THE EXCISE.

THE Excise, in the words of JOHNSON, is "a hateful tax levied on commodities" manufactured in the country. It is vexatious, as sub- jecting the dealers in the particular article to the domiciliary visits of • Mr. P,PCIna.ocit's Consmerciat Dictionary ; where a very able paper on the subject will be found. . the revenue-officers, and to be harassed by frivolous or spiteful.pwise- cations. It is generally unequal, being levied on commodities used by the bulk of the people, but on which the rich expend little or nothing. It is mischievous, as interfering with the conduct of trade, prescribing the modes in which business shall be carried on and articles manufac- tured, and virtually putting an extinguisher on exterprise, skill, and improvement. The necessities of the State render its entire abolition impracticable at present ; but eventually to get rid of the Excise, should be one of the great objects of all who concern themselves with finan- cial matters.

This branch of revenue was introduced by the Long Parliament as a war-tax. The Royalists shortly followed their example, imposing it as a war-tax also. Soon after the Restoration, it was permanently esta- blished; the articles subjected to duty being ale, cyder, metheglin, vinegar, and strong waters, i. e. distillery. On its introduction, the duties were moderate, and it does not appear that much smuggling took place. They were subsequently raised; the quantities "brought to charge " rapidly decreased, and there were great complaints against

illicit dealers and loud calls for penalties. Under WALPOLE, this branch of taxation was extended; and additions, both in the number of the articles and the rates of duty, were imposed during the wars of GEORGE the Third. Since the peace, several articles under this head of revenue have been repealed.

Some of the items are rather abitrarily placed under this department; as—

AUCTIONS AND LICENCES.

Aactions £218,083 Furniture, Pictures, Books, Horses, Carriages, &c., Is. in the pound. Estates, Shares, Plate, and Jewels, id. ditto.

Wool sold for the benefit of the growers or first purchasers, 2d. ditto.

Many articles anew materials. the produce atlas Kingdom, are exempt on the first sale from duty, if sold for the benefit of the producers. A similar exemption is granted on many imported commodities.

'Licences £919,174 Auctioneers £5 0 0 per annum,

Coffee dealers, &c. 0 11 0 ..

Glassmakers 20 0 0 ..

Papermakers 2

0 0

Riperstainers 4 0 0

Passage Vessels on board which

Exciseable Liquors are sold for

Passengers on the voyage 1

0 0

Stxtpmakers 4

0 0

Spirit umber, (Distillers) 10 0 0

Starch makers 5 0 0

Sweets and Mead—Makers 2 2 0

Retailers 1 1 0

Vinegar makers

5 0 0

Wine (Foreign)— It etailers basing a Licence to retail Beer but not

Spirits 4 4 0

Ditto having Licences to retail Beer

and Spirits 2 2 0 ..

Dealers not being Retailers 10 0 0 ..

The Licences for the fulluwing trades vary according to the

number of quarters made or barrels brewed in the year.

Brewers, varying from, pa annum, 10s. to i51.

Maltsters 7s. to 4/.' 10S.

Tobacco Manufacturers .. 51. to 301.

Licences for retailing Beer and Spirits vary according to the rent of the premises, from if to 101. 10s. Dealers in Tobacco and Snuff. 5s.

In their nature these duties seem rather to belong to the Stamps. In the case of Auctions, and in the majority of the Licences, there • exists no reason why a transfer should not be made to that department -which could furnish the Excise with lists of such traders as were sub, ject to its surveillance. Where the amount of the licence depends upon the quantity of business done, the sum to be paid must of course be fixed by the Excise, but the money might be received by the Stamps. Under the present arrangement, when an Excise-duty is repealed, the licence is generally abolished also.

We shall consider the incidence of Licences when we treat of Stamps. The Auction-duty falls upon the seller. It is finite in its operation, levied without the possibility of dispute, and easily collected. It is moreover established, and the back is accustomed to the burden. In other respects it is objectionable, for its operation is unequal; and it • may be considered a tax upon necessity, the sale itself implying need, and no man ever selling by auction who could dispose of his property in any other way. The amount it yields would, however, suffice to get rid of the Hop-duty and the duties on the minor articles subjected to an excise. It would sweep away very many Custom.duties on raw materials. It would more than suffice to abolish the Advertisement- -tax. If it be wise to retain a tax so long as others of a more mischiev- ous nature exist, the duty on Auctions will remain for the present, un- less a Property-tax be imposed. Much attention has been drawn by Mr. CORBETT'S speech to the Auction-duty. That it is unequal there is no doubt. That it was de- signedly intended to favour the rich at the expense of the poor is ques- tionable. A law-maker as often sells his furniture or pictures by auc- lion as his estate. The difference in the percentages was rather a mat- ter of fiscal prudence. The generality of furniture sales do not per- haps run much above 500/., not many reach 1,0001., few rise above it. It seems the sellers will pay 5 per cent. But bad such a rate been imposed on the sale of estates, which sometimes fetch from 50,000/. to 100,000/. no estates would probably have been sold by auction.

