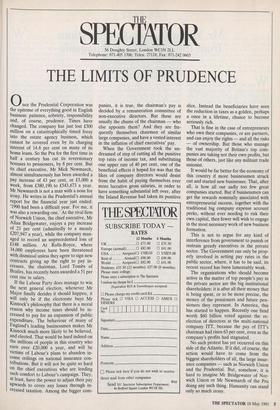

SPEd i tATOR

56 Doughty Street, London WC1N 2LL Telephone: 071-405 1706; Telex: 27124; Fax: 071-242 0603

THE LIMITS OF PRUDENCE

0 nce the Prudential Corporation was the epitome of everything good in English business: patience, sobriety, responsibility and, of course, prudence. Times have changed. The company has just lost £300 million on a catastrophically timed foray into the estate agency business, which cannot be covered even by its charging interest of 14.6 per cent on many of its home loans. So the Pru for the first time in half a century has cut its reversionary bonuses to pensioners, by 8 per cent. But its chief executive, Mr Mick Newmarch, almost simultaneously has been awarded a pay increase of 43 per cent, or £3,000 a week, from £380,190 to £543,673 a year. Mr Newmarch is not a man with a nose for irony. He writes in the Prudential's annual report for the financial year just ended: `1990 had been a difficult year. For me, it was also a rewarding one.' At the rival firm of Norwich Union, the chief executive, Mr Allan Bridgewater, enjoys a pay increase of 23 per cent (admittedly to a measly £207,947 a year), while the company man- aged to record an unprecedented loss of £148 million. At Rolls-Royce, where 34,000 employees have been threatened with dismissal unless they agree to sign new contracts giving up the right to pay in- creases, the chairman, Lord Tombs of Brailes, has recently been awarded a 51 per cent rise in salary.

If the Labour Party does manage to win the next general election, whenever Mr Major finally decides it should happen, it will only be if the electorate buys Mr Kinnock's philosophy that there is a moral reason why income taxes should be in- creased to pay for an expansion of public expenditure. The behaviour of many of England's leading businessmen makes Mr Kinnock much more likely to be believed, and elected. That would be hard indeed on the millions of people in this country who earn over £20,000 a year, and will be victims of Labour's plans to abandon in- come ceilings on national insurance con- tributions. But it will not be quite so hard on the chief executives who are lending such comfort to Labour's campaign. They, at least, have the power to adjust their pay upwards to cover any losses through in- creased taxation. Among the bigger corn- panies, it is true, the chairman's pay is decided by a remuneration committee of non-executive directors. But these are usually the chums of the chairman — who else appoints them? And they are fre- quently themselves chairmen of similar large companies, and have a vested interest in the inflation of chief executives' pay.

When the Government took the un- dreamed of step of cutting all the punitive top rates of income tax, and substituting one upper rate of 40 per cent, one of the beneficial effects it hoped for was that the likes of company directors would desist from the habit of paying themselves ever more lucrative gross salaries, in order to have something substantial left over, after the Inland Revenue had taken its punitive slice. Instead the beneficiaries have seen the reduction in taxes as a golden, perhaps a once in a lifetime, chance to become seriously rich.

That is fine in the case of entrepreneurs who own their companies, or are partners, and can enjoy the rights — and all the risks — of ownership. But those who manage the vast majority of Britain's top com- panies are taking not their own profits, but those of others, just like any militant trade unionist.

It would be far better for the economy of this country if more businessmen struck out and started new businesses. That, after all, is how all our sadly too few great companies started. But if businessmen can get the rewards nominally associated with entrepreneurial success, together with the traditional big company expense account perks, without ever needing to risk their own capital, then fewer will wish to engage in the most necessary work of new business formation.

This is not to argue for any kind of interference from government to punish or restrain greedy executives in the private sector. The Government can only be prop- erly involved in setting pay rates in the public sector, where, it has to be said, its recent record has been lamentably weak.

The organisations who should become active in the matter of top people's pay in the private sector are the big institutional shareholders: it is after all their money that is being spent, or to be more precise, the money of the pensioners and future pen- sioners they represent. In America, this has started to happen. Recently one fund worth $60 billion voted against the re- election of directors at the multi-national company ITT, because the pay of ITT's chairman had risen 63 per cent, even as the company's profits had stagnated.

No such protest has yet occurred on this side of the Atlantic. If it did, of course, the action would have to come from the biggest shareholders of all, the large insur- ance companies — such as Norwich Union and the Prudential. But, somehow, it is hard to imagine Mr Bridgewater of Nor- wich Union or Mr Newmarch of the Pru doing any such thing. Humanity can stand only so much irony.

Previous page

Previous page