Portfolio

Buying into manhole covers

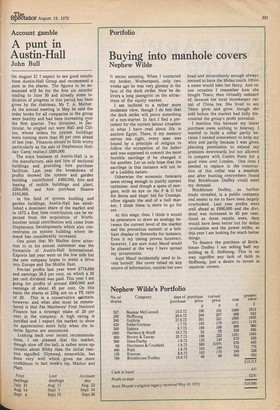

Nephew Wilde

It seems amazing. When I contacted my broker, Wotherspool, only two weeks ago he was very gloomy in the face of the dock strike. Now he delivers a long panegyric on the attractions of the equity market.

I am inclined to a rather more moderate view, though I do feel that the dock strike will prove something of a non-starter. In fact I find a precedent for the current labour situation in what I have read about life in ancient Egypt. There, if my memory serves me right, every man was bound by a principle of religion to follow the occupation of his father and was supposed to commit the most horrible sacrilege if he changed it for another. Let us only hope that the sacrilege in this instance will not be of a Luddite nature.

Otherwise the economic forecasts seem strong enough to justify current optimism. And though a spate of mergers, with an eye on the P & 0 bid for Bovis and Imps' bid for Courage, often signals the end of a bull market, I think there is more to go for vet.

At this stage, then, I think it would be premature to draw an analogy between the current level of the market and the precarious summit of a brilliant display of fireworks for instance, Even if my timing proves incorrect, however, I am sure Aunt Maud would be pleased at the way I have spread my investments.

Aunt Maud incidentally used to invest herself. She never relied on any source of information, outside her own head and miraculously enough always seemed to have the Midas touch. Often a name would take her fancy. And on one occasion I remember how she bought Tesco, then virtually unheard of, because her local storekeeper ran out of China tea. She lived to see Tesco grow and grow, though she sold before the market had fully discounted the group's profit potential.

I mention this because my latest purchase owes nothing to hearsay. I wanted to build a cellar partly because I needed somewhere to keep my wine and partly because I was given planning permission to extend my premises downwards but not allowed to compete with Centre Point for a good view over London. One item I needed to replace in the construction of this cellar was a manhole and after hunting everywhere found that Brickhouse Dudley could meet my demand.

Brickhouse Dudley, as further study revealed, is a public company and seems to me to have been largely overlooked. Last year profits were well ahead at £806,000 and the dividend was increased to 45 per cent. Good as these results were, they would have been better but for dollar revaluation and the power strike, so this year I am looking for much better things.

To finance the purchase of Brickhouse Dudley I am selling 'half my holding in S. Hoffnung. This in no way signifies any lack of faith in Hoffnung, just a desire to invest in manhole covers.

Previous page

Previous page