This disposition to favour wealth runs throughout our taxation ; fre- quently, no doubt, from a selfish motive, but sometimes, perhaps, upon the chapman-like principle of making an allowance where a quantity is taken. Thus, traders keeping more travellers than four, pay no tax on all above that number.

TEA £3,344.918 Sold for 2S, or upwards a pound. 100 per

cent.—under 2s a pound, 96 per cent.

The importation of Tea is at present prohibited, except by the East India Company-, who collect the tax. The nice distinction in the rate of duty between the higher sod the lower class of Teas, was owing, we believe, to a political amendment to which the-Minister, not to be behind-hand in policy, acceded. At present, any alteration in the rate of duty would be premature. When the China trade is thrown open, the article must of course be transferred to the Customs ; when a bold reduction of duty will be desirable, not only as a relief to the consumer, but to prevent illicit traffic in the article, which is well adapted to the

smuggler. Should no Measures for reducing the expense of the Pre- ventive Service have been by' that time adopted, Brandy, Tea, and To- bacco will make a very pretty trite It is most probable that any reduc- tion in the Tax will be opposed by the Colonial interests, lest the con- sumption of Coffee should be decreased.

Salinas.

English 1.954.578

Scotch 1,453,852 7 6 per gallon

3 4 ....

Irish 1,781,694 3 4 ....

Scotch or Irish imported into Englaiid 7 6 ....

£5,193,124

The tax upon ardent Spirits is one of the most proper duties upon consumption. The only question connected with it is, what revenue will yield the highest rate of duty, and at the Fame time put an end to illicit trading? In Ireland, Mr. GouLBURN's late addition to the duty (6d. per gallon) has been followed by a rise of about 200,000/. or 300,0001. in the revenue. In Scotland there has been little alteration in the produce of the tax. In England (coupled perhaps with the opening of the Beer trade), the revenue has fallen by nearly the amount of its rise in Ireland. The increase in the rate of duty is therefore unimportant in point of revenue, and it might perhaps be advisable to return to the old rate. A greater approach to equality in the rate of duty (as suggested by Sir HENRY PARNELL) between England, Ire- land, and Scotland, seems also desirable ; and this might perhaps be produced without any very great loss. The population of England is nearly double that of Ireland, the wealth out of all comparison. In Scotland the population is 2,400,000, in England 13,000,000; yet in both these countries, it will be seen that, at a duty lower by more than one half, the amount yielded is not greatly below that of England. Coupling this fact with the frequent discovery of illegal stills even in

i

London, it would seem that the English duty might be reduced to 4s. or Ss. a gallon without much eventual loss, even after every allowance is made for the greater consumption in England of beer and foreign spirits. It gill perhaps be objected, on behalf of the morals of the people, that the revenue might very greatly increase, but that we should have all the population corrupted by drunkenness. Even admitting this assertion, the question is between tippling and smuggling with all its violence and bloodshed. In reality, however, the apprehensien of the evil is much exaggerated. To repeat a common, maxim in finance, the apparent increase consequent upon a reduction of duty, arises as much from the transfer of the smuggler's trade to the regular dealer as from the actual increase of consumption. A good deal is also to be attributed to the discontinuance of adateraiion,—a better and more wholesome article is purchased. Any one who has ever tasted real malt whisky, will remember how much more pure the spirit is, than the medicated and adulterated stuff which is retailed in England under the name of gin.

The apprehended evil might, however, be guarded against by aiming- at the introduction of a dearer spirit. This might be accomplished by reducing the duty on Rum, and effecting a still greater reduction of the Brandy-tax than we hare already suggested. The remission of the Hop-duty, and the modification of the Malt-tax, would also have a ten- dency to divert the populace from ardent spirits of all kinds. These recommendations, however, are rather prospective than pre- sent. There are many measures of a more urgent nature than the mo- dification of the duties on Spirits. We come to

TAXES ON BEER.

Malt £4,359,339 Made from Barley. per bushel, 2s. id, .. Bear or Iligg only, in Scotland or Ireland, per bushel, 2s.

Mops' 149,594 Ed. per lb.

Both these taxes, though paid by the consumers of beer, react in some measure upon the Agriculturists by the check they give to con- sumption. This pressure is, however, se remote, that there exists not the slightest pretence for the statement that the Malt-tax is at tax upon the Landed interest. The brewers might as well affirm that these duties fell upon them, or the soap-boilers that they were the persons who paid the Soap-tax. These duties are unequal. The whole of the Hop-duty is paid by England ; as is nearly four millions of the Malts tax. The amount yielded by the Hop-duty is :uncertain, depending entirely on the productiveness of the crops. Sometimes it even sinks as low as 60,0001. or 70,000/. It can therefore scarcely be relied upon as a source of revenue. Coupling this with its small amount, we should recommend its entire remission, especially as the Excise regulations, though not quite so complex and vexatious as in some other branches of trade, are minute and troublesome. The existence of this trifling duty, moreover, causes the adulteration of beer. It also checks the em- ployment of agricultural labour, which is the chief source of outlay in the cultivation'of this expensive plant.

