Investment Notes

By CUSTOS

A NEW look at the security markets confirms

me in the opinion that the time has not yet come to be a bull of equity shares. It is now certain that we are going into the European Common Market, but the final agreement, which may be reached early next year, will be followed by two uncertainties—a general election (sooner or later) and the vulnerability of certain indus- tries or trades to the influx of European manu- factures at competitive prices and with more attractive designs. In the meantime there is a continual trickle of bad company reports to keep equity shares depressed. The sharp drop of nearly 30 per cent. in the half-yearly profits of DUNLOP, in spite of lower raw-material prices, was a shock; the slightly lower profits of DEBENHAMS did not help the store shares, and warnings of lower profits from VENESTA and the glass com- panies have all been bad for market sentiment. But I would repeat that this is not the time to sell good shares which are not vulnerable to European competition or to political crises. Be- sides, the new Chancellor might eventually de- cide to do something to stimulate the economy —the latest inquiry of the Federation of British Industries supports the case for it—and the Stock Exchange could begin to brush off the general election uncertainty by taking a bullish view of Tory prospects.

'Investment' Shares

There are .a number of equity groups which are not vulnerable to European competition or to British politics. The first are the industries which mainly depend on public investment spending which is unlikely to be changed by either Conservative or Labour governments. (Mr. Maudling has just forecast that next year public investment spending will be £175 million more than in the current financial year.) I start with the heavy electrical and boiler industries. The report of the Central Electricity Generating Board makes it clear that much more will have to be spent in the next four or five years on generating plant and the boiler equipment of the power stations. For 1966 orders will be two and a half times as great as last year's. I have already referred to the boiler companies and I was interested to read a well-informed brokers' report on the companies manufacturing electri- cal equipment. This report points out that. while there can be no great increase in deliveries of turbo-alternators and their associated boiler plant until 1966, there will be a steady rise in the volume of output of switchgear, transformers 015 and cables. Profit margins have been improved with the stabilisation of prices. While net operat- ing profits for 1961 were only 7.2 per cent. on the capital employed, these brokers expect profit margins to improve over the next few years, as prices are more likely to harden, and by 1971 they expect the profit ratio to be double the 1961 level. Of the eight shares they analyse I would pick out Bloc, which should begin to show an improvement in earnings almost imme- diately and go on improving for some years to come. For the first half of 1962 this company's trading profits showed an increase of about 91 per cent. over the first half of 1961 and of about 14 per cent. over the second half of 1961. REYROLLE is also well placed to benefit from in- creased government orders. This company has developed a range of switchgear in the medium and smaller sizes which is said to be of outstand- ing design. Their efficiency should enable them to make good profits in an expanding market. The chairman in the last report stated that they were increasing plant capacity and taking on additional factory space at South Shields. INTER- NATIONAL COMBUSTION maintained its profits for the six months to March, 1962, and this com- pany also can look for higher profits. Finally, GENERAL ELECTRIC, which is more interested in the lighter side of the electrical industry, will also benefit from the increased government orders, and under the present improved management higher profits are expected.

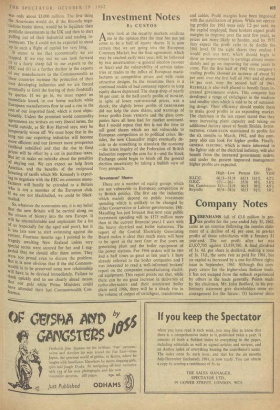

Div.

High—Low Present Div. Yield G.E.C. 37/--26/- 35/6 10% Int, Combustion 311-21/9 30/3 30% Reyrotle 50/9-38/6 50/3 9I%

66/3-51/9 63/3 131% 4.2%

5.6% 4.9% 3.8%

Previous page

Previous page