COMPANY NOTES

FOR the year ended January 3, 1959 (a fifty- three-week period), the accounts of Guest keen and Nettlefolds show very satisfactory re- sults with a trading profit of £31 million and an increase of £250,000 in the net profit, after tax, at £11.2 million. There has also been an increase in the dividend (after allowing for last year's 30 -1 per cent. scrip issue), which is to be 13 per cent. from earnings of 50 per cent. Naturally with this cover and the company's future looking encourag- ing the £1 ordinary shares at 62s. 6d. are on the low yield of 4 per cent., but with a £30 million development plan embarked on a year ago the next few years should, when this capital expendi- ture shows a return, bring further rewards for shareholders.

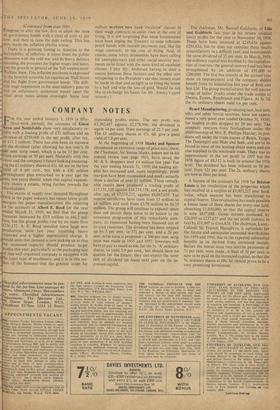

The excess of supply over demand throughout 958 in the paper industry has meant lower profit

Margins for paper manufacturers. On referring 0 the accounts of Albert E. Reed for the year nded March 31, 1959, we find that the group urnover increased by £3.9 million to £66.2 mil-

lion, but the group profits rose by no more than £236,172. A. E. Reed installed some large new roduction 'units last year incurring heavy xpenses and a higher depreciation charge. It ould seem that demand is now picking up so that he increased capacity should produce larger rotits this year, particularly as the packaging side this well-organised company is equipped with the latest type of machinery, and it is in this sec- ion of the business that the greatest scope for expanding profits exists. The net profit was £2,202,487 against £2,178,996; the dividend is again 14 per cent. from earnings of 21.3 per cent.

The ordinary shares at 47s, 6d. give a good yield of 5.8 per cent.

At the beginning of 1958 Marks and Spencer introduced an extensive range of price cuts; these, the Chairman, Sir Simon Marks, points out in his annual review (see page 901), have saved the M. & S. shoppers over £4 million last year. For the year ending March 31, 1959, the trading sur- plus has increased and, more surprisingly, profit margins have been maintained and stocks actually show a decline of over £1 million. These remark- able results have produced a trading profit of £17,131,332 against £16,234,578, and a net profit, after tax, of £7,558,715, against £6,042,655. Tax reserve certificates have risen from £3 million to £4 million and cash from £3.78 million to £6.55 million. The group will continue to expand; space does not permit these notes to do justice to the consistent progression of this remarkable com- pany, its expansion having been financed out of its own resources. The dividend has been stepped up by 5 per cent, to 371 per cent, and a 20 per cent, scrip issue is proposed-a 100 per cent, scrip issue was made in 1955 and 1957. Investors will have to pay as much as 64s. for the 5s. 'A' ordinary shares, to yield 2.9 per cent., but should have no qualms for the future; they can expect the same rate of dividend (at least) next year on the in- creased capital. The chairman, Mr. Samuel Goldstein, of Ellis and Goldstein last year in his review forecast lower profits for the year to November 30, 1958. These have been returned at £249,634 against £294,834, but he does not consider these results unsatisfactory in a difficult year, and recommends the same dividend of 35 per cent. In March, 1958, the ordinary capital was doubled by the capitalisa- tion of reserves; the general reserve fund has been strengthened by an addition of £91,000 to £280,000. The first five months of the current year show an improvement and the company should benefit from its acquisition last year of Bent and Son Ltd. The group manufactures the well-known range of ladies' frocks under the trade names of Dereta, Eastex, Rembrandt and Elgora. At 5s. 3d. the Is. ordinary shares yield 6.6 per cent.

Byard Manufacturing, producing lace, hair nets, silks and other textile sundries, have not experi- enced a very good year (ended October 31, 1958), for trading profits dropped by 20 per cent. The company operates from Nottingham under the chairmanship of Mrs. E. Phillips-Marder; its pro- ducts sell under the trade names of Bytex, Tango, The Dreamgirl and Hide and Seek, and are to be found in most of the leading chain stores and are also supplied to the wholesale trade. There was an improvement in the net profit in 1957 but the 1958 figure of £8,512 is back to around the 1956 level. The dividend has been reduced to 10 per cent. from 12f per cent. The 2s. ordinary shares are now at their par level.

A feature of the accounts for 1958 for Brixton Estate is the revaluation of the properties which has resulted in a surplus of £1,905,217 over book value, which amount has been transferred to capital reserve. This revaluation has made possible a bonus issue of three shares for every one held, absorbing £1,050,000, so that the capital reserve is now £857,088. Gross income increased by £26,899 to £237,625 and the net profit (subject to tax) by £11,907 to £164,824. The chairman, Lieut.- Colonel Sir Francis Humphrys, is optimistic for the future and anticipates increased distributions for 1959 and 1960, due to the expected substantial benefits to be derived from increased rentals. Before the bonus issue two interim payments of 71 per cent, were made. A final of 31 per cent. is now to be paid on the increased capital, so that the 5s. ordinary shares at 18s. 3d. should prove to be a very promising investment.

Previous page

Previous page