If it were notofor the large amount of duty which it yields, we should urge the repeal of the Malt-tax ; for so far as it presses upon the land- owner, its operation is very unequal, and its effects mischievous. The lands which produce barley, are chiefly the inferior sandy soils which were incapable of cultivation till the introduction of turnip husbandry. They are only rendered productive by the exercise of agricultural skill, and by considerable expenditure of capital and labour. The tax, there- fore, so far as it checks the consumption of barley, has a tendency to throw those soils out of cultivation which employ the most labour, re- quire the most skill, and have been reclaimed, as it were, at the greatest 7, expense to the owner. It is, moreover, unequal. Wheat land is greatly„' a considerable portion of grass land is entirely, indebted to Nature for their capabilities of production. They escape State-taxation alto- ther; the whole weight is thrown upon the land least able to bear it. ; It follows from all this, that whether the duty be looked at as a tax, falling entirely upon the consumer, or whether we allow for its opera- tion upon the owner of barley land, the agriculturists have no right to demand a protective duty on all kinds of corn, in return for a duty which falls solely upon barley. Whilst the Malt-tax continues, the barley-grower is entitled to some protection, though, in reality, be does not require it. The English production is not only far superior to any foreign grain for the purpose of malting, but the virtue of the barley deteriorating if it be not used when fresh, the foreigner, even were his commodity equal, would be unable to compete with the English grower.

Out of two million and a half quarters of foreign corn retained for home tonsumptionin 1830, there were only 52,000 quarters of barley. Till within these few years, there were no fewer than forty acts for

the purpose of regulating the Malt-trade.* These were then conso- lidated into one, whi& had no fewer than eighty-three clauses, whose regulations were enforced by one hundred and six penalties, amounting altogether to 13,500/. Some of these directions were so absurd, that, if we remember correctly, the Commissioners of Excise were obliged to suspend their operation for fear of stopping the Supplies by stopping the manufacture. This statute was soon superseded by another of a much less complicated and vexatious nature. This measure, coupled with the repeal of the Beer-duty and the throwing open the Beer-trade, has had the effect of increasing the consumption of malt by nearly one fifth,—the revenue rising from about three millions and a half, to some- what more than four millions and a quarter ; and during the past year it increased by another half million.

The obstacles in the way of repealing the duty, are the large amount of revenue it yields, and the necessity that would exist for maintaining the machinery of the Excise Office, merely to collect the Spirit-tax. Considering that till the late improvement, the consumption of Malt

had remained stationary for above a century, it is probable that a reduc- tion of the duty to one half its present amount would not be attended with a loss of more than a million to the revenue. The apparent loss upon Malt would, perhaps, be much less than this, owing not only to theincreased consumption, but to the blow that would be given to the adulteration of beer. As, however, this increase would be felt in the Spirit-duty, we set down the real loss at that amount.

Whilst we suggest the reduction of the Malt and the retention of the Spirit-duties, we would earnestly recommend a Commission of Inquiry 'to ascertain if better Excise regulations could not be framed, which, affording equal security for the collection of the revenue, should be less • ;injurious to the manufacture. Besides the prevention of improvement,

and the other more palpable injuries arising from the Excise interference, it is to be apprehended that much waste is incurred. It appeared, for in- stance, by a Parliamentary inquiry,- that ten per cent. more spirit could be extracted from grain by a slight change in the mode prescribed by the Excise; but it was apprehended that the alteration "would render the collection of the revenue liable to great difficulties. If duties are im- posed, they must, of course be levied ; but no real or apprehended trouble, or even "difficulty " should be allowed to create a waste- tithe.

TAXES ON MANUFACTURES AND ON THE RAW MATERIALS OF MANUFACTURE.

Excepting the Advertisement-duty, the taxes upon the following ar- ticles may, upon the whole, be considered as the most mischievous of any to which the country is subjected. They are collected at a heavy expense: they involve an interference with the respective trades, with- out the countervailing advantage, as in Spirits and Malt, of yielding a very large amount of revenue. Bricks and Paper are raw materials ; and the ocher articles are extensively used in manufactures, or form a part of some manufacture, if they cannot in strictness be termed mate- rials. In the case of Soap, Glass, and Paper, the interference of the Excise regulations is both vexatious and mischievous to the last degree. These three articles are also branches of our foreign trade ; Glass to the amount of nearly half a million being sometimes'exported, and consider- able quantities of both Soap and Paper. The effects of the interference upon the price, and still more upon the quality of the articles, are ex- ceedingly oppressive ; giving the foreign manufacturer considerable ad- vantages, and tending to shut us out from the Export market. The duty is, indeed, drawn back upon exporting the articles; but no draw- back can compensate for the Excise restrictions and regulations, or for the time and trouble of procuring the repayment. Nor must the ex- pense to the public be overlooked ; for nearly half a million of duty was repaid upon these articles after having been first collected, and in former years about as much was generally drawn back upon Glass alone.

