POSTSCRIPT.

SINCE the publication of the first edition of this treatise, the divi- sion on Mr. ROBINSON'S motion for a Commutation of Taxes, and some other unequivocal symptoms of public feeling, seem to have alarmed Ministers. The Government organs, accordingly, have been zealously disparaging any commutation of taxes. In accom- plishing their task, they have acted rather like the partisans of a faction, than like zealous inquirers after truth. Taking advantage of the vague and misty nature of Mr. ROBINSON'S plan, they generally assume, that by a Property-tax is meant a tax upon In- comes of all descriptions; and proceed to point out the inconve- niences and inequalities of an impost about which the people are much better informed than themselves. A writer in the last Number of the Edinburgh Review goes beyond this somewhat dishonest fallacy. Taking the term property in the most extended sense, he supposes (for lie scarcely assumes) that by a Property- tax may be meant a tax on capital, or rather on all that each in- dividual possesses, including "stock in trade," and the additional value of " a field that has been recently limed, marled, or other- wise manured, at a heavy expense ;" and he then pathetically pro- ceeds both in Latin and English to deprecate the mischiefs and inconveniences of a tax which no rational person except himself ever dreamed of imposing. - Even when what is generally meant by a Property-tax—a tax on income arising from realized capital, from rents, dividends, an- nuities, &c.—is separately considered, it is scarcely fairly con- • sidered. All its inconveniences are brought into strong light, all its advantages thrown into shade, and not a syllable breathed about the nature of the taxes whose repeal is sought for. We hear nothing, for instance, of the unfairness of subjecting one kind of property—House-rent—to very heavy taxes; nothing of the evils of the duties on Soap and Glass ; nothing about the fairness of that tax on the capital of the distressed, the Auction-duty, or of the duties on Mortgages and Sales. A stranger to our fiscal system, would never imagine that we raised a farthing by taxes on the materials of manufacture, or that such incentives to lawless tra& ing as the enormous duties on Spirits and Tobacco existed. A rubber-on disregards all inconveniences but the inconveniences of official people. In this new school of philosophy, it is nothing to cripple the skill and industry of the country, to demoralize large masses of people, and to throw the entire load of taxes on property upon one or two kinds of property. What are the capitalist's pro- fits and the labourer's wages, what are even life and morality, compared with the case of a Chancellor of the Exchequer? One argument against a Property-tax which the Edinburgh Reviewer notices at some length, is its tendency to check accumu- lation. The probable effects of the tendency, we have already al- luded to. Its actual results are capable of ocular demonstration If a uniform rate were adopted in imposing a Property-tax, it would probably not rise higher than 5 per cent.; were the tax graduated, it would most likely stop at 10. The present House-duty—say- ing nothins,° of the Land and Window Taxes—varies from 71 to 15 per cent. Let the Ondency-to-check school mount St. Paul's, and see the operation obi tax on house-rent to check the accumulation of houses.

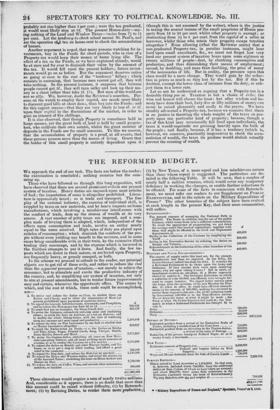

Another argument is urged, that many persons watching for in- vestments, buy in the Funds for short periods, who in case of a Property-tax would keep their money at home lying idle. The effect of a tax on the Funds, as we have explained already, would be at once and for ever to diminish their value by the amount of the tax. It would fall upon the present holders; • future invest- ments would go on as before. But the argument deserves notice as going at once to the root of the " tendency" fallacy ; which consists in assuming, that because men cannot get all, they will take nothing. In the present instance, it supposes that because people cannot get 31., they will turn sulky and lock up their mo- ney in a chest rather than take 2l. 17s. But men of the world are mot so silly. We, however, doubt the Reviewer's assertion. Per- sons on the watch to employ their capital, are much more likely to discount good bills at short dates, than buy into the Funds : and for this cogent reason—that they are very likely to lose 4/. or 5/. upon their capital by the fluctuations of the market, in order to gain an interest of five shillings. It is also observed, that though Property is sometimes held in large masses, yet the great bulk of-land is held by small proprie- tors, who cultivate their own estates, whilst the great number of deposits in the Funds are for small amounts. To this we answer, that the accumulation of pi.operty is a proof, at all events, that these persons possess more than the means of living. Grant that the holder of this small property is entirely dependent upon it (though this is not assumed' by the writer), where is the justice in taxing the annual income- of the small proprietor of House pro- perty from 10 to 20 per cent. whilst other property is exempt ; or abstracting from 2i to 5 per cent. from the capital of a seller or borrower, whilst those who retain their property escape taxation altogether ? Even allowing (What the Reviewer omits) that a non-graduated Property-tax,, in peculiar instances, might bear hard upon small annuitants, &e., we must not forget how very hard our present system of taxation bears upon some eighteen or twenty Millions of people—first, by checking consumption and production, and thus diminishing their means of employment; second, by doubling, and more than doubling, the price of many of the necessaries of life. But in reality, the pressure upon this class would be a mere change. They would gain by the reduc- tion in prices as much as they lost by the tax. But if this be doubted, exempt the lower class of incomes from the duty, or sub- ject them to a lower rate.

Let us not be understood as arguing that a Property-tax is a desirable thing per se. Taxation is but a choice of evils; the wise and honest will choose the least: but after wisdom and ho- nesty have done their best, forty-five or fifty millions of money can never be raised pleasantly and easily to the payers. We have steadily advocated a Property-tax, because we conceive that there is no justice in throwing the whole weight of the taxes on pro- perty upon one particular kind of property; because, though a tax of this kind may occasionally fall hard upon individuals, the taxes it would supersede are pressing heavily upon the bulk of the people ; and finally, because, if it has a tendency (which is, however, we conceive, practically inoperative) to check the accu- mulation of wealth, the taxes its produce would abolish actually prevent the creating of wealth.

Previous page

Previous page