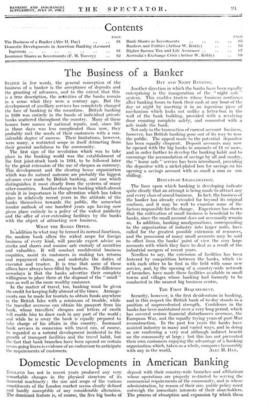

The Business of a Banker

STATED in few words, the general conception of the business of a banker is the acceptance of deposits and the granting of advances, and to the extent that this is a true description, the activities of the banks remain in a sense what they were a century ago. But the development of ancillary services has completely changed the face of banking in the meantime. British banking in 1880 was entirely in the hands of individual private banks scattered throughout the country. Many of these houses bore names of national repute, and, since life in those days was less complicated than now, they probably met the needs of their customers with a con- siderable degree of success. Their limitations, however, were many, a restricted scope in itself detracting from their general usefulness to the community. The first sign of the revolution' which was to take place in the banking world was the establishment of the first joint-stock bank in 1834, to be followed later by the great extension of the use of cheques as currency. This development and the clearing house organization which was its natural outcome are probably the biggest advance ever made by British banking,- and one which distinguishes it most clearly from the systems of many other countries. Another change in banking which almost rivals it in importance is the alteration which has taken place in relatively recent years in the attitude of the banks theinielves towards the public; the`somewhat insular outlook of one hundred years ago having now given place entirely to a policy of the widest publicity and the offer of ever-extending facilities by the banks with the object of attracting new business.

WILAT THE BANKS OFFER.- -

_

In addition to what may be termed its normal functions, the modern bank offers the widest scope for foreign business of every kind, will provide expert advice on stocks and shares and assume safe custody of securities and valuables. It will conduct confidential business enquiries, assist its customers . in making tax returns and repayment claims, and undertake the duties of executor and trustee. It is true that some of these offices have always been filled by bankers. The difference nowadays is that the banks advertise .their complete willingness to place them at the disposal of the " small " man as well as the more wealthy customer.

In the matter of travel, too, banking must be given the credit for keeping fully abreast of the times. Arrange merits can be made for tourists to obtain funds anywhere in the British Isles with a minimum of trouble, while the traveller overseas can obtain- his passport from his bank, whose travellers' cheques and letters of credit will enable him to draw cash in any part of the world ; and while he is away the bank is equally prepared to take charge of his affairs in this country. Increased bank services in connexion with travel can, of course, be regarded as a natural development incidental to the growth of transport facilities and the travel habit, but the fact that bank branches have been opened on certain ocean-going liners is evidence of an endeavour to anticipate the requirements of customers.

DAY AND NIGHT BANKING.

Another direction in which the banks have been equally enterprising is the inauguration of the " night safe system. This enables traders whose business continues after banking hours to bank their cash at any hour of the day or night by inserting it in an ingenious piece of mechanism which looks not unlike a letter-box in the wall of the bank building, provided with a revolving door ensuring complete safety, and connected with a safe inside the bank.

Not only in the transaction of current account business, however, has British banking gone out of its way to woo the public. The appeal made to the potential depositor has been equally eloquent. Deposit accounts may now be opened with the big banks in amounts of XI or more, and in order further to develop the banking habit and to encourage the accumulation of savings by all and sundry, the " home safe " service has been introduced, providing the depositor with a nickel-plated box for savings on his opening a savings account with as small a sum as one shilling.

RESULTS OF AMALGAMATION.

The lines upon which banking is developing indicate quite clearly that an attempt is being made to attract any and every class of sound business. In fact, the business of the banker has already extended far beyond its original Confines, and it may be well to examine some of the factors responsible for the change. Experience has shown that the cultivation of small business is beneficial to the banks, since the small account does not necessarily remain so. In addition, banking amalgamations, corresponding to the organization of industry into larger units, have called for the greatest possible extension of resources, and the 'possession of many small accounts may he said to offset from the banks' point of view the very large accounts .with which they have to deal as a- result of the industrial mergers of recent years.

Needless to say, the extension of facilities has been fostered by competition between the banks, which vie with each other to be first in the field with some new service, and, by the opening of a country-wide network of branches, have made these facilities available in small towns and villages whose banking had formerly to be conducted in the nearest big business centre.

TILE FIRST REQUIREMENT.

Security, however, is the first desideratum in banking, and in this respect the British bank of to-day stands in a position of unprecedented strength. Confidence in the banks has been maintained over a very long period, which has covered serious financial disturbances overseas, the European War, and the equally trying years of post-War reconstruction. In the past ten years the banks have assisted industry in many and varied ways, and in doing so are conferring a very real although indirect benefit on the community at large ; but this has not prevented their own customers enjoying the advantage of a banking organization which, taken as a whole, compares favourably

Previous page

Previous page