Account gamble

A punt in Austin-Hall

John Bull

On August 21 I expect to see good results from Austin-Hall Group and recommend a punt in the shares. The figures to be announced will be for the first six months' trading to June 30 and already some indication of progress in this period has been given by the chairman, Mr T. A. Mather. At the annual meeting in May he said the order books for all companies in the group were healthy and had been increasing over the first quarter. Two divisions, in particular, he singled out were Hall and Clifton, whose orders for system buildings were running more than 50 per cent ahead of last year. Finances should be little worry particularly as the sale of Stephenson Holiday Camp realised £500,000.

The main business of Austin-Hall is in the manufacture, sale and hire of sectional buildings and providing hire purchase facilities. Last year the breakdown of profits showed the system and garden building contributed £469,000, hire and leasing of mobile buildings and plant, £204,000, and hire purchase finance £193,000.

In the field of system building and garden buildings, Austin-Hall has establishecj a dominant share of the market and in 1972 a first time contribution can be expected from the acquisition of Worth. Another initial contribution will come from Stephenson Developments which also concentrates on system building where demand has considerably increased.

One point that Mr Mather drew attention to in his annual statement was the formation of Austin-Hall International. Exports last year were on the low side but the new company hopes to make a drive into Europe and the Middle East.

Pre-tax profits last year were £774,000 and earnings 38.5 per cent, on which a 25 per cent dividend was paid. This year I am going for profits of around £900,000 and earnings of about 45 per cent. On this basis the shares at 220p are on a PE ratio of 20. This is a conservative eaimate. however, and what also must be remembered is that Pat Matthews' First National Finance has a strategic stake of 20 per cent in the company. A high rating is Justified and I expect the market to show its appreciation more fully when the interim figures are announced.

Looking back over recent recommendations, I am pleased that the market, though slow off the ball, is rather more optimistic about Bibby than the initial reaction signified. Glynwed, meanwhile, has done very well which gives me more confidence in last week's tip, Mather and Platt.

First Lust Account dealings dealings day July 31 Aug 11 Aug 22 Aug 14 Sept 1 Sept 16 Sept 4 Sept 15 Sept 26

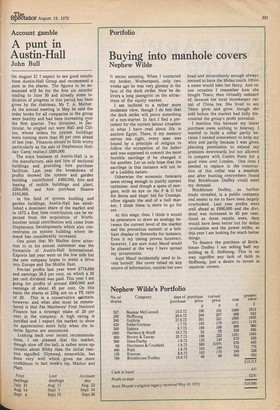

Previous page

Previous page