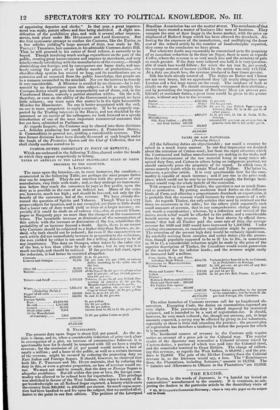

Total Suva

Real Value Exported Year ending, 5th

Gross Produce. Drawback. klanaged. Net Produce.

Jan. Ms.

Glass .. £732,454 £199,507 £932,061 £531,498 £.499,631 Paper . 723,247 30,077 753,394 677,103 280,0484 Soap. 1,431,475

190,972.

1,69%447 1,138,261

297.2961

£2,887,176 420,556 3,307,832 2,346,862 936,969

So that an expense in managing 2,887,1761. is paid to net 2,346,862/. ; and in the case of Glass, we are paying charges on the management of three quarters of a million of money to receive very little more than half a million.

Nor should their more remote tendencies be altogether overlooked, for these taxes come under the division of those which prevent the. creation of more wealth than they actually abstract. And the evil does not stop here. With the exception of Bricks, these manufactures can only be carried on in large and well-built workhouses ; they also re- quire expensive implements, and, in the case of Soap and Glass, con- sume considerable quantities of coals. Every individual connected with these businesses—every hewer of wood, every worker in iron or other metal, the owner of coal-mines, the persons connected with their transport—all, in short, who are concerned with the Building, the Iron, and the Coal trades, are specially interested in the abolition of these duties.

So much for the general views arising out of these articles : we pro- ceed to notice the particular points connected with each different manu- facture.

Bricks and Tiles. £365,237 Bricks not exceeding 10 in. long, 3 in. thick.

and 5 inches wide per 1,000.E0 5 10

Ditto Smoothed or Polished 0 12 10

Exceeding thesedimensions, Common .. 0 10 0

Ditto Smoothed or Polished ..

Tiles, Plain .. 0 5 8 ... Pan or Ridge .. 0 12 10

... Paving, not exceed. 10 in. square.. 1 4 2

... Ditto exceed. 10 in. square .. 2 8 4 ... All other Tiles .. 2 8 4

• M'Culloeli's Dictionary, p. 725, 726. f Economy of Manufactures, chap. 30 (306). : Books and Stationery.

i Includes Candles. Glass

531,498 Materials of viz-- Flint per lb. 0 0 Broad per cwt. 1 10 Crown .. 313 3 0 6

Plate, in sheets, of not less size than 6 inches by 4 inches, and not less than 1 nor more than i thick per cut. 3

0 0

Other than such plates 4 19 0

Common Bottles 0

7

0

Paper

677,103 First Class per lb. 0 0 3

Second ditto . 0

0

1/

Glazed Paper, Millboard, and

Scaleboard per evil. 1 1 0

Pasteboard, first class .. 1 8 0

Ditto, second ditto . 0 14 0 Printed Goods...

59,969

(i. e. Paper Hangings)..per square yard. 0 0 11 Soap 1,133,261 Hard per lb. 0 0 3

Soft .. 0

0 It

£2,771,067

1. BRICKS AND TILES.

The duty on Bricks and Tiles varies from 15 to 30 or 35 per cent., falling heaviest (of course) upon the cheapest article. It is also an unequal duty in other respects. The Stone and Marble and Slates which are used in the rich man's mansion are duty-free ; the Bricks arid Tiles of the cottage, the house, or the factory; are subjected to taxation. The levy of this duty does not, in strictness, involve any direct interference with the processes of the manufacture. But an enumeration of the- evils to which the trader is subject, will clearly show that bad is the best of an Excise law. Notice must be given of the intention to begin making, under the penalty of 1001. The size, the form, and it may be said, the quality of the article, is prescribed, and the size of the sieve is fixed. The articles are chargeable with the duty (su'iject to an allowance of 10 in the 100 for waste) directly as they come from the mould. From the nature of the manufacture, this is, however, insuffi- cient, and the same raw material may have to pay the duty several suc- cessive times. For as all the processes take place in the open air, the article is liable to be injured, or even destroy ed, by heat, by cold, or by rain ; and, when a batch has successfully escaped the elements, there is still the ordeal of the kiln. Thus, when the bricks, on leaving the mould, are set up, they may be destroyed by frost in a single night. After reworking and repaying, they may be washed away, or otherwise damaged, by a storm or land flood. If the material, or any part of it, is saved, it is again reworked, the duty is again levied, and the bricks are placed in clamp ; where they may, from accident, turn out shaky, or be altogether spoiled. For natural risks, the consumers of a manufac- ture must, of course, pay ; but, in the present case, the premium of in- surance is very greatly raised by the tax, whilst the risk itself is very greatly increased by the regulations. For instance, when the bricks are once set up, there they must remain till the officer has "brought them to charge," or what is virtually the same, has given permission to remove them, although their non-removal should subject them to be in- jured or destroyed. Every spot where they are placed during the process of a manufacture must be entered. If, from accident, carelessness, or design, they are put in an unentered place, the maker is subjected to a penalty of 501. After all, the duty only yields 365,0001., from which there is to be deducted the expense of the collection. This is very considerable, for brick-fields are scattered all over the country, and frequently established for a temporary purpose,—as when houses are to be erected in a remote neighbourhood, or when brick earth is found

upon the intended site and the builder turns brickmaker for the nonce.

