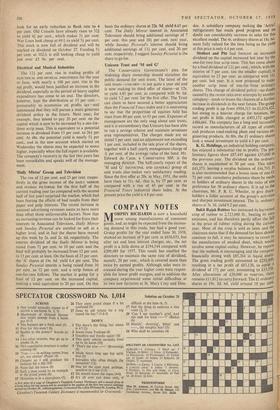

INVESTMENT NOTES

By CUSTOS

THE announcement of a £15 million Australian loan of 5{ per cent. stock 1975-78 at 98 did not stop the rise in the gilt-edged market although it depressed the prices of existing Australian issues. The market was cheered by the record surplus of £334 million on our international trading account for the half year. For the first time this century a surplus of £137 million was actually earned on our visible trade. This encouraged the market to look for an early reduction in Bank rate to 4 per cent. Old Consols have already risen to 521 to yield 44 per cent., which makes 31 per 'cent. War Loan look cheap at 69,96 to yield 51 per cent. This stock is now full of dividend and will be marked ex dividend on October 27. Funding 51 per cent, at 102-4 is still looking cheap to yield just over £5 9s: per cent.

Electrical and Musical Industries The 121 per cent, rise in trading profits of ELECTRICAL AND MUSICAL INDUSTRIES for the year to June, with nearly a 100 per cent, rise in the net profit, would have justified an increase in the dividend, especially as the period of heavy capital expenditure has come to an end. The directors, however, kept the distribution at 15 per cent.- presumably to economise on profits tax-and announced that they will pursue a more generous dividend policy in the future. Next year, for example, they intend to pay 20 per cent. on the capital which is now to be increased by a one-for- three scrip issue. This is equivalent to a potential increase in dividend from 15 per cent. to 261 per cent. At 48s. the potential yield is nearly 51 per cent., and in the new account which started on Wednesday the shares may be expected to move higher, especially when the full report is available. The company's recovery in the last two years has been remarkable and speaks well of the manage- ment.

`Daily Mirror' Group and Television The rise of 12 per cent, and 25 per cent. respec- tively in, the gross income of the DAILY MIRROR and SUNDAY PICTORIAL for the first half of the current trading year (as compared with the second half of last year) surprised the market, which had been fearing the effects of bad results from their paper and pulp interests. The recent increase in national advertising revenues seems to have more than offset those unfavourable factors. Now that an increasing revenue can be looked for from their interests in Associated Television, Daily Mirror and Sunday Pictorial are entitled to sell at a higher level, and in fact the shares have moved up this week by 2s. and 2s. 6d. respectively. The interim dividend of the Daily Mirror is being raised from 74 per cent. to 10 per cent, and the final will probably be increased from 12 per cent. to 15 per cent. at least. On the basis of 25 per cent. the 'A' shares at 19s. 6d. yield 6.4 per cent. The Sunday Pictorial interim is being raised from 10 per cent, to 12 per cent, and a scrip bonus of one-for-two follows. The market is going for a final of 12 per cent. on the increased capital, making a total equivalent to 20 per cent. On this basis the ordinary shares at 22s. 9d. yield 6.65 per cent. The Daily Mirror interest in Associated Television should bring additional earnings of 7 per cent, this year and 104 per cent. next year, while Sunday Pictorial's interest should bring additional earnings of 131 per cent, and 20 per cent. respectively. I suggest Sunday Pictorial is the share to go for.

Unicorn Trust and 'M and G' The Conservative Government's plea for widening share ownership should stimulate the public demand for unit trusts. The latest of the

unit trusts-UNICORN-is not quite a year old and is now making its third offer of shares-at 12s. to yield 4,85 per cent. as compared with 9s. 6d, to yield 5.2 per cent, for the first offer. The Trust can claim to have secured a better appreciation than the Financial Times index and it is interesting to see that the proportion of equities held has risen from 80 per cent. to 93 per cent. Expenses of management are the only snag about unit trusts, and it is extraordinary that Unicorn has been able to run a savings scheme and maintain seventeen area representatives. The charges made are an initial 5 per cent. and an adjustment not exceeding 1 per cent. included in the sale price of the shares, together with a half-yearly management charge of lc per cent. of the average value of the fund. M r. Edward du Cann, a Conservative MP, is the managing director. The half-yearly report of the 'M and G' (MUNICIPAL AND GENERAL) group of unit trusts also makes very satisfactory reading. Since the first offer at 20s. in May, 1951, the units have risen to 31s. 6d., that is, by 57 per cent. as compared with a rise of 43 per cent. in the Financial Times industrial share index. At the present price the yield is 4.8 per cent.

Previous page

Previous page