THE REFORMED BUDGET.

WE approach the end of our task. The facts are before the reader; the examination is concluded ; nothing remains but the sum- ming up.

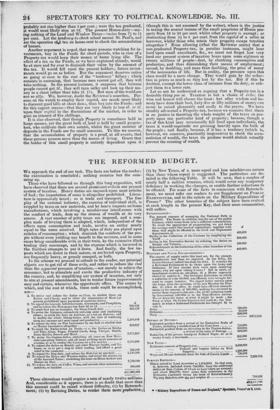

Those who have followed us through this long exposition, will have observed that there are several- prominent evils in our present system of taxation. Heavy duties are imposed-upon most articles of food ; the importation of some is altogether prohibited. Litera- ture is oppressively taxed ; so is trade and transport. The free play of the national industry, the exercise of individual skill, is crippled by taxes on raw materials, and by heavy imposts on home manufactures, which involving a mischievous interference with the conduct of trade, dam up the stream of wealth at its very source. A vast number of petty taxes are imposed, and a com- plex mode of levying them is adopted, which, independent of the 'effects upon consumption and trade, involve an outlay nearly equal to the sums received. High rates of duty are placed upon Articles of consumption ; which diminish the comforts of the peo- ple without even yielding any benefit to the revenue, and in some cases bring considerable evils in their train, by the extensive illicit trading they encourage, and by the expense which is incurred in the fruitless attempts to put it doWn. And finally, the few im- posts which are direct in their nature, or are levied upon Property, are frequently heavy, or grossly unequal, or kith. In the scheme we proceed to submit to the reader, our principal objects are to get rid of these evils, and rather to reduce the real than the apparent pressure of taxation,—not merely to relieve the consumer, but to stimulate and excite the productive industry of the country, and, by simplifying our system of taxation, not only to aim at present amendments, but to render future improvements easy and certain, whenever the, opportunity offers. The means by which, and the cost at which, these ends could be accomplished, are-

1. To revise and reduce the duties ou Corn, to abolish those on Batter and Cheese, and to allow the importation of Meat (at present prohibited) upon payment of moderate duties.

2. To repeal the taxes on Advertisements, Almanacks, and Pamphlets,

and to reduce the Newspaper-tax from 4d. to Id 250.000

3. To remit that tax on transport, the Stage-Coach duty 422,479 4. To revise the Licences. extensively reducing some and abolishing others; to remit the duty on Auctions, as a tax on distress; and to modify the whole Stamp-duties, with the view or rendering them less onerous and more equal and productive 1,500,000 5. To reduce the duty on Fire Insurances by one half, to abolish that on Marine Insurances altogether 222,927 • . To remit the Excise-taxes on Trade.—i. e. the Duties on Bricks and Tiles, Glass, Paper, Printed Goods, Soap, Vinegar, Starch, Stone Bottles, Sweets and Mead 0,874,583

7. To revise the Custom-duties, abolishing all taxes on Raw Mate- rials (excepting Timber), and all items yielding small amounts of

revenue, so as to confine the Customs to a few articles 2,200,000 8. To reduce the duties on Brandy and other Foreign spirits, and To- bacco, so as to put a stop to illicit trading, and afford a great

relief to the consumer 750,000

9. To repeal the Hop-duty, and reduce the Malt-tax by one-half 1,148,594 10. To repeal the House and Window-duties, and revise We remainder of the Assessed Taxes ; abolishing the taxes on Horse-dealers and

Horses for Hire 2,700,000

11. To reduce the duty on Coffee, Wines,and several other necessaries,

comforts, or luxuries 200,000 £11,968,588

These alterations would require a sum of nearly twelve millions. And, considerable as it appears, there is no doubt that more than this amount could be raised without difficulty, (1) by Retrench- ment; (2) by Revising Duties, to render them more productive; (3) by New Taxes, of a more equal and less mischievous nature than those whose repeal is suggested. The particulars are de- tailed in the following Table. It will be seen, that a surplus of nearly half a million remains, which would cover any temporary deficiency in working the changes, or enable further reduction's to be effected. For some of the facts in connexion with Retrench- ment, we must refer our readers to our Supplement on PUBLIC EXPENDITURE, and to the article on the Military Expenditure of France.* The other branches of the subject have been evolved, at such length in the present Key, that their mere enumeration. will suffice.

those that might be effected in the Civil and Diplomatic

departments. at Saving in the Collection of the Customs by simplifying the

Tariff Saving in the Preventive Service by reducing the duties on Brandy and Tobacco Retrenchments in the Collection of the other branches of the Revenue

MILITARY AND NAVAL ESTABLISHMENTS— The sources of supply under this head are, for the present, considerably less than we expected. In the Navy, Sir JAMES GRAHAM indeed has done his duty. It remains for a Reformed Parliament to do theirs upon the Army and Ordnance. If they rescind their votes upon remitting money, why not upon taking it away? But in sooth, re• trenchment receives no attention, in a House expressly elected to enforce it. The Ordnance Estimates, in which. a reduction of some 80,000/. was effected, were brought for- ward to empty benches. We expect better success upon the Army, from the exertions of the new Member for Dun- dee. If, when in office, he could have effected retrench- ments to the amount of 600,0001., nothing has occurred to render them impracticable non.; fur, of the reduction made by Government, 180,0001. is in the Non-effective service. We set down the Army at what it might be made • the Navy at what Sir JAMES GRAIrAII has made it ; the 'Ord- nance at what a Reformed Parliament has thought fit to

vote it.

Army Ordnance Navy 780,000 88,000 220,000

2,834909

REVISAL OF DUTIES— Estimated produce from a revisal of the Protective Scale of Duties, including a modification of the Corn-laws

750,000

Estimated produce from an alteration in the Timber-duties. 500,000i

.... a revisal of the rates of Postage

200.0.00.

Reduction of the preseut bounty on Refined Sugar, so as to

render it only a drawback

851:080 1,800.000,

NEW TAXES—

Estimated amount of Property.tax 5,000,000

Probate and Legacy duties on IlCal

Property 1.500.000

Ways and Means derivable from the Sale of Crown Lamds 750,000

7,250,000

SURPLUS RYIVENUE-

This is stated by Lord ALTIfORP at 1,500,0001, In that sum. is, however, included about P,00,000/. from the additional duties on Raw Cotton, of wtieh we lapre taken no account; and about 500,000/. more arises from reductions in the

Estimates (included un.aer the head of Retrenchment)

We way therefore rate t,tw real surplus at

#12,1 v,.00

• "Military Expenditure of France Bud England," Spectator,Devn0 sr 8,1832. RETRENCHMENT— The present expense of managing the National Debt is 273,0001. The Bank, in addition, has the use of the public Winces, which many deem tube a sufficient remuneration. To avoid the appearance of exaggerating, we put down the savings under this head of expenditure, together with

400,000 300,000 500,000 400,000,

700.000

Previous page

Previous page