We may here allude to the dealer's expense of collection ; which applies more or less to all the Excise Taxes. In London, a fortnight's credit is given, and the duty is paid at the head office. In the country,

a delay of six weeks is allowed, and the money must be paid at the different towns where the collector for the division sits. In either case,

the amount due is of course transmitted by the dealer; and must be paid

on the exact day and within certain hours, or the defaulter may be pro- ceeded against in the Exchequer. All this is, perhaps, indispensable

to the collection of the duties, but mark the result. The capital, really necessary to conduct these trades, is artificially raised from 40 to 150 per cent. ; and, looking at the punctuality with which the duties must be paid by a certain time, perhaps a good deal beyond these percentages. The wealthy enjoy another advantage. They can make arrangements by which their duty can be paid through a banker, or some other agent. The small dealer must send a person to the receiver ; no matter from what distance or at what inconvenience. Again, the rich are more likely to possess the means of conciliating the officer ; and even when any irregularity comes before the Board, their respectability is not likely

to injure their cause. Not, we believe, that either the officers or the Commissioners are rigidly fastidious, (for if they were, the respective

trades would be at end), nor do they ever proceed to extremities where there is no suspicion of dishonest intentions. But it is not pleasant to have one's money and character dependent upon the conjectures strangers may form of our intentions. Besides, if the Commissioners were omniscient, there would still be the trouble of dancing attendance upon the Board, and the expense of professional assistance.

2. GLASS.

The direct duty on this article varies from 100 to 200 per cent. ; that on Plate Glass being in some instances still higher. There are also duties levied upon some of the raw materials used in its manufacture, which, together with the loss consequent upon the Excise regulations, adds 25 or 30 per cent. to the tax. On Flint Glass, for instance, the officers may charge the duty at 3d. per pound in the pot, or 6d. out. It is found, or fancied, more advantageous to exact the duty in the pot; and the tax is by This means virtually raised to 7d., whilst the manu- facturer who makes the fine glass from the middle, and the coarser from the bottom and top, is compelled, whether he requires it or not, to manufacture the whole from having paid the duty, whereas he would often remelt the coarser parts. This, however, is only a trifling speci- men of the vexatious operations of the Excise-laws. Notices must be given, in writing, twelve hours previous to charging the glass-pot ; and these notices must be delivered between certain hours. The officers have access to the workhouses at all times both by dayand night, for the purpose of gauging and marking the pots, &c. The different stages of the manufacture are prescribed by law, as well as the processes to be adopted; and in flat glass, the thickness of the article is limited.. These,

and numerous other regulations, of the most complex, minute, and vexatious kind, are scattered over various statutes, and are all enforced under heavy penalties. The result of the whole is, to forbid, not only improvement, but even experiment : and—to select a very trifling in- stance, and where the deficiency is palpable—even a beautiful red colour has riot been produced, simply, it is asserted, because the duty and the regulations together will not allow the manufacturers to institute ex- periments where there is not a certainty of immediate success.

If the duty on this article were repealed, there is no doubt but the manufacture would become one of the staples of the country. The beauty and utility of the article, the number of purposes, both useful and ornamental, to which it may be applied, and the endless variety of form, &c., of which it is susceptible, seem to render it capable of almost unlimited extension. At present, with all the disadvantages of a high duty and prescribed processes, very considerable quantities are exported. If the trade were thrown open, there is no doubt but this exportation would considerably increase. " A manufacturer," says Mr. POULETT THO3IsON, in his speech on moving for an Inquiry into the Taxation of the United Kingdom, " who has lately travelled through France, the Netherlands, and Germany, has assured me, that our manufacturers could advantageously cope with foreigners were it not for the duties im- posed by the Government. Labour is as cheap in this country, our in- genuity is greater, and materials are also as cheap ; it is then the vexa- tious onerous duty alone that gives the foreign manufacturer the advan- tage over the English." It might have been added, that the bulk of the materials are of native produce, as are also the bricks and tiles with which the work-houses are built and the coals with which the manufac- ture is carried on, and that the chief expenditure both in this trade and in those connected with it is for labour.

3. PAPER.

Excepting the very coarsest Wrapping-papers, all Paper is sub- jected to a " first class " duty ; and even Wrapping-paper, to be charged at the lower rate, must be manufactured wholly of tarred ropes. This absurd regulation has had the effect of raising the price of the privi- leged material, of causing the refuse from the materials of the finer paper to be entirely wasted, and of preventing any cheaper or better mode of production from being discovered. The other regulations are as absurd as this ; and they are so complex and confused, that it is al- most impossible to master them, or to comply with them when mas- tered. " We are bound," writes a manufacturer to Mr. P. Tinamsosr, " to give twenty-four or forty-eight hours' notice (according to the dis- tance the exciseman lives) before we can change any paper, and to keep it in our mills for twenty-four hours afterwards, before we send it to market, unless it has been reweighed by the supervisor; to have the dif- ferent rooms in our manufactories lettered; to have our engines, vats, chests, and presses numbered; and labels pasted on each ream ; should We lose one label, the penalty is 200/. I generally write a request for 500 labels to the Excise at one time, and should any person get into my mill and steal or destroy them, the penalty would be 100,0001. I believe there is not any kind of paper pays more than 20s. per ream duty. If the penalty were 40s., it would be quite sufficient to answer every pur- pose for the security of the revenue."

