current level of 40s. (yield 5 per cent.) unless the chairman has some optimistic statement to make at the forthcoming annual general meeting, for which there is some hope.

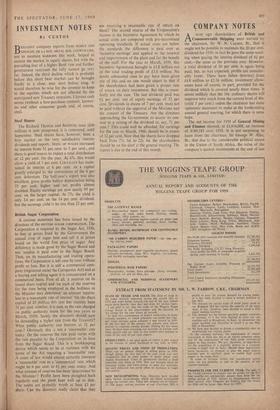

The net income for 1959 of General Mining and Finance showed, at £1,916,008, an increase of £189,183 over 1958. It is .not surprising to learn from the chairman, Sir George W. Albu, Bt., that due to the considerable political unrest in the Union of South Africa, the value of the company's quoted investments at the end of last year declined by no less than £21,804,000 to £30,071,200. Mining interests administered by the Corporation consist of Buffelsfontein, Ellaton, South Roodeport, Stilfontein, West Rand Con- solidated and East Rand Extensions. There was little change in the dividend payments made by these companies, except for a cautious half-yearly increase from ls. 9d. to ls. lOid. by Buffets, and a decrease from Is. 71-cl. to Is. 6d. by Stilfontein. The Corporation is, of course, interested in many other gold-mining concerns in the Union and also in such companies as Africair Limited, Ban- croft Mines Ltd. (copper), De Beers (diamonds), Metal Traders Limited and National Finance Corporation of South Africa, etc. At 92s. 6d. the £1 ordinary shares give a very fair yield of 7.6 per cent. on the 7s. dividend; the balance sheet discloses strong liquid assets.

The accounts of the newly constituted Seafield Amalgamated Rubber Co. cover the period from July 9, 1958, to September 30, 1959. The new chairman, Mr. A. H. Marshall, advises share- holders that the company and the rubber planta- tions industry suffered a great loss by the death in 1959 of the late chairman, Mr. T. J. Cumming, and in 1960 of two directors, Mr. A. Hollington and Mr. H. R. Quartley. The company now owns twenty rubber estates in Malaya with a total planted area of 42,112 acres. In 1958-59 they produced 21,567,155 lb. of rubber, 1,319 tons of palm oil and 347 tons of palm kernels. The consolidated net profit was very satisfactory at £759,879, from which dividends totalling 371 per cent., absorbing £307,064, have been paid. The chairman advises that prospects for the cur- rent year are encouraging, harvested crops to date being already ahead of estimates. He men- tions that the Federal Government intends, at some future date, to requisition land to the west of Kuala Lumpur, covering 1,777 acres of the company's Pilmour Estate, to build a new airport. Presumably compensation would be paid to the company and this might be far in excess of the present book value. The company certainly has excellent prospects from the further development of its estates. The chairman says that if the present price of rubber continues throughout the remainder of the year, profits should be mater- ially in excess of those under review, in which case it is intended to pay a dividend of 50 per cent., of which 20 per cent. would be paid as an interim this October. This would put the 2s. ordinary shares at 7s. 9d. on a 12.8 per cent. yield basis—an excellent return.

The report for 1959 of Simms Motor and Elec- tronics is attractively produced to show share- holders just what the twelve subsidiary companies manufacture. These products include, apart from the many electrical and precision parts for the motor and aircraft industries: plastics, electric fans and heaters, ironing tables and adjustable lamps. The chairman, Mr. G. E. Liardet, reports a substantial and satisfying increase in profit of some £400,000 (before tax) over 1958. The two most successful subsidiaries were Clearex Pro- ducts, making plastic products, and British Vacuum Flask Co., which achieved the largest turnover in its history. The net profit (after tax) was £489,490, against £266,072, from which a total dividend payment of 214- per cent. has been made, but this included a special interim of 61 per cent. The chairman does not regard 1959 as a peak year and states that the company plans to expand to meet the growing demand from many industries. This will call for new capital. Share- holders have an excellent investment in the 5s. ordinary shares at 15s., yielding 5 per cent. on the effective dividend of 15 per cent., and may well soon be given an opportunity to subscribe for more capital on attractive terms.

Previous page

Previous page