Account Gamble

Warming to Valor

John Bull

At the time of the motor show there is usually more market interest in motor shares. Just as this is seasonal interest so I believe the coming winter conditions and the threat of a power strike (although averted for the time being) will attract attention to groups such as Valor. This company iS one of the largest in the oil heater market in this industry, accounting for some 60 per cent of sales. It also has 10 per cent of the gas heater market and Plans to enter the gas cooker field at the beginning of 1973.

This would be thin ground above for selecting Valor as a share for the account and what is of paramount importance is that at the end of November the group produces its results for the six months to end-September. At the annual meeting only last July the chairman, Mr Michael Montague, said the profits in the first quarter were "up to highest expectation," and results reflected an increase in business and improved efficiency. For the rest of the year, prospects were said to be excellent and Mr Montague confirmed a forecast of £1.1 million. This compares With £770,000 last year and £351,000 in the period before that.

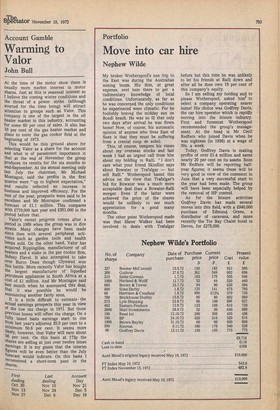

Valor's recent progress comes after a Period in 1969 when the group was in dire straits. Many changes have been made since then with several peripheral activities such as garden tools and health lamps sold. On the other hand, Valor has acquired Rippingilles, manufacturer of oil heaters and a stake in the gas cooker firm, Sidney Flavel. It also attempted to take Over Burco Dean though Glynwed won this battle. More recently Valor has bought the largest manufacturer of liquefied Petroleum appliances in South. Africa at a cost of El million. And Mr Montague said last month when he announced this deal, that it was possible he would be .announcing another fairly soon. It is a little difficult to estimate the actual earnings prospects this year in view of the low tax charge in 1971. But those Previous losses will offset the charge. On a fully taxed basis earnings start to rise from last year's adjusted 35.5 per cent to a Minimum 50.8 per cent. It seems more likely, however, that Valor will earn about 36 per cent. On this basis at 172p the Shares are selling at just over twelve times earnings. It is my guess that the interim figures will be even better than the July forecast would indicate. On this basis I recommend a short-term punt in the Shares.

Previous page

Previous page