" It is no slight aggravation of the evil," adds another, " that the laws are so scattered and confused as to render it almost impossible for anybody to have a perfect knowledge of them, and frequently what is a great annoyance to an honest man, is no check to a rogue. It is true, the Excise-laws are seldom, or perhaps never, acted upon to their ut- most rigour ; but still they confer almost unlimited power on those who have the administering of them over the property of all who come under their influence ;"—a power, we may presume, that is unquestionably more or less used for the benefit of those who possess it. It should be added, that notwithstanding the minute and vexatious nature of the regulations (which embrace provisions as to " entries, folding, weighing, sorting, labelling," &c.) they do not seem to have prevented improvement to such a degree as in the soap and glass trades.

The duty on the First Class Paper varies from 25 or 30 to 200 per cent. In an octavo volume of 500 copies, the amount of the tax is one- half of the profit that remains for the publisher and author, if all the impression is sold.

4. PRINTED GOODS.

This duty formerly extended to Cottons, Oil-cloths, and Paper Hangings. It then yielded a gross revenue of about two millions ; of which one million and a half was drawn back. The suggestion of Sir HENRY PARNELL to get rid of so absurd a tax was partially adopted by Lord ALTHOItP, but he retained the duty on Paper Hangings,— keeping up the machinery of collection to levy a tax upon the article which yielded the smallest amount of revenue ! This duty involves no interference with the actual manufacture of the article. It is levied by calculating the superficial quantity contained in the roll of paper, and stamping the roll with a mark of the coarsest kind, which is capable of imitation by the commonest blockcutter. The tax is vexatious to the manufacturer, as giving the officers power to enter and search his premises, and take stock, whenever they please. The duty is easily evaded, either by smuggling or counterfeiting the stamp. By artificially raising the amount of the capital required to conduct the business, it gives a sort of monopoly to the established manufacturer. The facility with which the duty is evaded, exposes him to the compe- tition of the rogue, whilst it preserves him from that of the honest man. The tax is very unequal; falling at the rate of 60 or 70 per cent. upon the cost price of the cheapest article ; whilst its pressure, gra- dually diminishing, becomes almost nothing upon the more expensive manufactures. Were this petty tax remitted, it is estimated that the consumption of the cheaper sortsof Paper Hangings would be doubled or even trebled.

5. Soar.

Amongst our numerous taxes, this is one of the worst. It is levied

on an article essential both to cleanliness and health ; it is very une- qual ; for whilst the duty adds two thirds to the price of the coarse Soap which the poor man uses, it becomes trivial when levied on the refined and scented Soaps of the rich. It combines in itself, and that to a considerable extent, all the most objectionable elements in taxa- tion. Duties are laid upou the raw materials of its manufacture; a heavy duty, both mischievous and vexatious, is levied upon the manu- factured commodity ; the effect of the regulations under which it is col- lected being to encourage smuggling, and to shut out all improvement in the legitimate trade ; and lastly, Soap itself is in some sense a raw material, being extensively used in various manufactures. The tax is also a partial tax : Great Britain is subject to it, Ireland is exempt. This circumstance, combined with the high rate of duty, the facilities which modem chemical discoveries have given to the illicit trader, and the actual necessity for the use of the commodity by the bulk of the people, not only gives rise to the most extensive smuggling, but, under the name of a drawback, gives a bounty to the smuggler. The high authorities—PARNELL, POULETT THOMSON, and M'Cum.ocu—in fa- vour of a mere reduction instead of an abolition of the duty, induce us. to go into the subject at considerable length. Premising, that for the power of communicating the full and detailed particulars we shall lay before the reader, we are indebted to a very high practical authority, we proceed to examine the subject in its principal bearings. And first, of THE REAL AMOUNT OF THE DUTY.

This varies, as we have already stated, according to the quality of the soap. The local situation, and especially the skill of the manufacturer, will also have an effect upon the exact proportion which the duty bears to the necessary price of the commodity. But the estimate in the fol- lowing Table may be relied upon, as an accurate representation of the mode in whichthe various duties enhance the price of a tort of Yellow soap in general use, and which is sold by wholesale for 561. per ton, or at the rate of 6d. per lb.

Quantities Materials. used.

cwts. qrs.lbs. X

rust. Total

s. d.

Duty.

X s. d.

Necessary price.

X s. d.

Tallow or oil 10 2 0 ..

