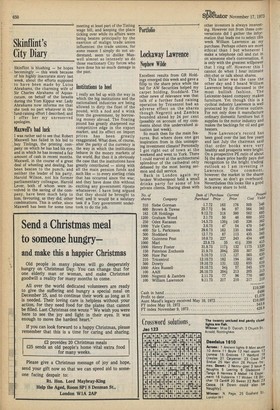

Portfolio

Lockaway Lawrence

Nephew Wilde

Excellent results from GR Holdings emerged this week and gave a fillip to the share price while the bid for AW Securities helped my carpet holding, Stoddard. The other news of relevance was that talk of a further fund raising operation by Tricentrol had an adverse effect on the shares though Negretti and Zambra bounded ahead by 24 per cent (possibly on account of my comments about this undervalued situation last week).

So much then for the main features. But where does one get inspiration from in this uninspiring investment climate? Personally I got right out of town at the weekend and went to York. There I could marvel at the architectural splendour of the cathedral only debased by the most boring sermon and dull service.

Back in London again my broker Wotherspool held a small drinks party for some of his private clients. Sharing ideas with other investors is always interesting. However not from these conversations did I gather the information that leads me to select this week William Lawrence as my purchase. Perhaps others are more ethical than 1 but whenever I make a telephone call and cut in on someone else's conversation, it is only with the greatest willpower that I ring off. However this I cannot do when I hear intimate chit-chat or talk about shares.

This latter was the case the other day and I heard William Lawrence being discussed in the most bullish fashion. The Leicester-based company makes furniture. Yet though this is a cyclical industry Lawrence is well protected by its diverse outlets. For not only does it manufacture ordinary domestic furniture but it supplies to the motor industry and makes the backings for oil and gas heaters.

Now Lawrence's record has been good over the last few years and last July the chairman said that order books were very healthy and prospects were bright. On a prospective PE ratio of about 54 the share price hardly pays due recognition to the bright trading outlook so I am investing in Lawrence. One comment, however: the market in the shares is narrow, so don't go overboard. Nevertheless this looks like a good lock-away share to hold.

Previous page

Previous page