21 0 0 .. 1 13 0 19 6 9 Resin 3 2 0 .. 1 8 0 .•

1 8 0 Emilia 6 0 0 .. 3 6 0 .. 0 12 0 2 14 0 Expenses of manufacture .. 3 10 0 . •

3 10 0 Duty on Soap, at 3d. per lb. MI cr one tenth allowed fur waste 25 4 0

25 4 0

54 8 0

27 9 3 26 18 9 Estimated profit 1 12 0

16 9

15 3

£56 0 0

28 6 0 27 14 0

It therefore appears, that upon an article of average quality, whilst the necessary price of the commodity is only 271. 14s., the duty creates an addition of 281. 6s. ; or above 100 per cent. There is, moreover, a loss upon the soap before it is fitted for market ; this amounts to about I6s. per ton, and renders the actual addition made by the duties nearly 110 per cent. Upon inferior articles the propor- tion rises still higher. Upon Mottled Soap, the Excise-duty, we are assured, is full 281. per ton ; a large proportion of the alkaline lye being necessarily framed in combination with the soap, from which, after the duty is charged, it settles down, and the extra waste is more than equivalent to the allowance of one-tenth. The direct duty is, however, far from being the whole amount which is created by the existence of the tax. The regulations, by practically forbidding experiment, prevent all improvement; by prescribing the processes of manufacture, both positive loss is incurred and waste takes place ; whilst, by unnecessary restrictions, a great waste of time and sometimes a heavy loss is incurred. We proceed to illustrate these points in detail. To make them clearly intelligible, it will be neces- sary briefly to describe

THE PROCESS OF MANUFACTURE.

If olive oil or liquid tallow is well agitated with a strong solution of soda in fit proportions, a hard soap is formed ; and this principle is the basis of the manufacturer's operations. His first business is to form an alkaline solution or ley. This is done by freeing his alkalies (barilla, for instance,) from carbonic acid, by means of lime. Heat is then ap- plied to facilitate the union of the tallow, resin, &c. with the ley. After exhausting one portion of the solution of its alkali, the dross, so to speak, is removed ; and the operation is renewed with successive charges of ley, till a satisfactory product is obtained. After settling awhile in the coppers, the soap is conveyed into deep wooden troughs or frames, where it becomes solid and fit for removal. This is accom- plished by removing the frames part by part, and cutting the blocks into slabs, which are again divided into bars of various sizes for the re- tail dealer.

Such, briefly, is the mode of manufacturing soap ; during the first process of which, the various chemical changes that take place are both intricate and curious. Into these, however, we shall not enter : suffice it to say, that notwithstanding the late extensive improvements in chemistry, no improvements in the manufacture of soap have taken place in Enyland—the processes and apparatus are essentially the same as they were one hundred years since. But whilst the fair trader is pre- vented from advancing with the advance of science, fresh discoveries facilitate the frauds of the smuggler. In what way these results are produced, we proceed to show under the head of

THE EXCISE REGULATIONS;

Which are vexatious and harassing to the last degree.

" There is no step in the whole of the processes," writes a most intelligent correspondent, himself a manufacturer, "in which the soap-maker does not find himself greatly hampered by the Revenue Laws. The length, breadth, and thickness of his coppers are regulated ; and for each process a given time only is allowed. With every portion of soap exceeding 28lbs. in weight, the maker must send an Excise certificate. His coppers are daily locked and sealed by the Excise-officers; and he must give notices for each distinct operation. Whether his materials or workmen disappoint him or not, the law requires him to produce one ton of yellow soap from fourteen hundredweight of raw material ; if he fails to do so, he is nevertheless charged with the duty in this ratio ; but if he succeeds, he pays the duty upon the actual product. He has no remedy for those mistakes and accidents which will occur, as every chemist knows, in the best managed laboratories, when materials so variously constituted in the pro- portion of their ingredients have to be combined. And he is further liable to great annoyance from the conceit and obstinacy of Excise-officers, many of whom are fond of exercising the power they possess, and if offended in any way, can retaliate on the manufacturer greatly to his prejudice."

There can be no doubt that considerable improvements in the manufacture of soap would take place if the trade were unshackled by regulations. But, independent of future improvements, a consider-

Able addition (estimated at 10 per cent. at least) is made to the cost of he manufacture, by the existing regulations; the mischievous effects of which are enumerated in the following extract from a letter we have received. " A glance it them," says our correspondent, " must satisfy any one conversant with manufactures, how much they interfere with economical production."

" 1. It is impossible to experiment upon the proces ; for be the result favour- able or not, the duty must be paid on the product, and the sacrifice is in some

instances very great. +.•

" 2. No preparation or improvement of the raw material can he attempted without interruption of the Excise; whose presence is a fatal bar to that secrecy which the enterprising trader must avail himself of in case of new discoveries. As the same officers (at least in towns) survey many manufactories, no process can be kept secret by the inventors. "0. It an inferior article is accidentally produced, the manufacturer cannot return it to the coppers without a sacrifice of the whole duty paid on it. An enormous injustice ! and which might be corrected without the slightest risk to the revenue, as the duty would be ultimately paid for every pound reuranu- teamed.

" 4. There is considerable expense of time and labour incurred by weighing the raw material (which can only be done in the presence of the officer), and the necessity of notices to the Excise for each'distinet operation, in failure of which notice the operation must be suspended. "5. the limitation of the time for sundry operations, and the restrictions as to the shape and size of the utensils or vessels used, the manufacturer is pre- vented from consulting his own convenience ; and the article is produced of a less perfect quality, and subject to unnecessary waste in preparing it for the market.

" One of the operations occurring almost hourly, is to discharge the alka- line ley front the coppers, when deprived of its free alkali. This must all be done by a pump and manual labour ; whereas, if we could introduce a cock at the bottom of the vessel, much time and trouble would be saved."

Thus far as to the effect of the Regulations. We now come to TILE ILLICIT TRADING IN SOAP; Which is carried on in two modes,-first, by means of the drawback ; second, by evading the duty altogether ; or it is possible to combine both, and draw back a sum which has never been paid.

Ireland being exempt from the tax on soap, a drawback to the full amount of the duty (28/. per ton) is allowed on exportation to that country. As a credit of six weeks is given out of London, whilst the drawback is immediately paid, a bond fide exporter may carry on busi- ness with the public money. But in the majority of cases, much more considerable frauds upon the public are perpetrated. Sometimes the soap is immediately smuggled back and sold. Sometimes a very in. ferior article is manufactured, and a profit made by the difference between the full amount of the drawback (281) received, and the duty (25l. 4s.) paid. Sometimes the drawback is successively received upon the same article. There is good reason for believing that these different modes of defrauding the revenue are carried on as regular trades, in the same way as smuggled geneva may be insured in Holland, or brandy and silks in France. A short time since, a manufacturer at Bristol was invited to enter into a transaction of this kind : the party proposing it was to be remunerated by a large douccur, and he tattler- took to receive the drawback and return the soap within a certain time into the exporter's hands. A practitioner of this description recently boasted that he received the drawback fonr successive times upon the same soap ! It is possible it had never paid the duty. It was probably, after all, sold under price to the poor ; a circumstance, as Sir FRANCIS BURDETT judiciously observed in relation to this subject, which is the chief point to be regarded.

But besides the frauds connected with the drawback, very large quantities of soap are smuggled, sometimes in private manufactories, but more generally in those which are regularly surveyed by the Excise; the officers being bribed, or their vigilance eluded. In this matter the improvements in the manufacture of alkali have greatly favoured the illicit traders.

"Till within these few years," we again quote our excellent correspondent, "the soap-maker has obtained his alkali solely from kelp, or foreign barilla; thelormer being a very impure article, containing only 4 to 6 per cent. of pure alkali, and the fatter from 20 to 25 per cent. These substances are very bulky, require much labour to reduce to powder before lixiviation, and were scarcely procurable except at places of import. Now that common salt (which contains about 50 per cent. of pure soda) is decomposed in many parts of the kingdom, the manufacturer (whether honest or illicit) is furnished with his alkali in a very pure and concentrated state, capable of being conveyed and treated with far greater ease and convenience than substances containing a large proportion of insoluble matter. " The manufacturers, it is true, are divided as to the economical advantage of using this article ; but such considerations do not occur to the smuggler, who, (if he succeeds in evading the duty on his soap), can affind to pay a far higher price for his raw material than the honest manufacturer."

These are the practices of the smuggler, and the facilities which he possesses at present. To what extent the trade may be carried on, it is difficult to tell. About some facts there is no doubt. It has been computed by several statistical writers, that the consumption of soap per head is about !;lb. a week. The consumption of the "duty-paid" commodity in Great Britain is, however, computed at only 6?,lbs. a year to an individual, being less than is used in workhouses. When, in consequence of a memorial to the Board, increased vigilance took place on the part of the Excise-officers in the Bath district, an in- crease of more than 50 per cent. ,took place in the quantity of soap brought to charge, though the regular trade in the article was known not to have sensibly increased. In 1524, the drawback allowed on ex- ports to Ireland was 1,985/. ; in 1830, it amounted to 82,8751., being a moderate increase in the proportion of 56 to 1.

Such are some of the effects produced by the duty on a manufacture which, after articles of sustenance, is in more universal use than any other taxed commodity, and the total remission of which would afford more direct relief to the poorer classes than any other duty yielding nearly the same amount of revenue. The alteration lately proposed by Lord ALTHORP will reduce the price of soap by I'd. per lb. It may have a tendency to check the existing frauds ; or, by inducing se- curity and remissness, it may afford facilities for their increase. The principal mischiefs of the Excise-laws must still remain. None of the existing regulations could be abolished without risk, althoagh permis- Awn might safely be granted to remanufacture inferior products, and

some freedom might be given to experirfibital manufaetnife: For thesto reasons, we would earnestly press upon Ptirliament time propriety of totally repealing the duty, not only as a relief to the consedracr and the manufacturer, but in order to give the country the chance of esta- blishing a foreign trade in the commodity, which it is generally be- lieved could be accomplished if it were not for the Ombined effect of the duty and regulations.

Previous page

Previous page